For an effective loan officer resume, focus on your relevant skills like underwriting, client relations, or legal compliance. Give examples of your success working with borrowers, and cite any related training or certificate programs you’ve done. This guide provides expert tips to help you create a results-driven resume showing your best loan officer qualifications.

Key takeaways:

- Brainstorm details about your work history on a separate document or sheet of paper. Then, identify the most relevant ones to feature in your experience section – this helps you focus your resume on the loan officer role.

- Spell out the results of your past work as a loan officer. Describe how your efforts helped clients and organizations achieve their financial goals.

- Use bullet points to accent your achievements. Start each bullet point with a strong verb like “Created,” “Enhanced,” or “Pinpointed.”

Loan Officer Resume Templates and Examples (Download in App)

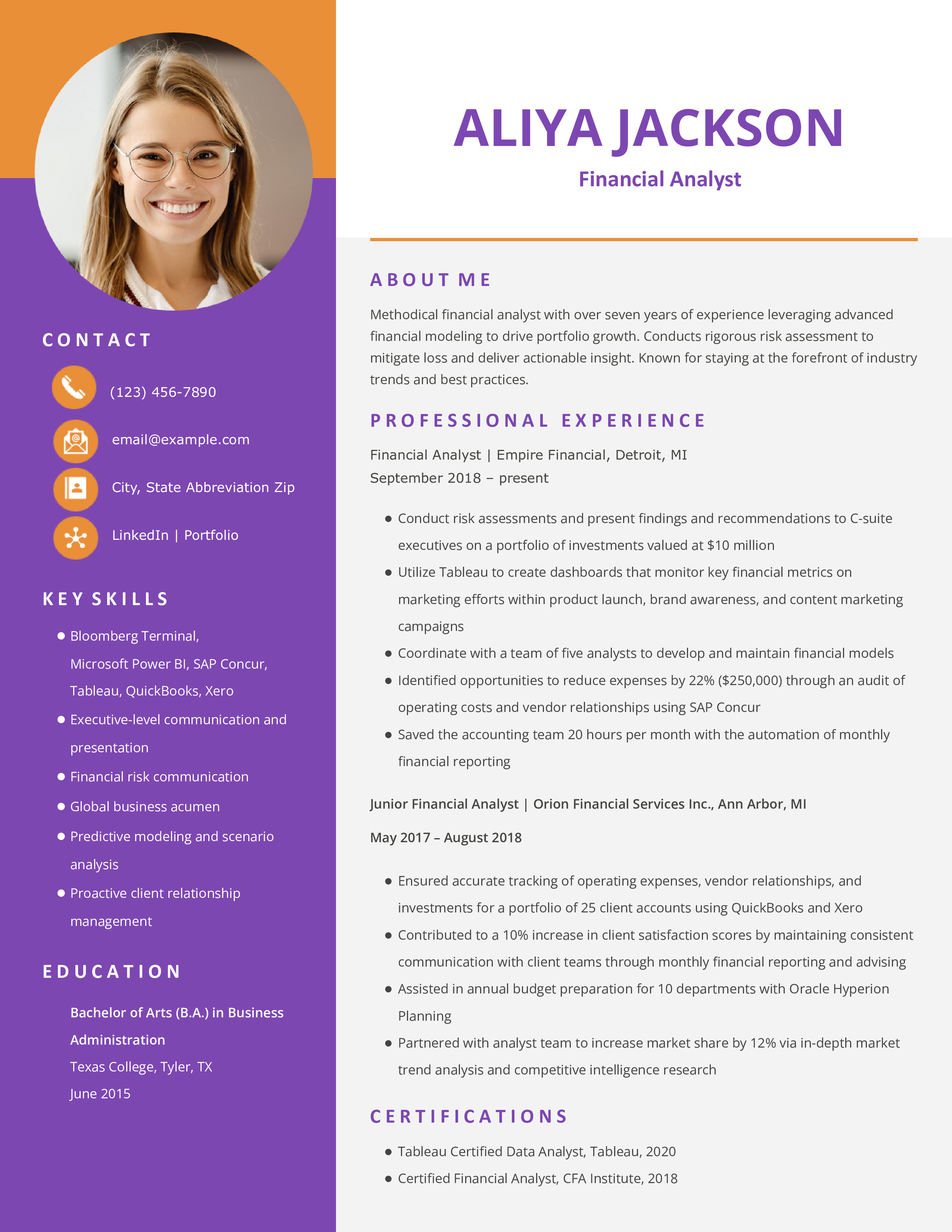

Loan Officer Resume Example

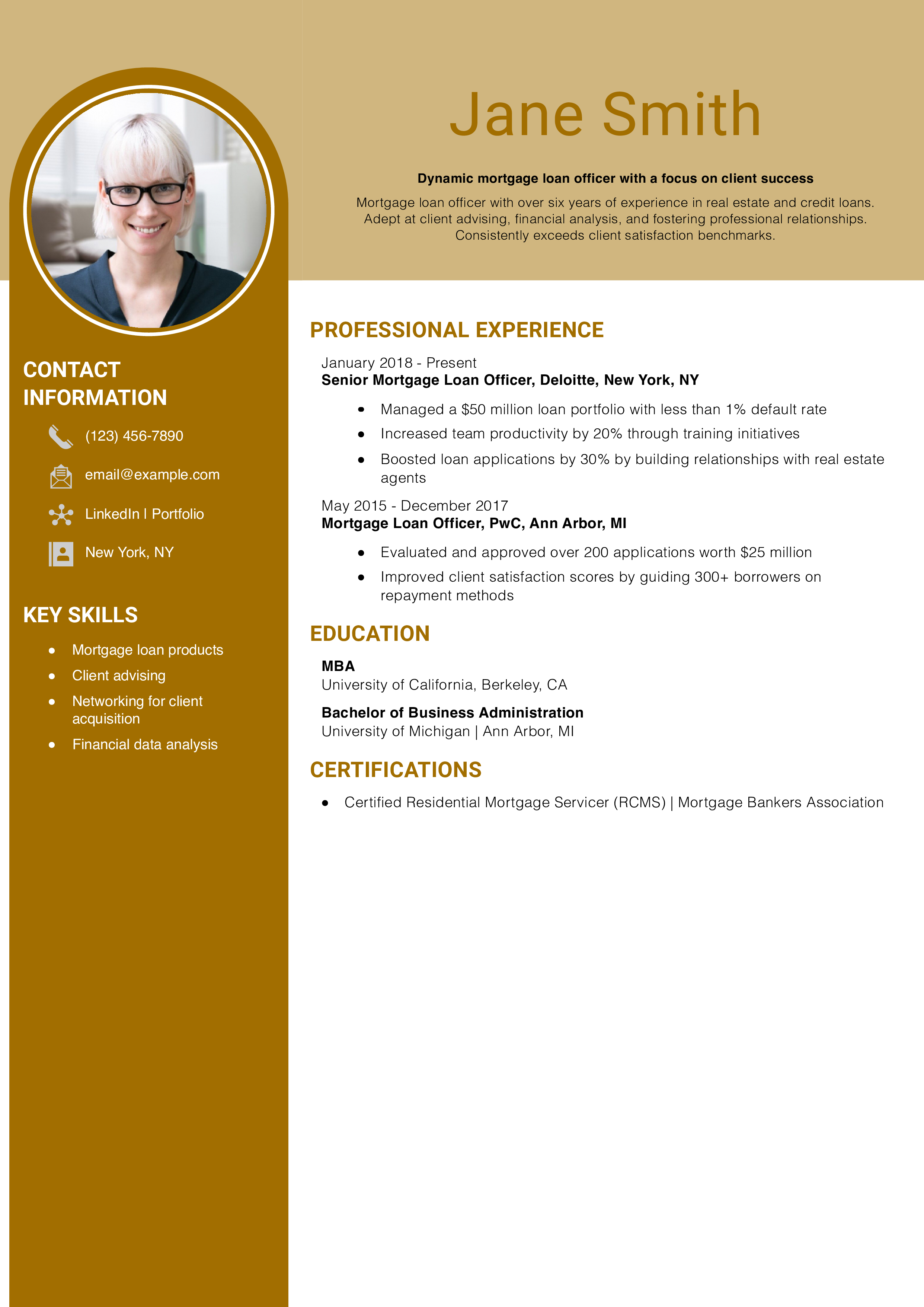

Mortgage Loan Officer Resume Example

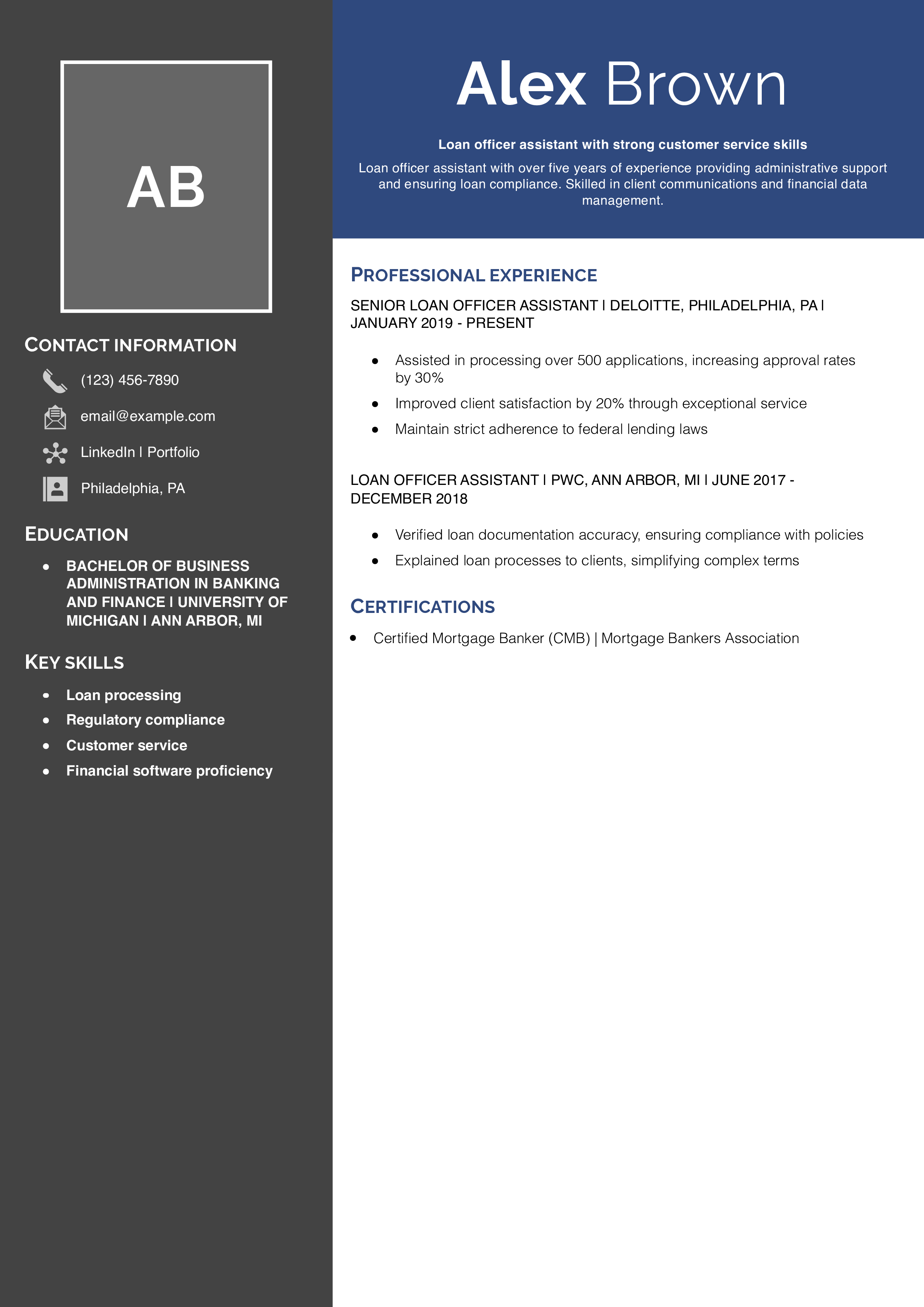

Loan Officer Assistant Resume Example

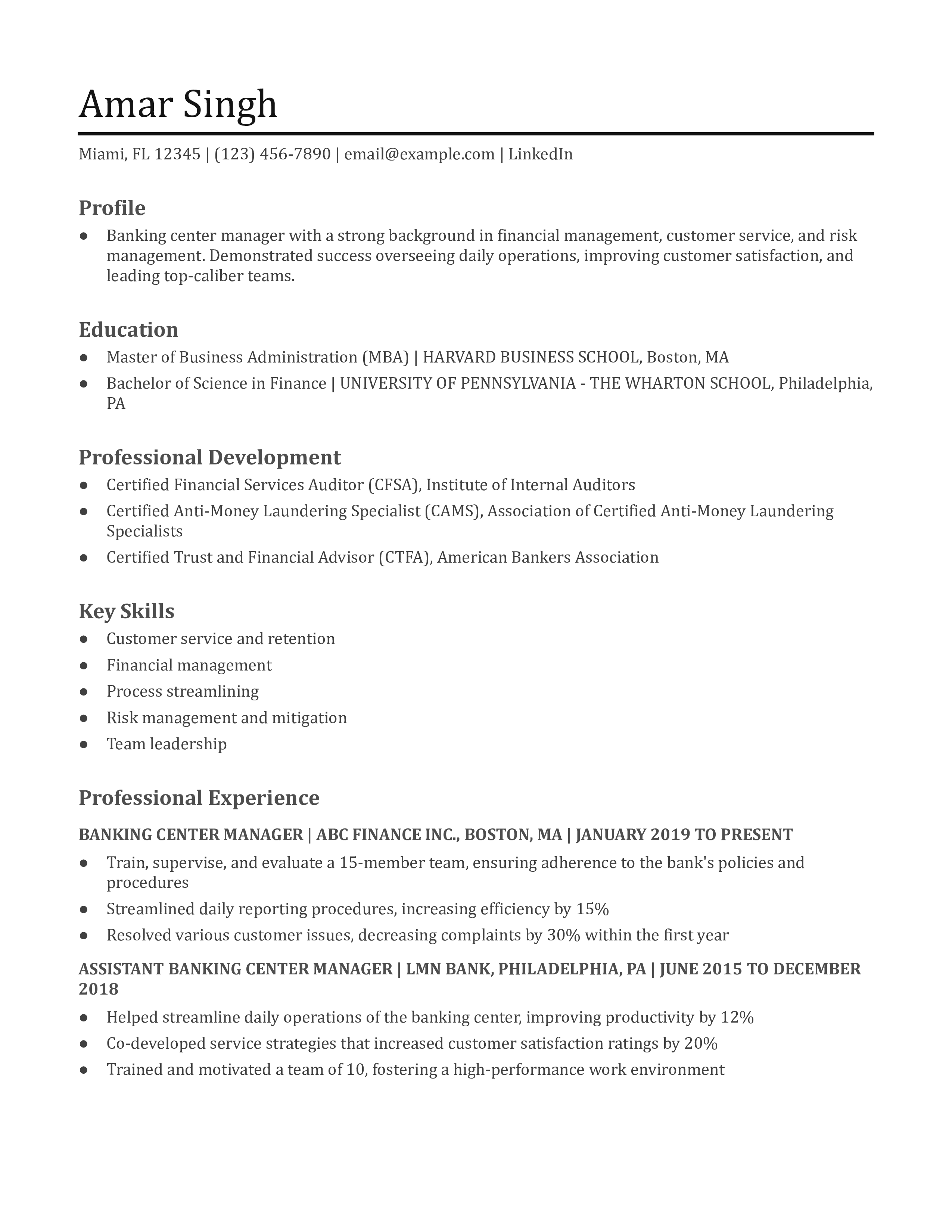

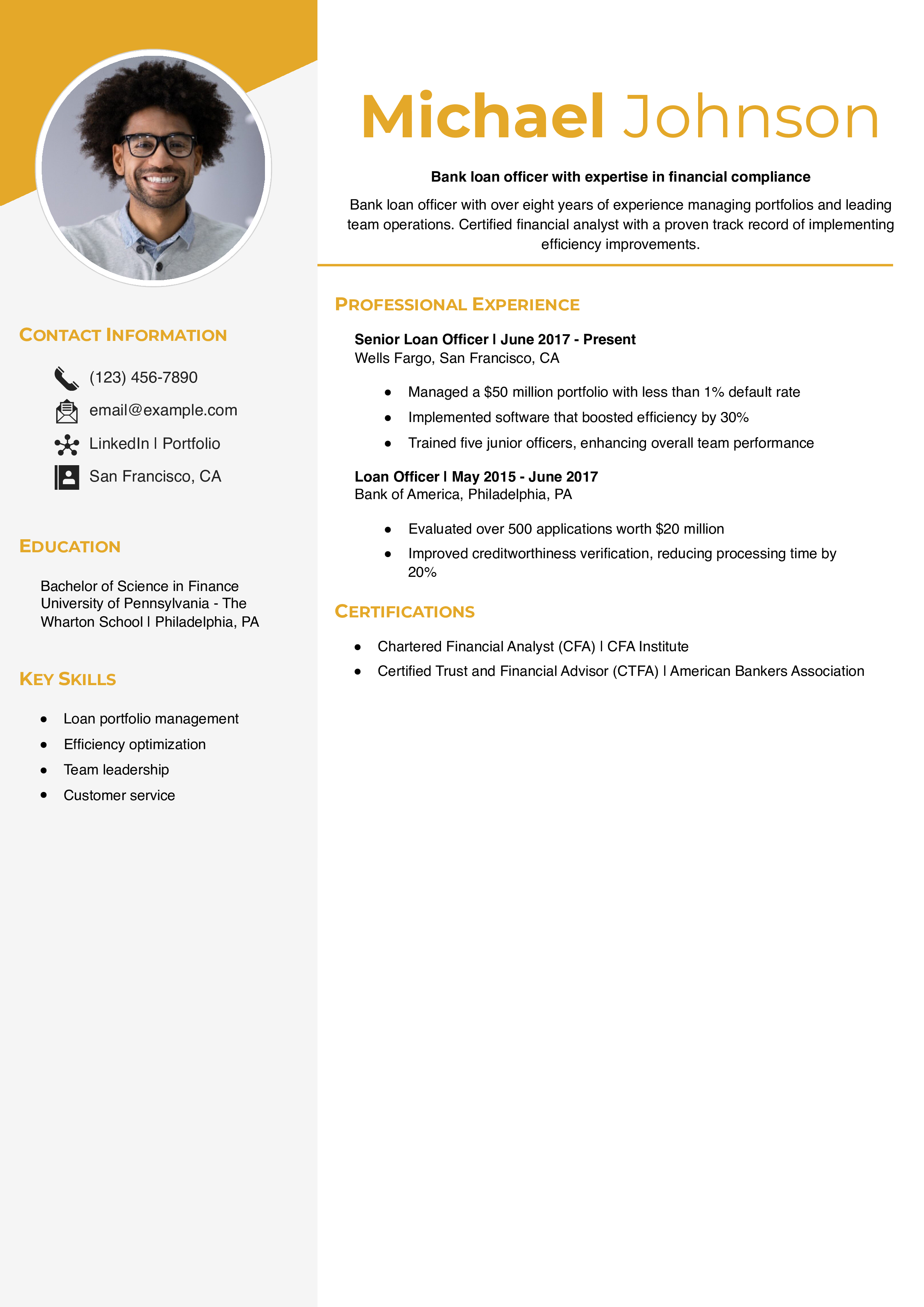

Bank Loan Officer Resume Example

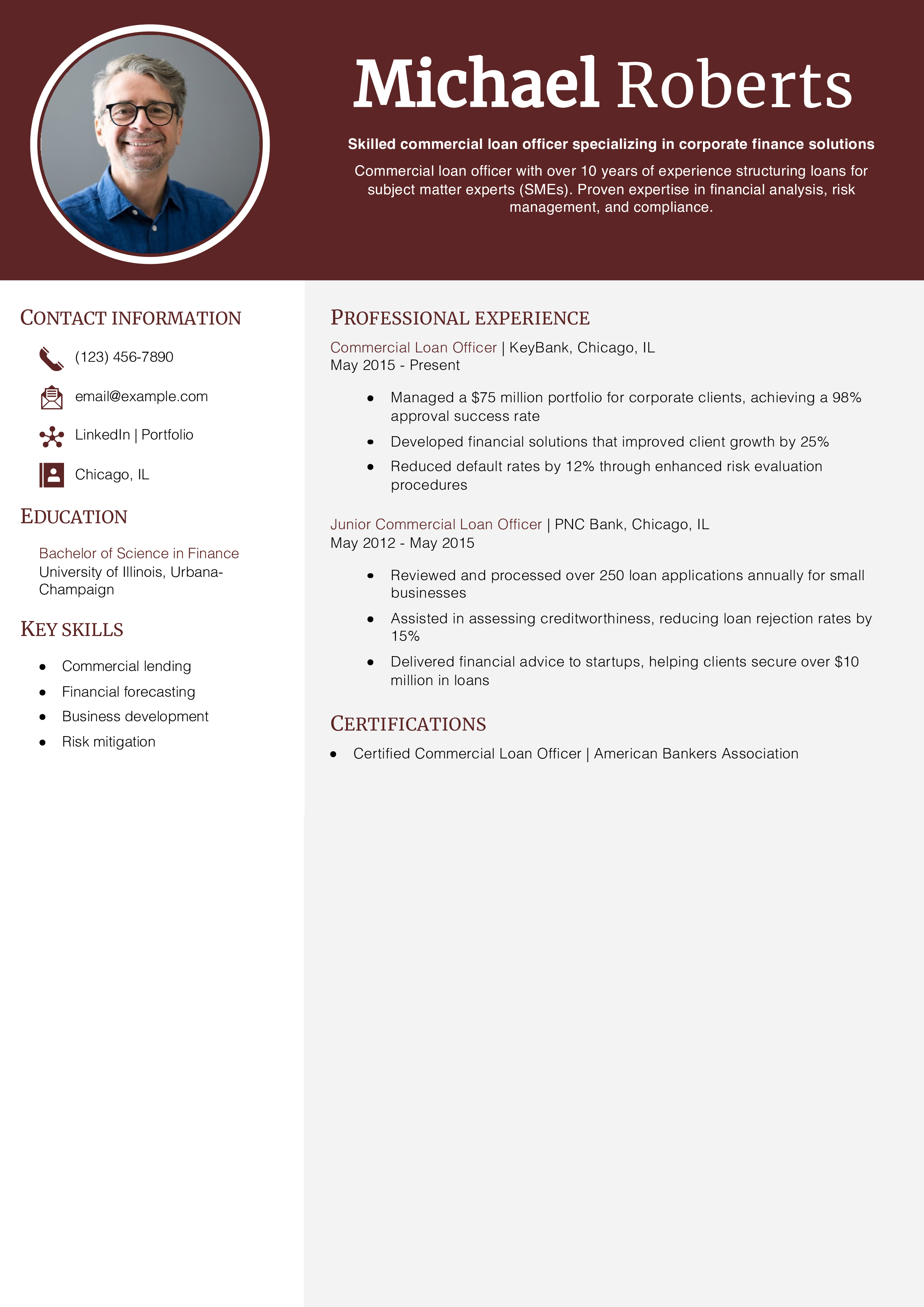

Commercial Loan Officer Resume Example

Consumer Loan Officer Resume Example

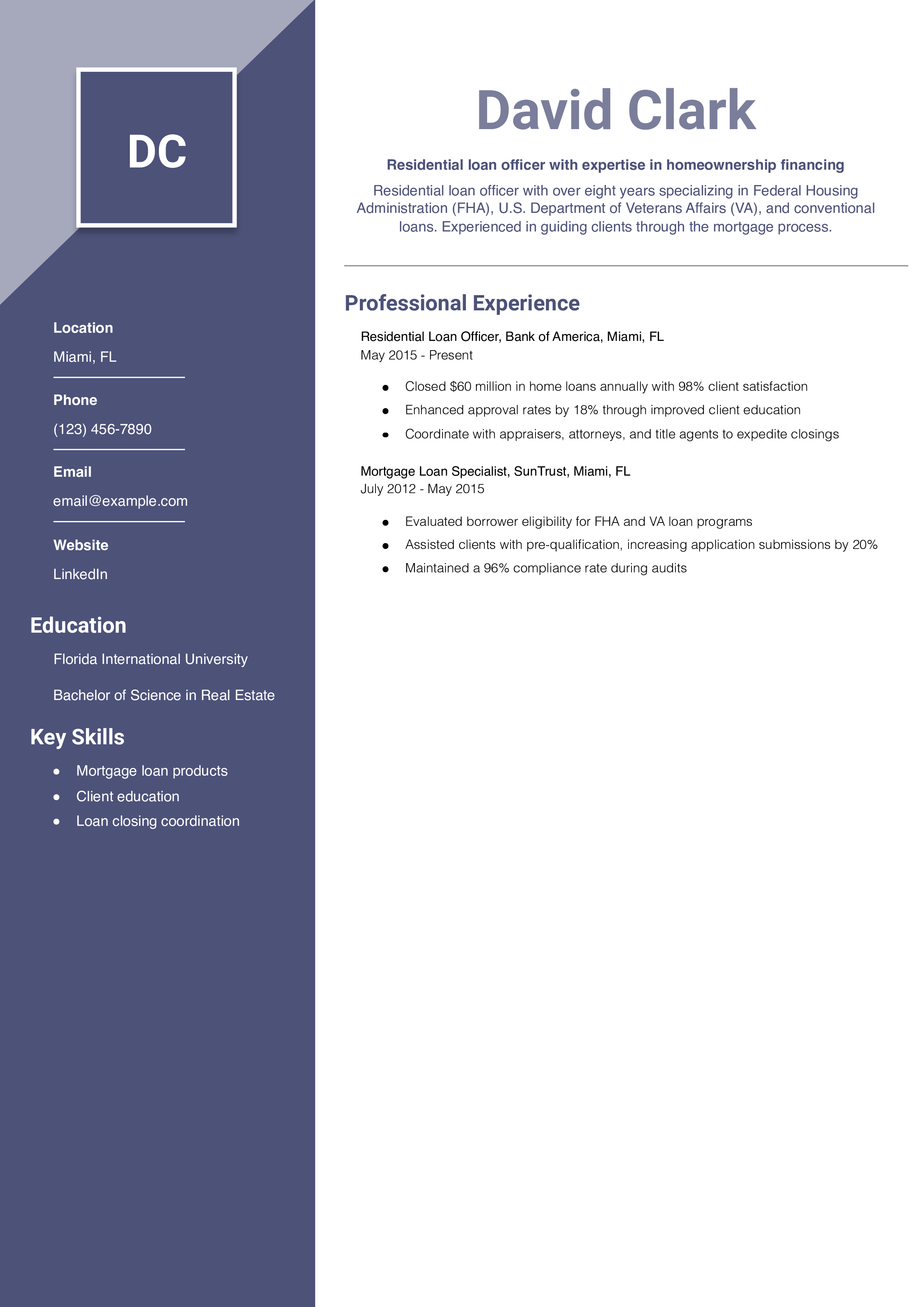

Residential Loan Officer Resume Example

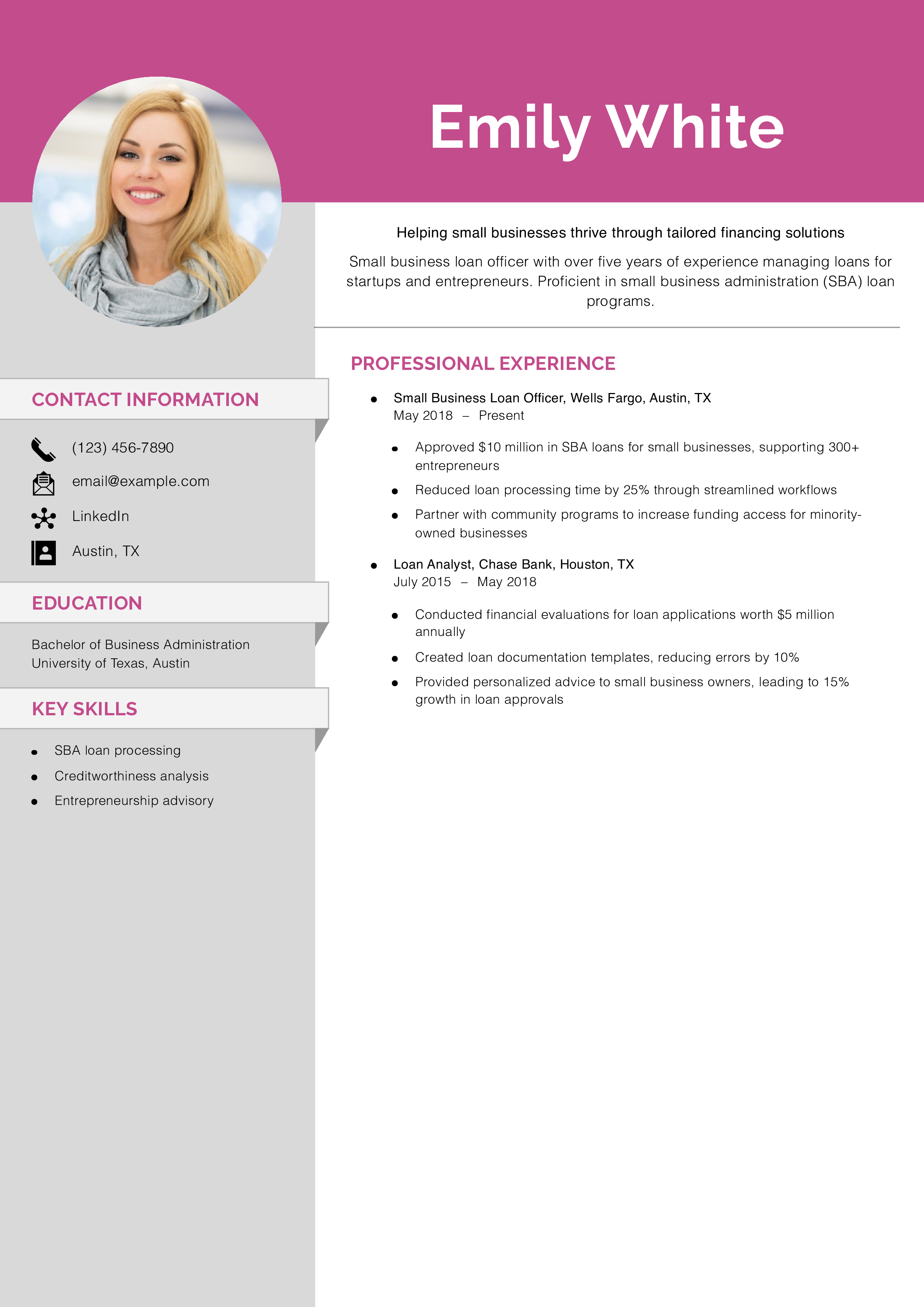

Small Business Loan Officer Resume Example

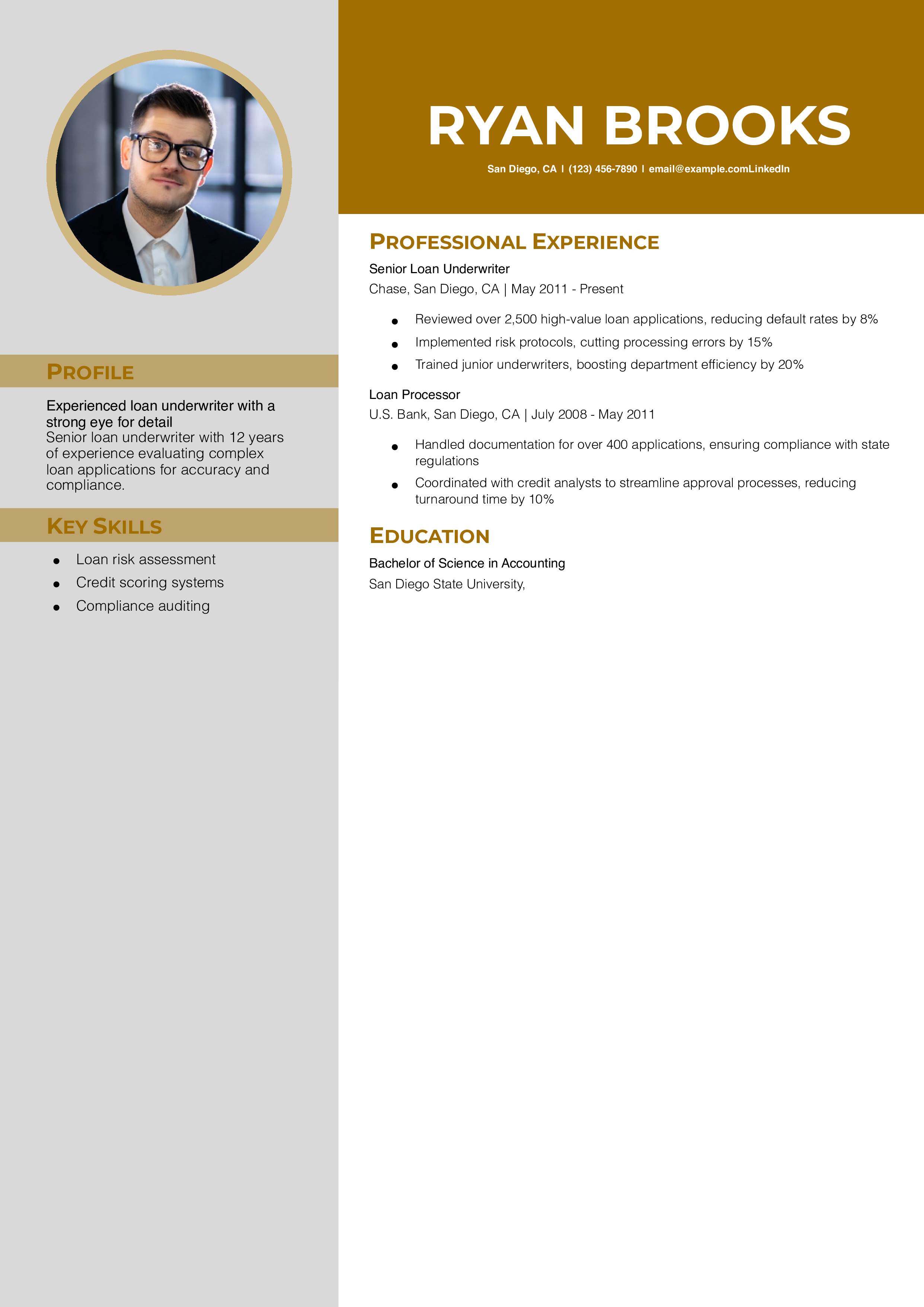

Senior Loan Underwriter Resume Example

Loan Portfolio Manager Resume Example

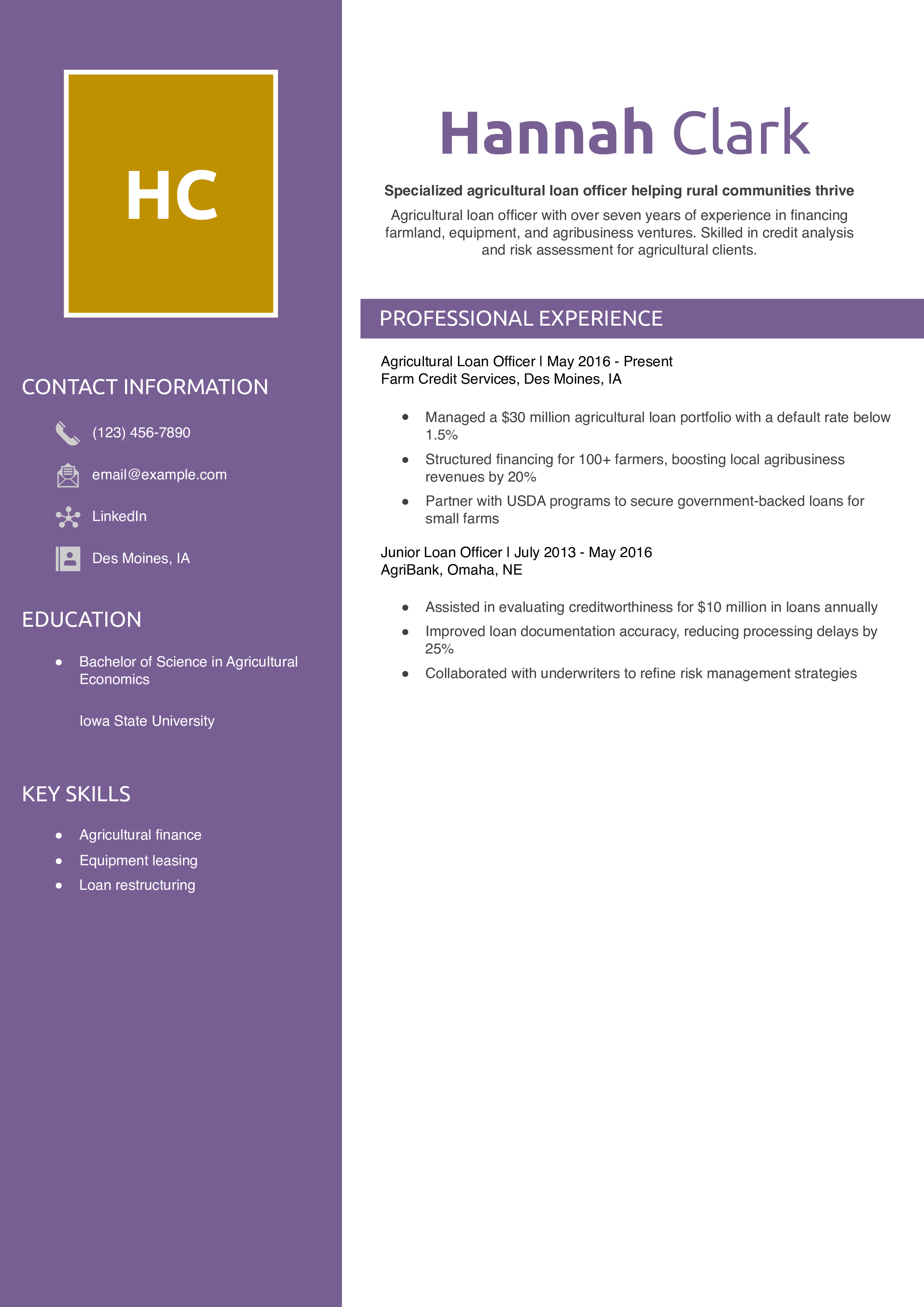

Agricultural Loan Officer Resume Example

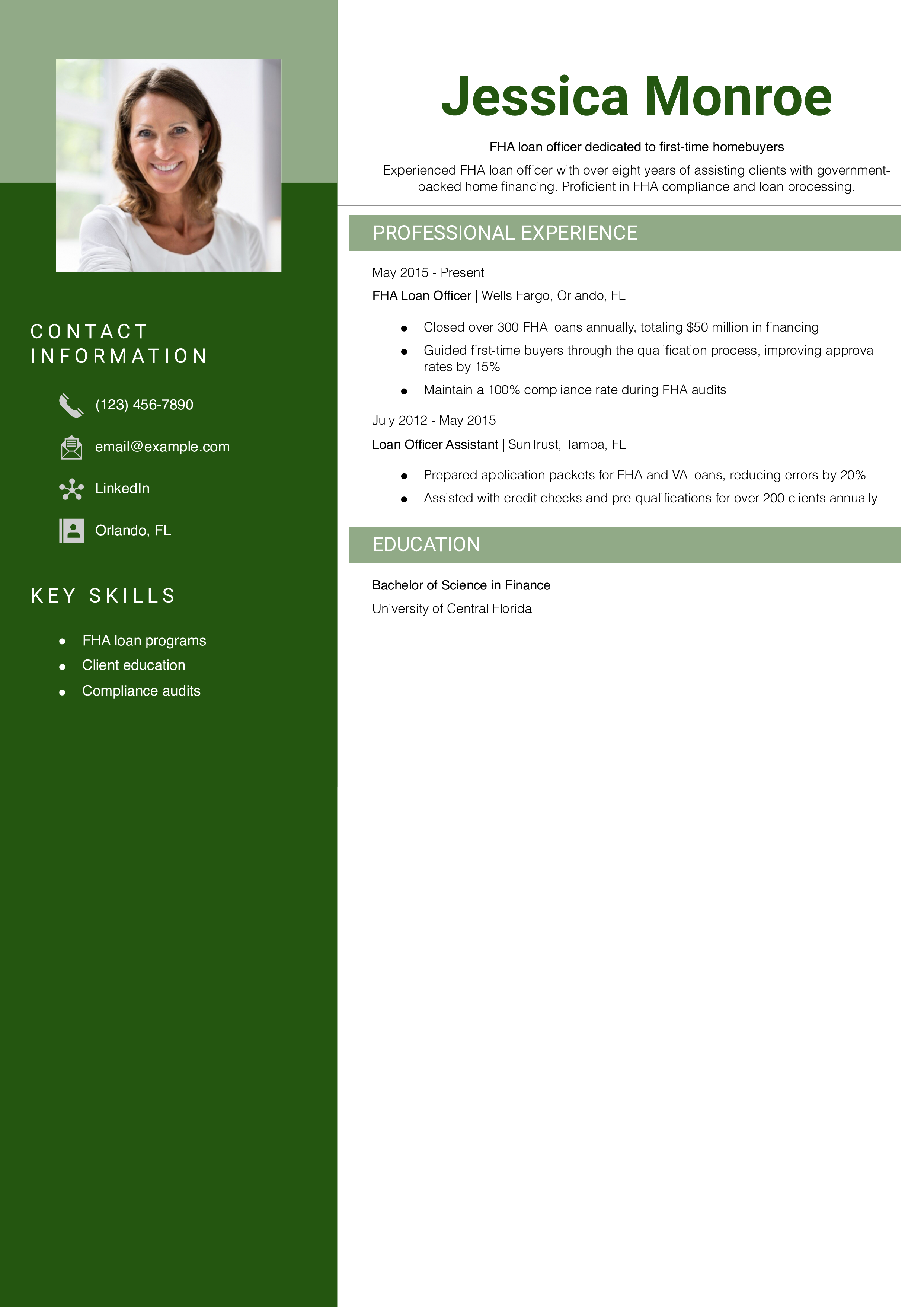

FHA Loan Officer Resume Example

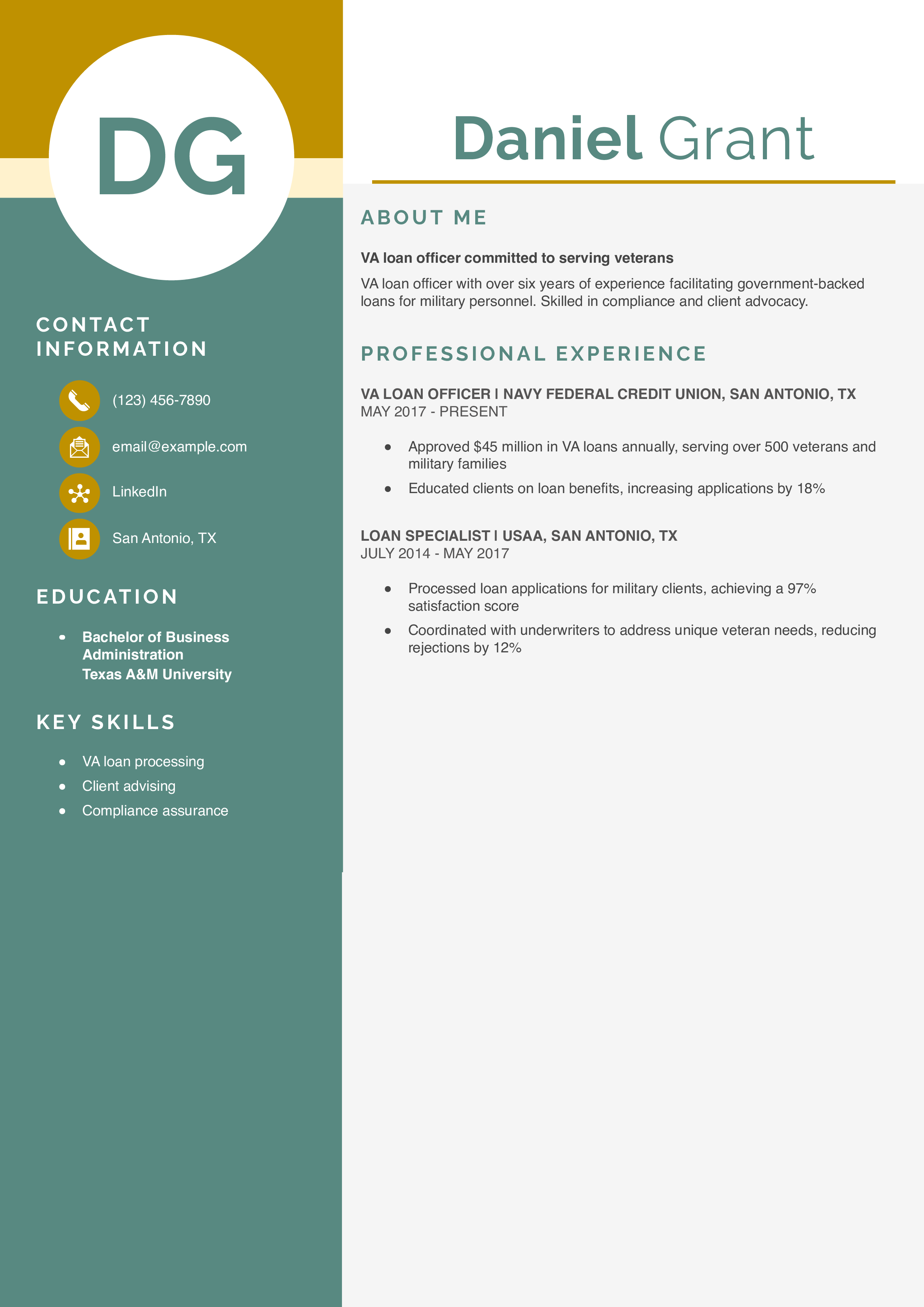

VA Loan Officer Resume Example

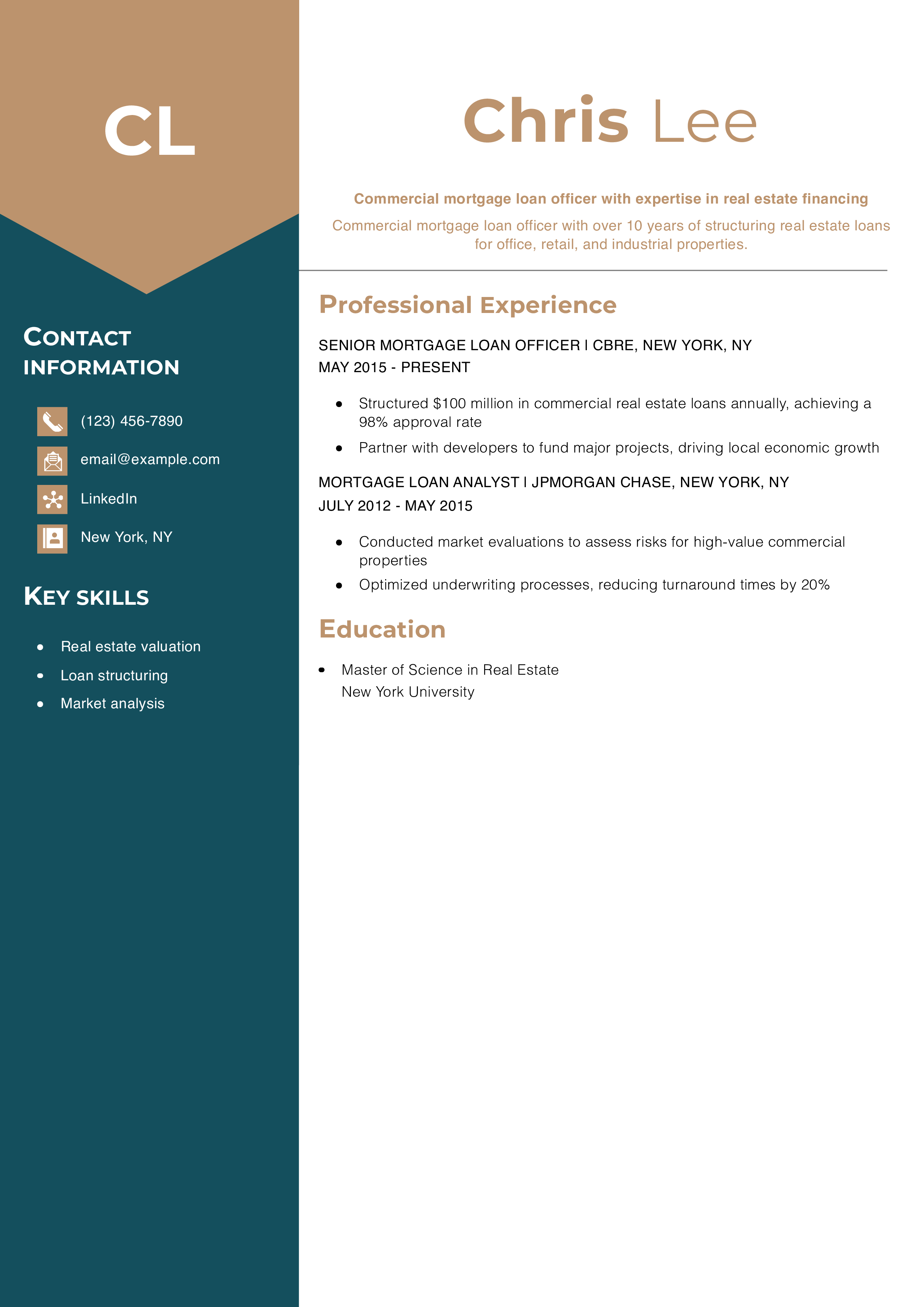

Commercial Mortgage Loan Officer Resume Example

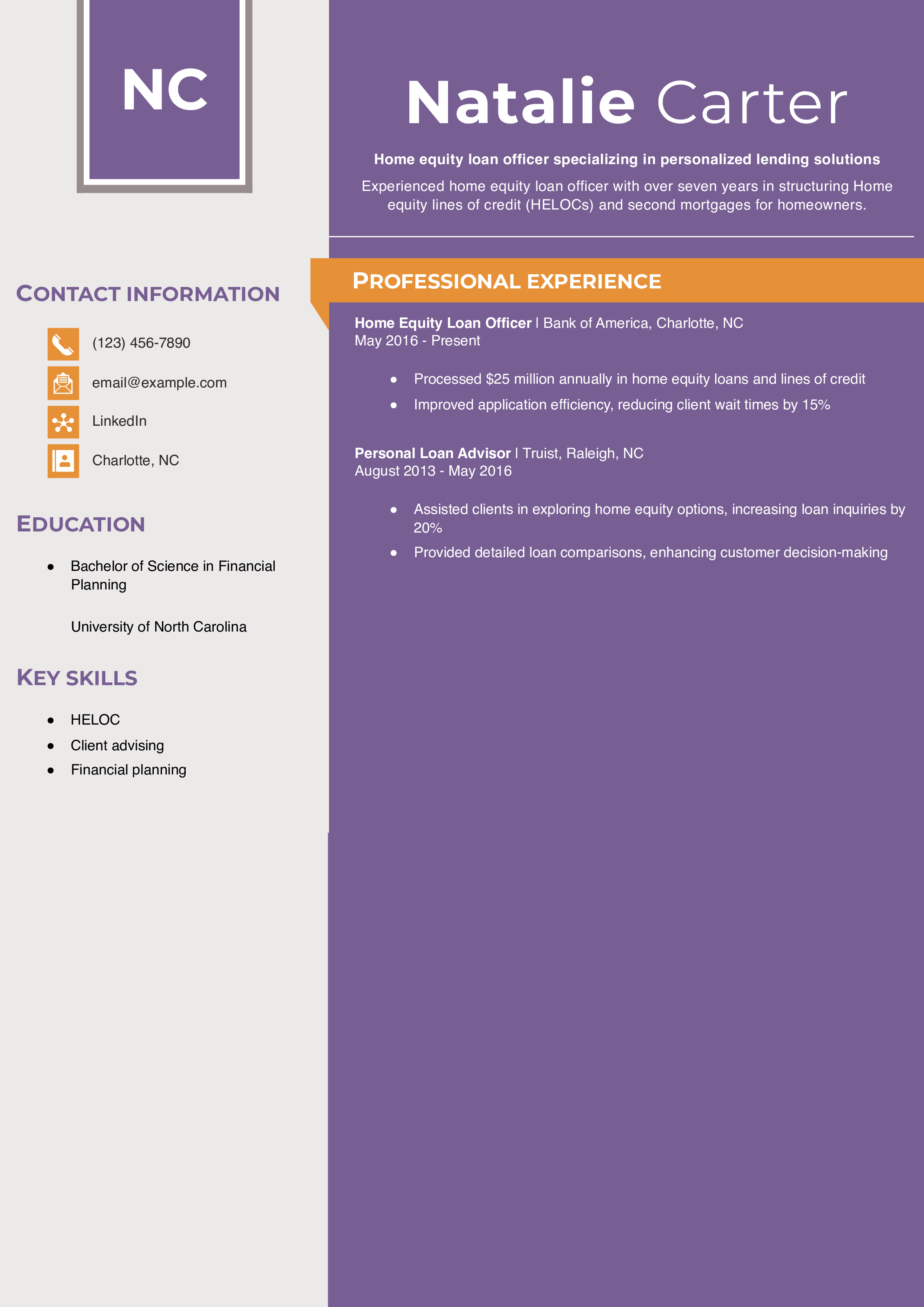

Home Equity Loan Officer Resume Example

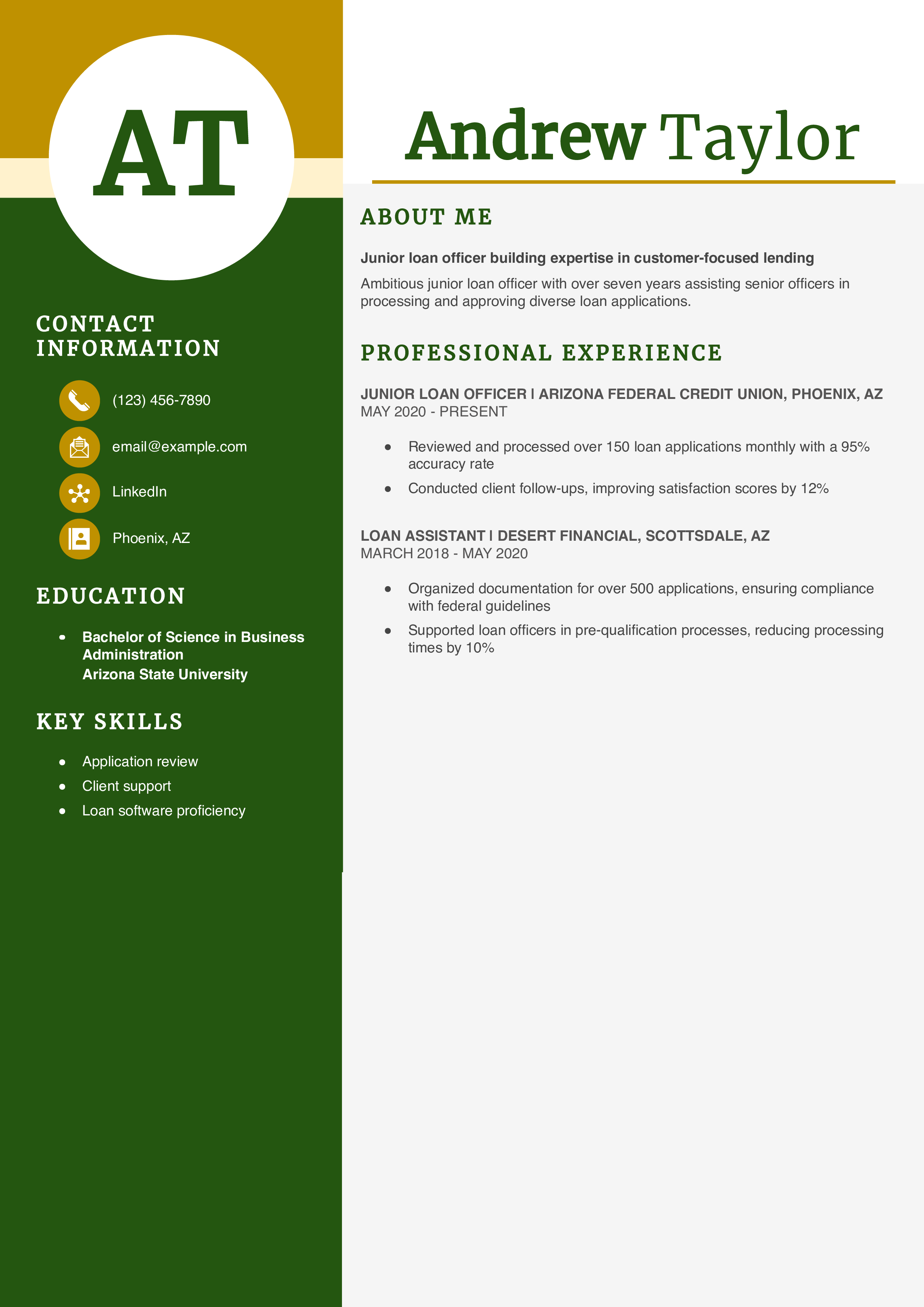

Junior Loan Officer Resume Example

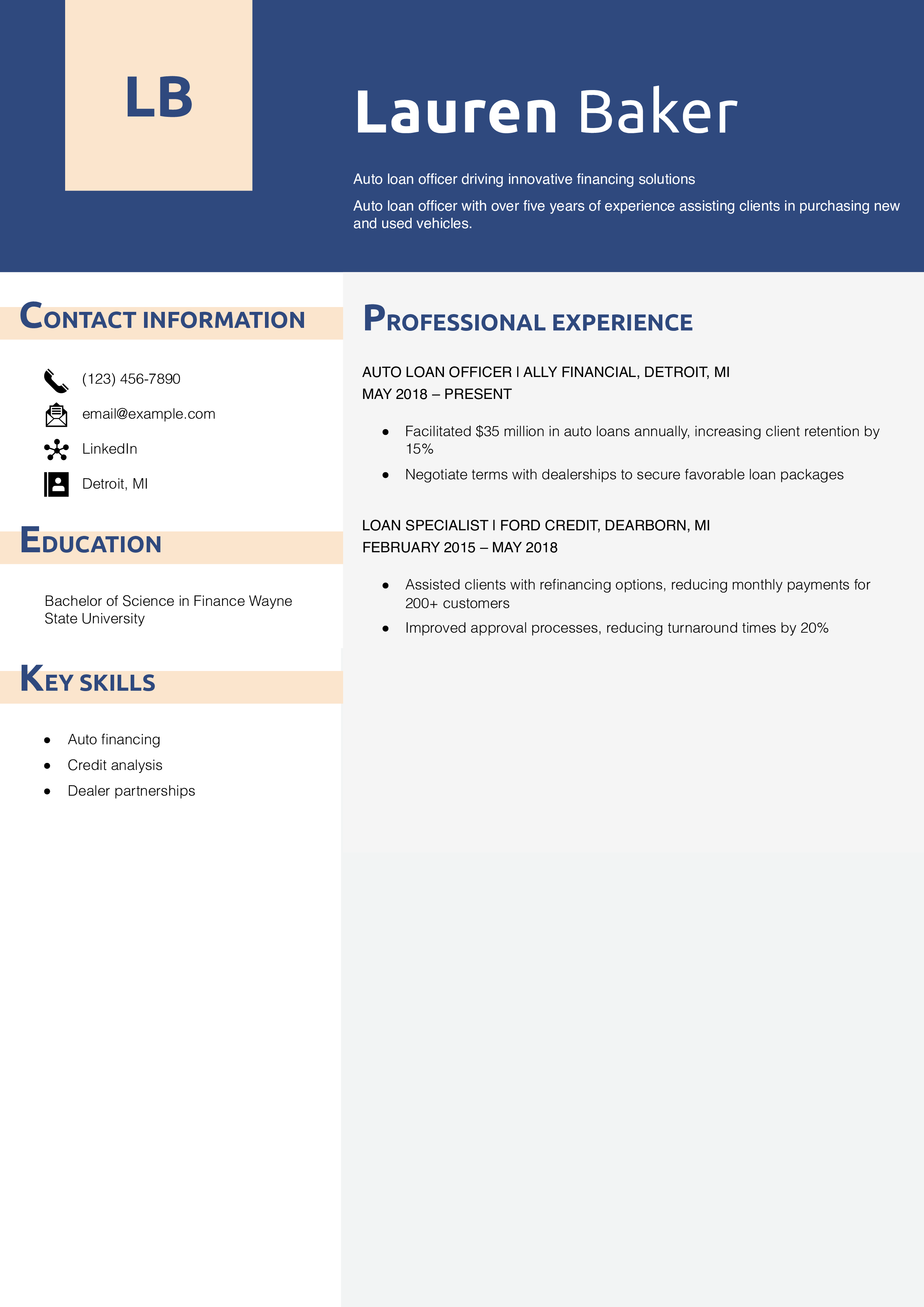

Auto Loan Officer Resume Example

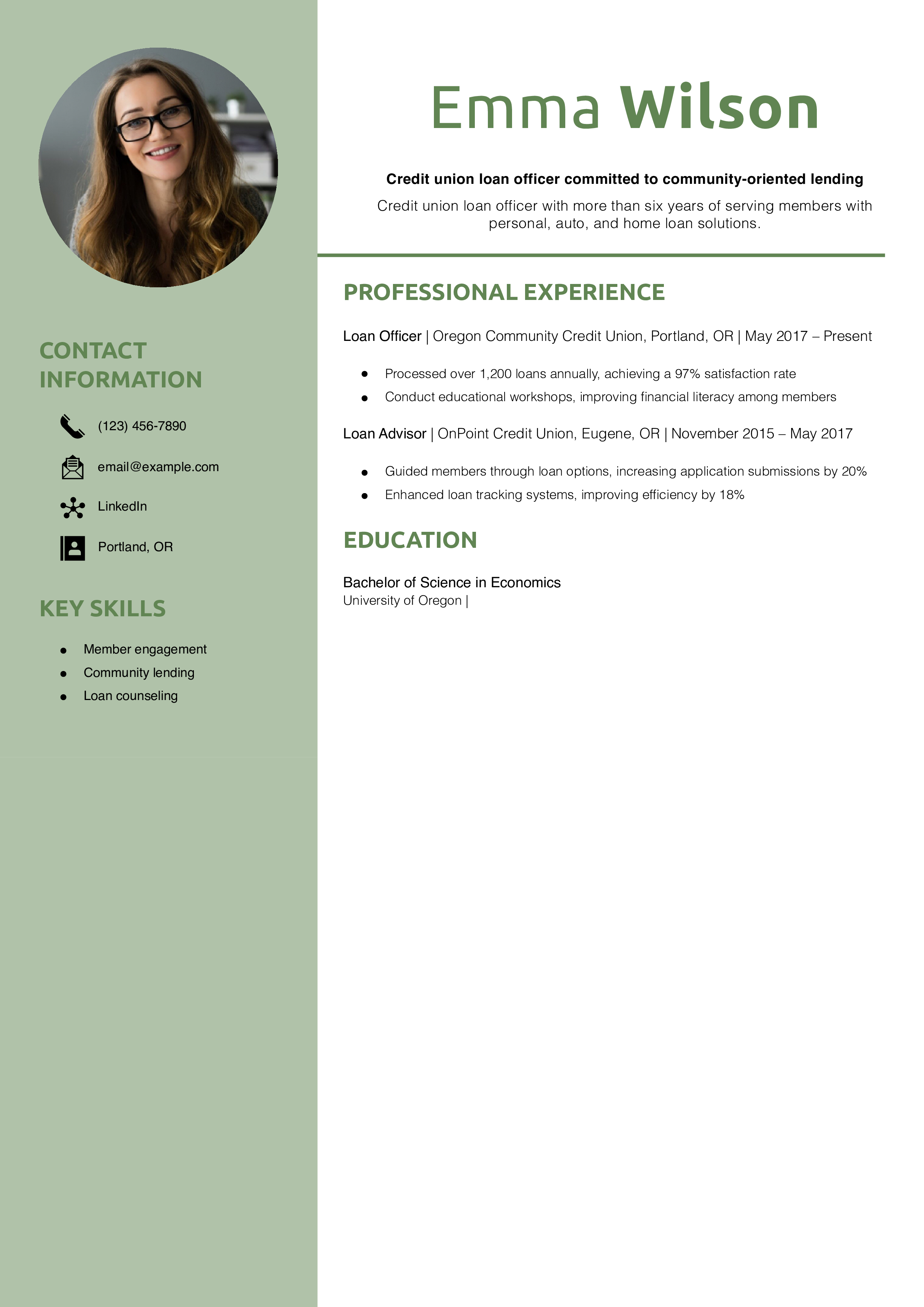

Credit Union Loan Officer Resume Example

Private Loan Officer Resume Example

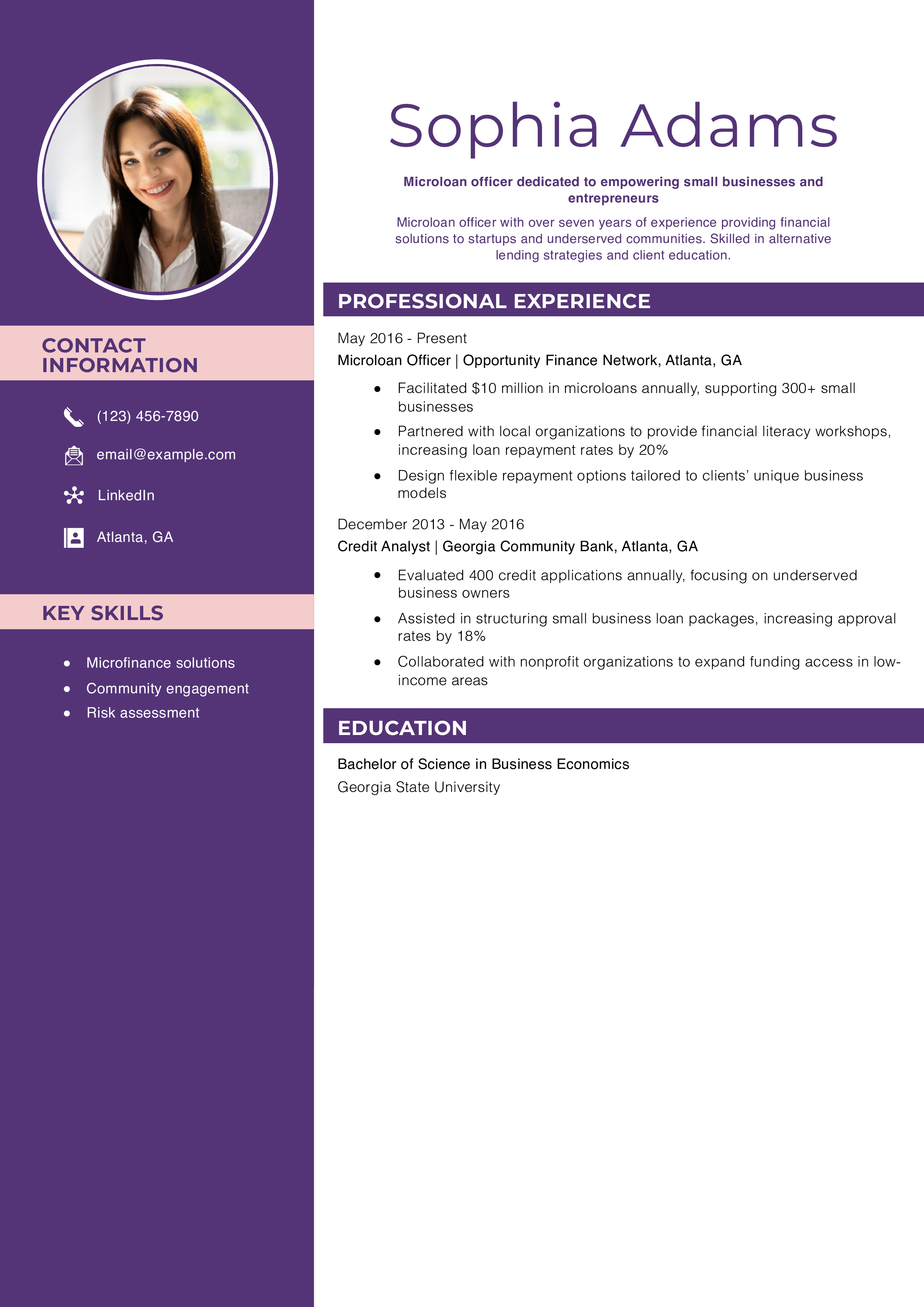

Microloan Officer Resume Example

Loan Officer Text-Only Resume Examples and Templates

How To Write a Loan Officer Resume

Your loan officer resume should usually include these sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

Below are tips and samples to help you organize each resume section.

1. Share your contact information

Give your full name, phone number, email address, location, and links to any online professional profiles. Ensure your contact information is current so employers can reach you for an interview.

Template:

Your Name

(123) 456-7890 | [email protected] | City, State Abbreviation Zip Code | LinkedIn

2. Write a compelling profile summarizing your loan officer qualifications

You can impress hiring managers at the top of your resume by giving the three to five primary reasons you’ll excel as their next loan officer. These key selling points may include your:

- Main strengths or specialties

- Work style or approach (efficient, diligent, collaborative…)

- Advanced degree(s) or certifications in your field

(Note: Most job seekers find it easier to write their profile last.)

Example:

Mortgage loan officer with over six years of experience in real estate and credit loans. Skilled at advising clients, analyzing financial data, and building professional relationships. Consistently exceed client satisfaction benchmarks.

3. Add an accomplishment-driven professional experience section

View the experience section as a chance to give examples of your success in roles similar to the one you’re pursuing. For each job in your recent work history, brainstorm and jot down your duties and achievements on a separate document or sheet of paper. Then, choose the most relevant details to feature as bullet points in this section.

Example:

Senior Loan Officer Assistant, Deloitte, Philadelphia, PA | January 2019 to present

- Helped process over 500 applications, increasing approval rates by 30%

- Improved client satisfaction by 20% by providing high-quality service

- Maintain strict adherence to federal lending laws

Resume writer’s tip: Quantify your experience

When possible, cite relevant performance data and metrics to show the results you’ve achieved as a loan officer. Hard numbers put your work in context and give recruiters a better sense of your scope and impact.

If you’re trying to move from a large firm to a startup or vice versa, some of your data may not speak to this goal. But you can still capture the impact and substance of your work by trading out numbers for percentages. For instance, if you have “Grew portfolio by 80 clients,” you can instead say “Grew client portfolio by 30%.”

Resume writer’s tip: Tailor your resume to each application

Customizing your resume takes time, but can shorten your overall job search by giving you an edge over the many applicants who send a general application. (See the FAQ section below for advice on tailoring a resume.)

What if you have no experience as a loan officer?

As long as the job posting doesn’t strictly require it, you don’t need direct work experience to write an effective resume. The trick is focusing on your transferable skills, which can come from various areas such as your past jobs, internships, volunteer positions, or college courses. Review each job posting closely to know which skill areas matter most to the employer. By detailing these areas in full on your resume, you can ensure it helps you get an interview.

4. Include relevant education and certifications

With the education and certifications sections, you can show you have a strong knowledge base in your specialized field. Each degree or credential also serves as a formal endorsement of your skills and professionalism. Following are templates to help you organize this information on your resume (note, years are optional).

Education

Template:

[Degree Name], [School Name], [City, State Abbreviation] | [Graduation Year]

[Relevant honors, coursework, or activities]

Example:

Bachelor of Science in Finance, University of Pennsylvania – The Wharton School, Philadelphia, PA

Certifications

Template:

[Certification Name], [Awarding Organization] | [Completion Year]

[Description if the credential is lesser-known but relevant]

Example:

Chartered Financial Analyst (CFA), CFA Institute

5. List pertinent key skills

A separate skills section lets you quickly display the (possibly various) ways you can serve clients and businesses. Below, you’ll find some key terms and skills to consider for this section:

| Key Skills and Proficiencies | |

|---|---|

| Client consultation | Contract negotiations |

| Customer service | Efficiency improvement |

| Financial data analysis | Loan portfolio management |

| Loan processing | Loan underwriting |

| Regulatory compliance | Reporting and documentation |

| Risk assessment | Team collaboration |

Resume writer’s tip: Use common action verbs

Start each bullet point with a strong action verb. Dynamic verbs help you keep the hiring manager’s attention and show the varied nature of your experience.

The following list can help you find a good mix of action verbs for your loan officer resume:

| Action Verbs | |

|---|---|

| Approved | Authorized |

| Consulted | Created |

| Decreased | Enhanced |

| Fostered | Generated |

| Grew | Improved |

| Increased | Introduced |

| Lowered | Managed |

| Negotiated | Prevented |

| Processed | Ranked |

| Recommended | Reduced |

| Reversed | Reviewed |

| Streamlined | Underwrote |

| Updated | Won |

How To Pick the Best Loan Officer Resume Template

A resume is a simple tool for professional communication and should be formatted that way. Choose a clear and straightforward template, and avoid any with elaborate graphics or various colors and font styles. Simple resume design helps a hiring manager scan for relevant information. It also lets you tailor the document to each job application and update your work history.

Frequently Asked Questions: Loan Officer Resume Examples and Advice

Focus on editing your skills section. With a few quick changes to this section, you can hone your resume and help it get past screenings by applicant tracking systems (ATS).

First, look closely at the job posting and highlight any required skills. Then, compare those highlighted terms with your resume’s existing skills section. Delete any skills that don’t appear in the job posting from your list, and add any missing skills of yours that do.

The combination (or hybrid) format, because it lets you present yourself both clearly and strategically. According to job search experts Wendy Enelow and Louise Kursmark, this format “gives you many opportunities to share your specific successes…. It offers immense flexibility in an easy-to-follow structure.”

A combination resume has these two features:

- An introduction describing your strengths. The traditional resume intro comprises a profile paragraph and skills list, as in the examples on this page. But there are many variations. Depending on your job search, you may omit one or both of these sections in favor of a one- or two-sentence professional headline. You may also add elements like graphs or client testimonials. Whatever approach you choose, make sure your introduction tells why you’re great for the job.

- One or more experience sections. Hiring managers want to know your latest career activities. The combination format lets you provide that information with sections for your recent years’ work, internship, education, or other experience. For most job seekers, the bulk of their combination resume will be a “Professional Experience” section with detailed job descriptions in reverse chronological order.

Expert advice: include a cover letter with your resume

A good cover letter sharpens your job application by answering the question, Why do you want this particular job? As with starting your resume, brainstorm your thoughts on a separate document or paper and choose the most compelling ones as your foundation. When possible, quote or paraphrase text from the job posting and explain why it caught your eye.

Check Out Related Examples

Resume Templates offers free, HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.