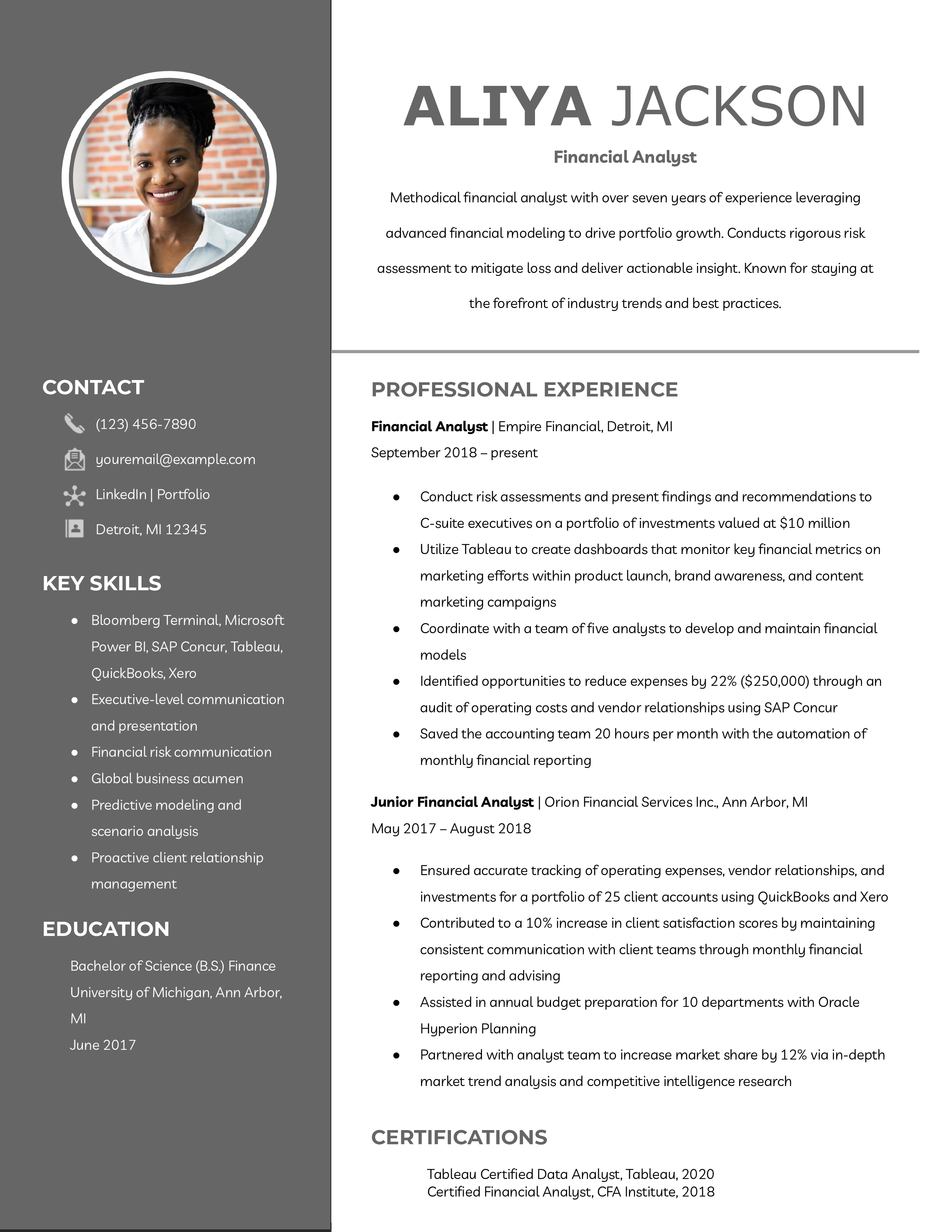

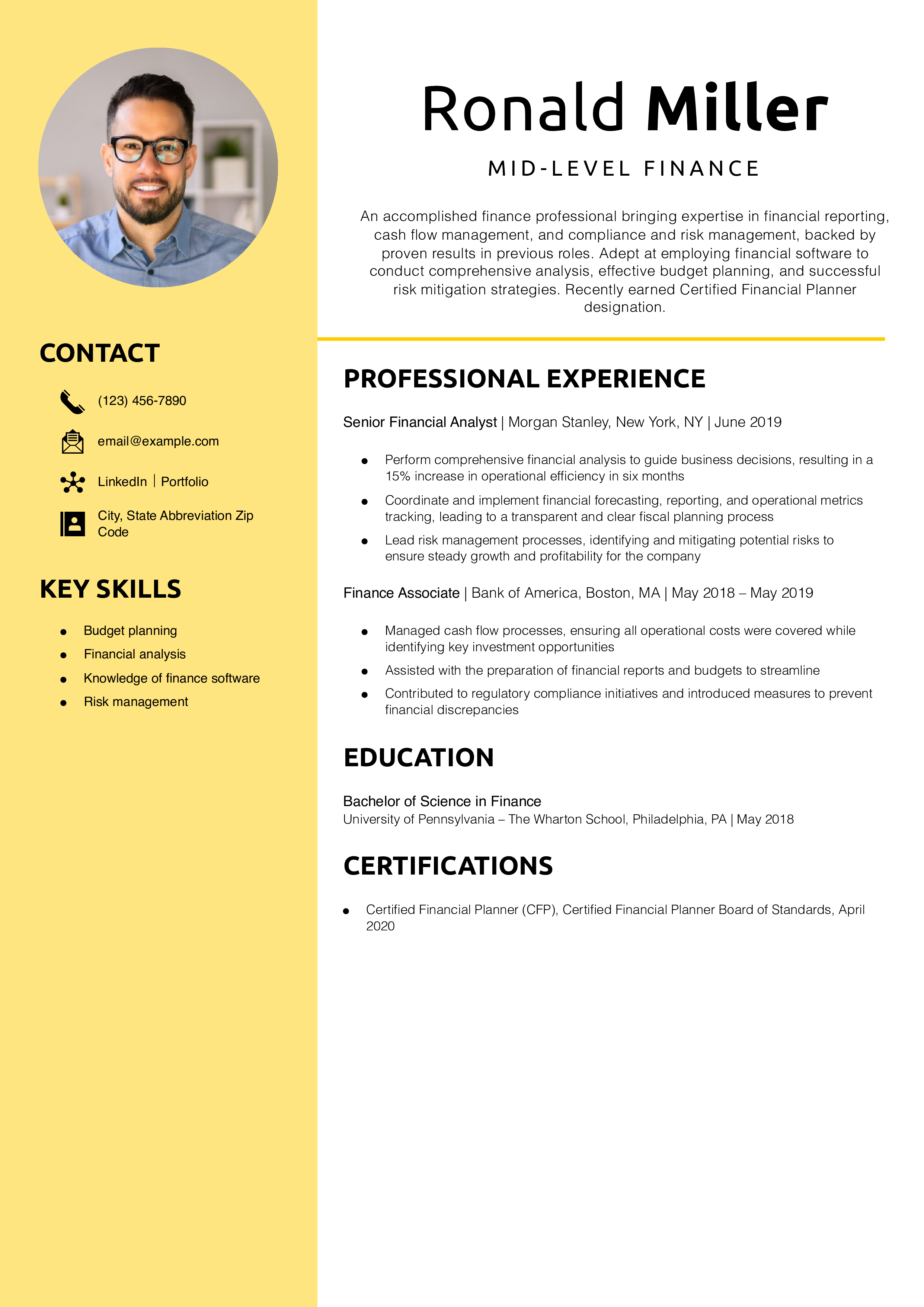

Finance Resume Templates and Examples (Downloadable)

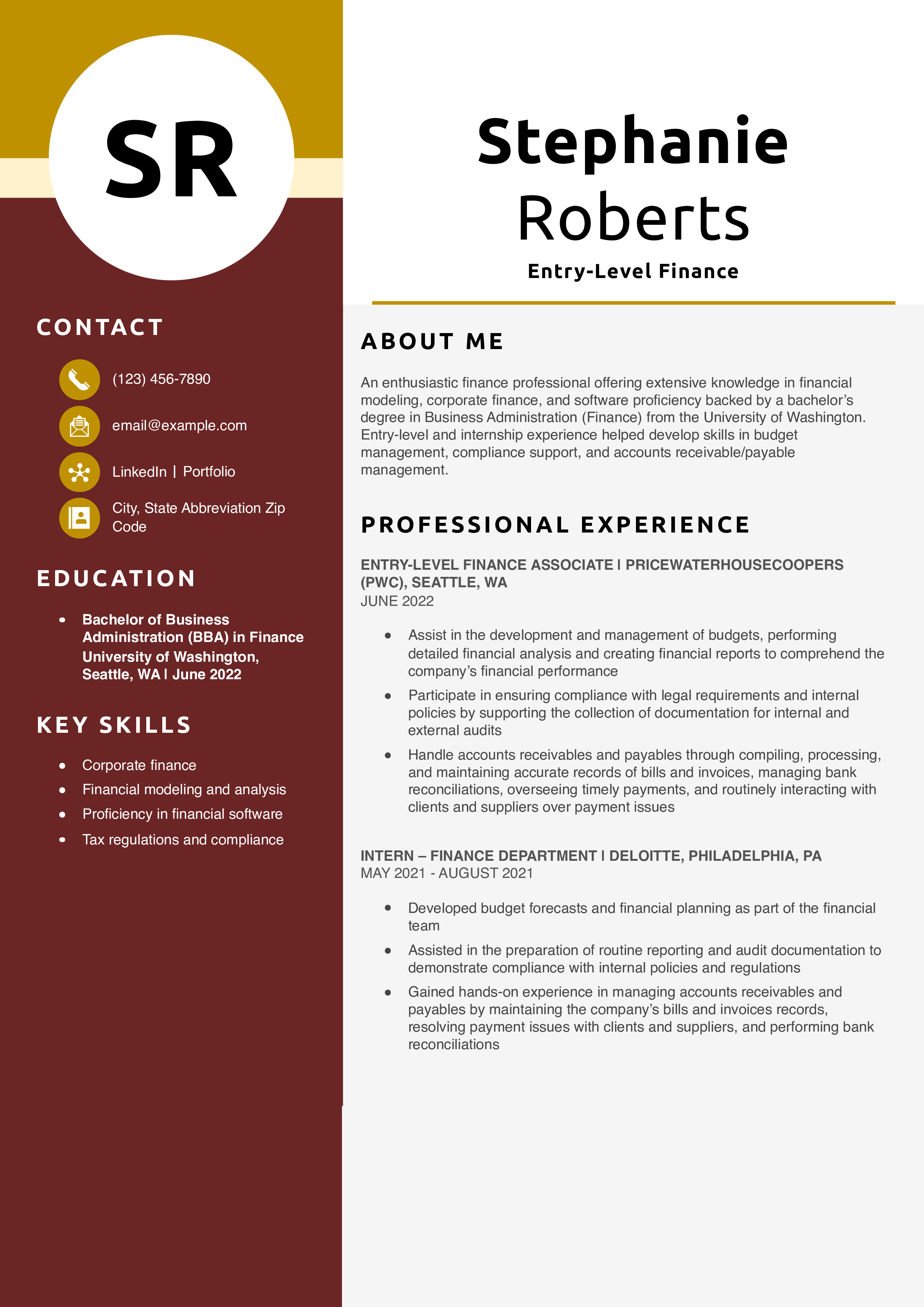

- Entry-Level Finance

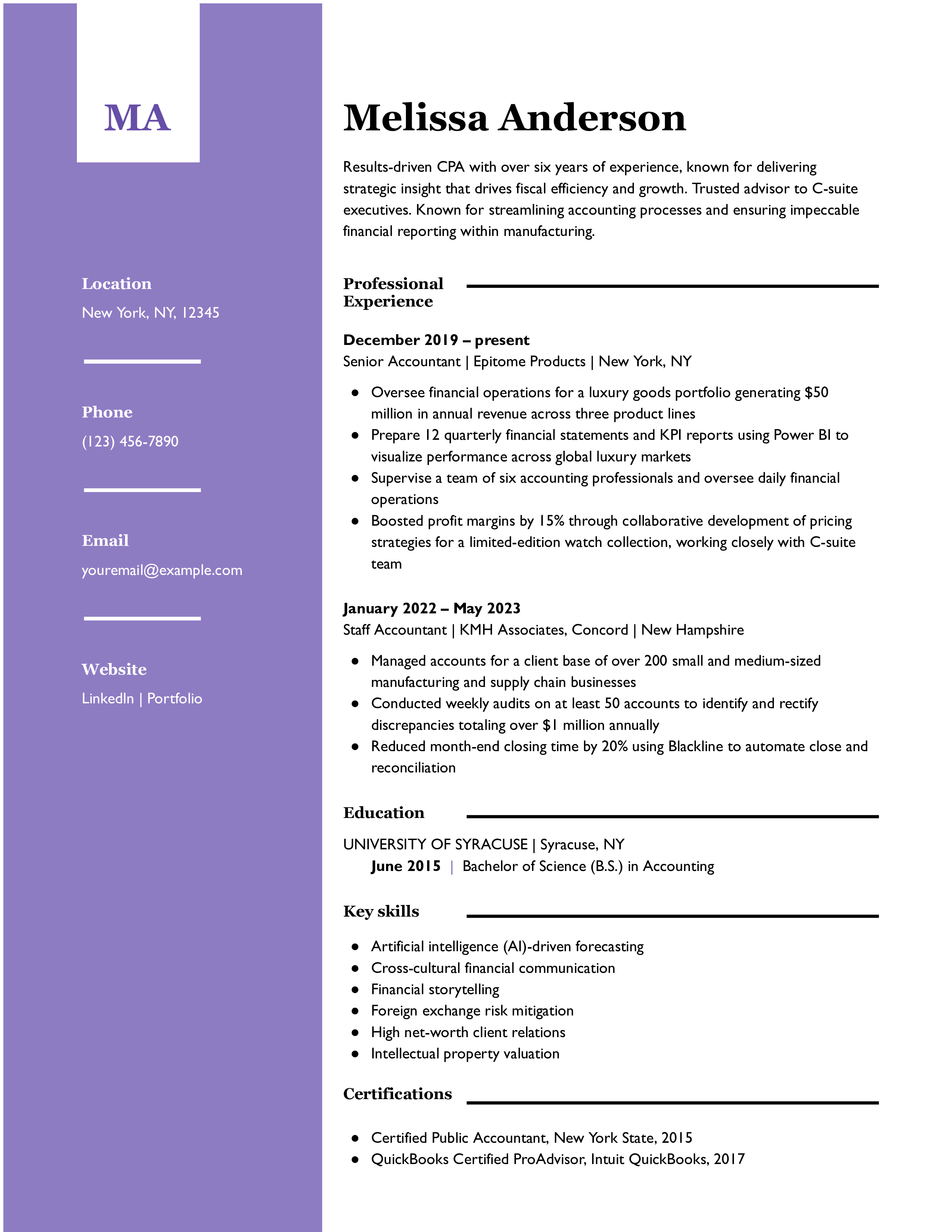

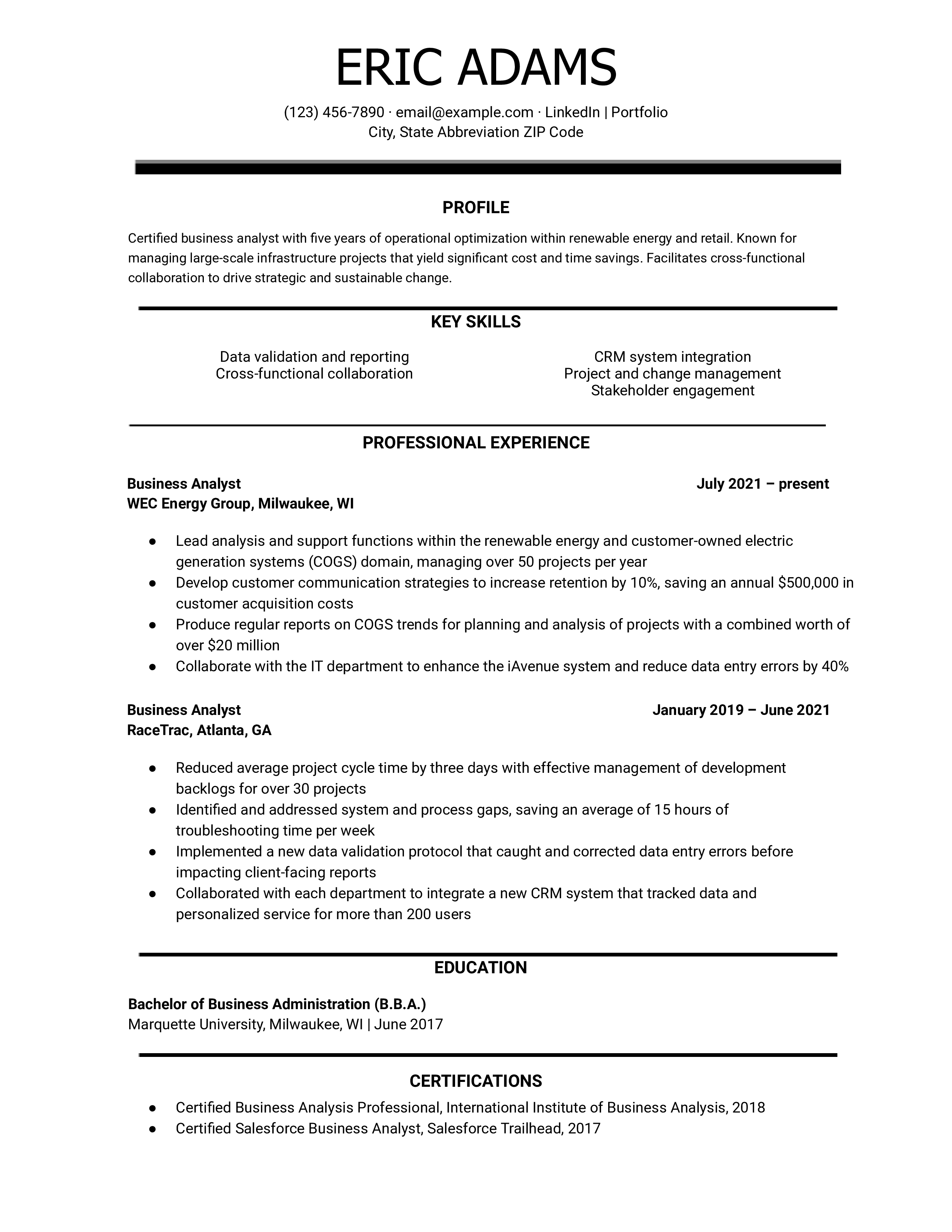

- Mid-Level Finance

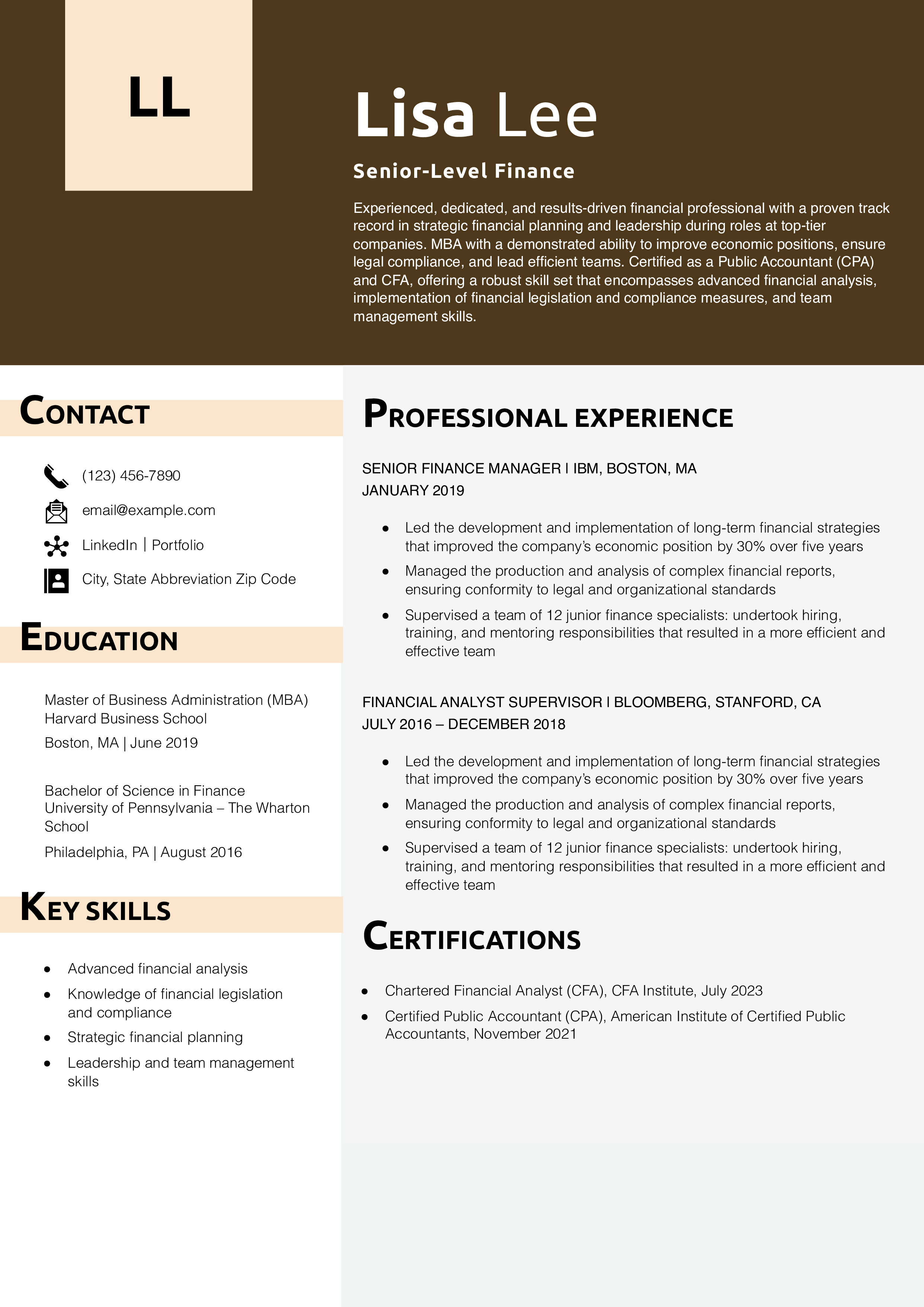

- Senior-Level Finance

As a finance professional, your resume must reflect expertise in money management. Highlight your proficiency in things like financial analysis, risk assessment, and strategic decision-making skills. This guide provides expert insights and examples to help you write a finance resume that shows you would be a valuable asset to any organization.

Key Takeaways

- Emphasize specializations: Finance professionals can specialize in different business roles, from accounting to financial planning to investment banking and more. Your resume should be specific about your financial skills, including the software you use, degrees and certifications you have, and other details.

- Detail quantifiable achievements: Quantifying your accomplishments can help potential employers understand the value that you bring. Share any numbers you can, whether it’s how you saved your team money, increased return on investment (ROI), or achieved a strong accuracy or customer service rating.

- Use keywords for ATS: Using some of the same keywords and phrases from job descriptions can help ensure that your resume is selected by applicant tracking systems (ATS). This can help you make it to the human phase of the job search.

How To Write a Finance Resume Example

Ensure your finance resume looks professional and well-organized by using a ready-made template. Your finance resume should include these sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

1. Share your contact information

List your current contact information in the header at the top of your resume. Include your full name, phone number, email address, location, and a link to your online professional profile. This ensures hiring managers and clients can easily reach you for more information or to schedule an interview.

Example

Your Name

(123) 456-7890

[email protected]

City, State Abbreviation Zip Code

LinkedIn | Portfolio

2. Write a dynamic profile summarizing your qualifications

A resume profile concisely summarizes the professional experiences of your most recent job titles, years of experience, and unique specializations within finance. As you create your profile, use the job description as a guide to align your resume with the role’s requirements. Highlighting what’s most relevant shows potential employers you’re an ideal candidate who can contribute to their financial goals.

Senior-Level Profile Example

A dedicated and results-driven financial professional with extensive experience in the field, possessing a Master’s in Business Administration. Proven track record in strategic financial planning and leadership during roles at top-tier companies with a demonstrated ability to improve economic positions, ensure legal compliance, and lead efficient teams. Certified as a Public Accountant (CPA) and Chartered Financial Analyst (CFA), offering a robust skill set that encompasses advanced financial analysis, implementation of financial legislation and compliance measures, and team management skills.

Entry-Level Profile Example

An enthusiastic finance professional offering extensive knowledge in financial modeling, corporate finance, and software proficiency backed by a bachelor’s degree in Business Administration (Finance) from the University of Washington. Entry-level and internship experience helped develop skills in budget management, compliance support, and accounts receivable/payable management.

3. Add a compelling section featuring your finance experience

This section of your resume should clearly outline your career trajectory within finance. Starting with your most recent job first, describe past duties and achievements, recounting times when you worked on a team, optimized operations, mitigated a risk, or increased profitability. Hiring managers like to see results, so quantify your work when you can.

Senior-Level Professional Experience Example

Senior Finance Manager, PricewaterhouseCoopers (PWC), Boston, MA | January 2016 – present

- Led the development and implementation of long-term financial strategies that improved the company’s economic position by 30% over five years

- Managed the production and analysis of complex financial reports, ensuring conformity to legal and organizational standards

- Supervised a team of 12 junior finance specialists: undertook hiring, training, and mentoring responsibilities that resulted in a more efficient and effective team

Financial Analyst Supervisor, Ernst & Young (EY), Stanford, CA | July 2010 – December 2015

- Executed strategic financial planning responsibilities; designed and implemented financial models that predicted future market trends, aiding business strategies

- Maintained compliance with financial legislation by overseeing and managing the company’s financial operations, ensuring complete accuracy in all financial procedures and reports

- Led teams and applied innovative communication strategies for external stakeholders to build robust relationships

Entry-Level Professional Experience Example

Entry-Level Finance Associate, PricewaterhouseCoopers (PWC), Seattle, WA | June 2022 – present

- Assist in the development and management of budgets, creating detailed analyses and reports to comprehend the company’s financial performance

- Participate in ensuring compliance with legal requirements and internal policies by supporting the collection of documentation for internal and external audits

- Handle accounts receivables and payables through compiling, processing, and maintaining accurate records of bills and invoices, managing bank reconciliations, overseeing timely payments, and routinely interacting with clients and suppliers over payment issues

Intern – Finance Department, Deloitte, Philadelphia, PA | May 2023 – August 2023

- Developed budget forecasts and financial planning as part of the financial team

- Assisted in the preparation of routine reporting and audit documentation to demonstrate compliance with internal policies and regulations

- Gained hands-on experience in managing accounts receivables and payables by maintaining the company’s bills and invoices records, resolving payment issues with clients and suppliers, and performing bank reconciliations

Resume writer’s tip: Quantify your experience

As a finance professional, you know that numbers can be more impactful than words alone. Quantifying your experience provides concrete evidence of your capabilities. Each time you use numbers to illustrate your past achievements, you convey a sense of measurable value. This increases credibility and helps hiring managers gauge the scale and impact of your work.

Do

- “Manage a portfolio of more than 150 loans, closing on at least 20 loans per year.”

Don’t

- “Responsible for the management and closing of a large portfolio of loans.”

Resume writer’s tip: Tailor your resume for each application

The job outlook for professionals in finance is bright, with faster-than-average growth predicted for the next 10 years. Although demand will likely continue to increase, your resume must be well-tailored to land your dream job. To resonate with hiring managers, each resume you submit should be uniquely customized for that specific position and organization.

Start by identifying the key qualifications the employer values. Then, highlight similar skills, experiences, and qualifications on your resume. Include those keywords from the job ad throughout your document to optimize it for ATS now used by many employers. Your goal is to show you meet the unique criteria of each finance job you apply for.

What if you don’t have experience?

While you may not have held an established role yet, you can leverage a wide range of assets to create an effective finance resume. If you have a robust academic background, start by featuring your degrees, honors, scholastic achievements, and related coursework prominently on your resume. Include internship and externship experiences as well.

Next, consider the transferable skills you have that easily translate across industries and roles. Things like analytical thinking, software proficiency, and customer service are all essential to a well-rounded portfolio. If you were involved in extracurricular finance clubs and associations or donated your time and finance skills as a volunteer, be sure to describe these experiences.

4. Add finance education and certifications

The education section should start with your highest degree and any other finance-related academic experience, including relevant coursework and honors. Next, list certifications that could help set you apart from other applicants. Prioritize finance and industry-specific credentials such as Certified Public Accountant (CPA) or CFA.

Education

Template:

[Degree Name]

[School Name], [City, State Abbreviation] | [Graduation Year]

Example:

Bachelor of Science (B.S.) Finance, September 2012 – June 2016

Wayne State University, Detroit, MI

Certifications

Template:

[Certification Name], [Awarding Organization], [Completion Year]

Example:

- Chartered Financial Analyst (CFA), CFA Institute, 2020

5. List key finance skills and proficiencies

Whether you’re a credit counselor or financial manager, a key skills list immediately communicates to hiring managers what you’re capable of within your field. Technical competency and interpersonal dynamics are equally important in finance. Include both skill types on your resume while customizing the list to align with the demands of the job.

Here are some possible skills you can include:

| Key Skills and Proficiencies | |

|---|---|

| Accounting principles and practices | Budgeting |

| Data analysis and interpretation | Financial modeling |

| Investment analysis | Market research |

| Negotiation | Portfolio management |

| Tax planning and compliance | Valuation techniques |

Resume writer’s tip: Use specific action verbs

To instantly improve the professional experience section of your finance resume, use action verbs instead of first-person language (e.g., “I was responsible for…”). These words help to quantify your work history and frame your daily responsibilities as accomplishments. As you describe the work you’ve done in past jobs, start each bullet point with an action verb like the ones we’ve listed below:

| Action Verbs | |

|---|---|

| Analyzed | Balanced |

| Budgeted | Calculated |

| Consolidated | Forecasted |

| Implemented | Invested |

| Modeled | Negotiated |

| Optimized | Reconciled |

| Streamlined | Underwrote |

| Validated | |

How To Pick the Best Finance Resume Template

When choosing a resume template for finance, go with one that is professional, simple, and easy to read so that your qualifications and skills are the focus. Stay away from heavily designed templates that could be distracting or difficult for ATS to read.

Finance Text-Only Resume Templates and Examples

Stephanie Roberts

(123) 456-7890

[email protected]

City, State Abbreviation Zip Code

LinkedIn | Portfolio

Profile

An enthusiastic finance professional offering extensive knowledge in financial modeling, corporate finance, and software proficiency backed by a bachelor’s degree in Business Administration (Finance) from the University of Washington. Entry-level and internship experience helped develop skills in budget management, compliance support, and accounts receivable/payable management.

Key Skills

- Corporate finance

- Financial modeling and analysis

- Proficiency in financial software

- Tax regulations and compliance

Professional Experience

Entry-Level Finance Associate, PricewaterhouseCoopers (PWC), Seattle, WA | June 2022 – present

- Assist in the development and management of budgets, performing detailed financial analysis and creating financial reports to comprehend the company’s financial performance

- Participate in ensuring compliance with legal requirements and internal policies by supporting the collection of documentation for internal and external audits

- Handle accounts receivables and payables through compiling, processing, and maintaining accurate records of bills and invoices, managing bank reconciliations, overseeing timely payments, and routinely interacting with clients and suppliers over payment issues

Intern – Finance Department, Deloitte, Philadelphia, PA | May 2021 – August 2021

- Developed budget forecasts and financial planning as part of the financial team

- Assisted in the preparation of routine reporting and audit documentation to demonstrate compliance with internal policies and regulations

- Gained hands-on experience in managing accounts receivables and payables by maintaining the company’s bills and invoices records, resolving payment issues with clients and suppliers, and performing bank reconciliations

Education

Bachelor of Business Administration (BBA) in Finance

University of Washington, Seattle, WA, June 2022

Frequently Asked Questions: Finance Resume Examples and Advice

How do you align your resume with a finance description?

There are many different roles under the umbrella of finance so it’s important to zoom in on your specific skills. For instance, if you’re a financial analyst, your resume should include specific skills and accomplishments to demonstrate your proficiency in that role. You can also go a step further by looking at job descriptions and finding ways to match your skills and experience to what the employer is seeking.

What is the best finance resume format?

The reverse-chronological resume format is the most widely used option, and it works well for finance professionals. Hiring managers like seeing your most recent accomplishments front and center while also looking back at your job history and related accomplishments.

include a cover letter with your resume

Crafting a cover letter to supplement your resume can allow you to describe what makes you a strong fit for a particular role.

Check Out Related Examples

Resume Templates offers free, HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.