Banking Resume Templates and Examples (Downloadable)

- Banker

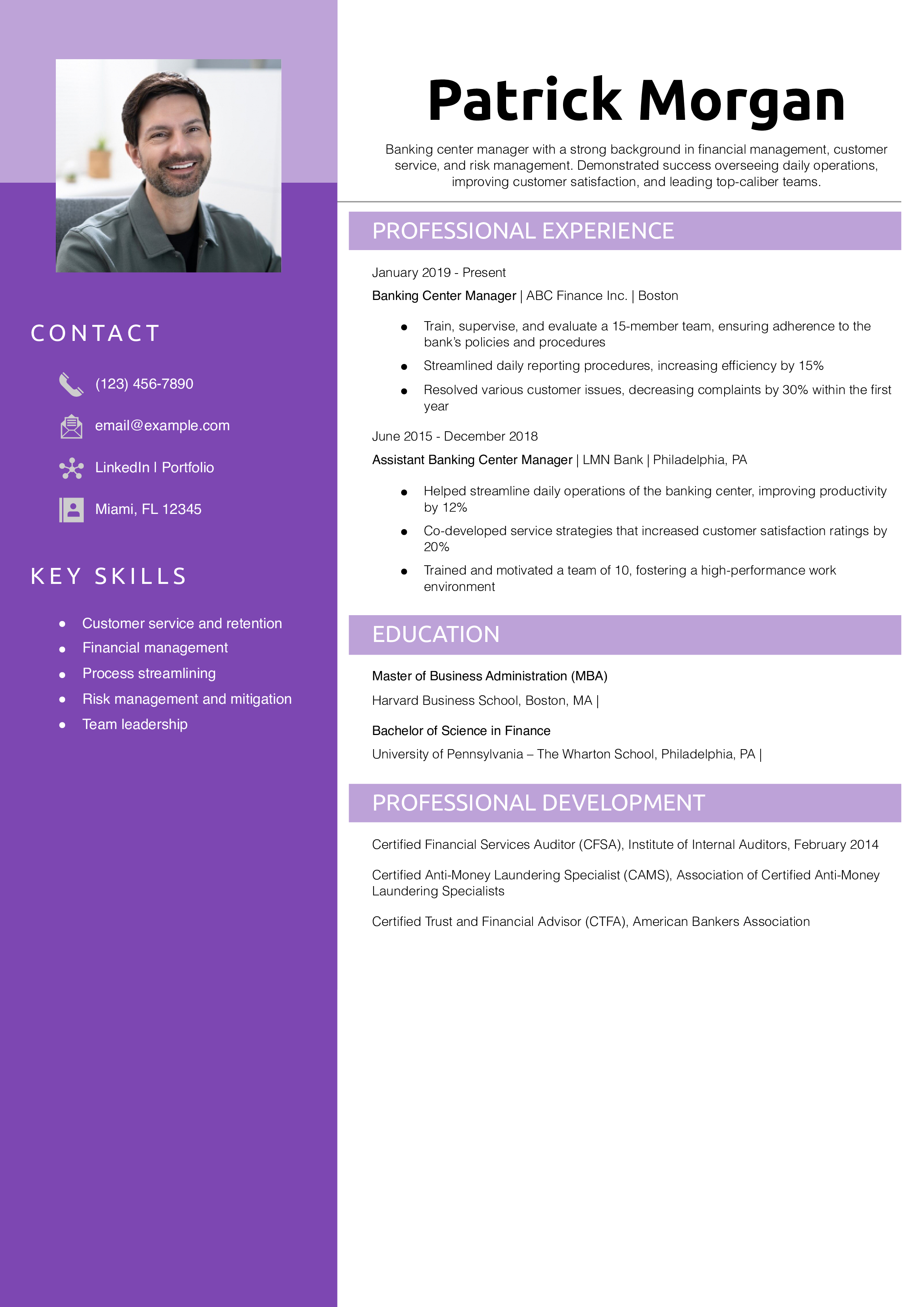

- Banking Center Manager

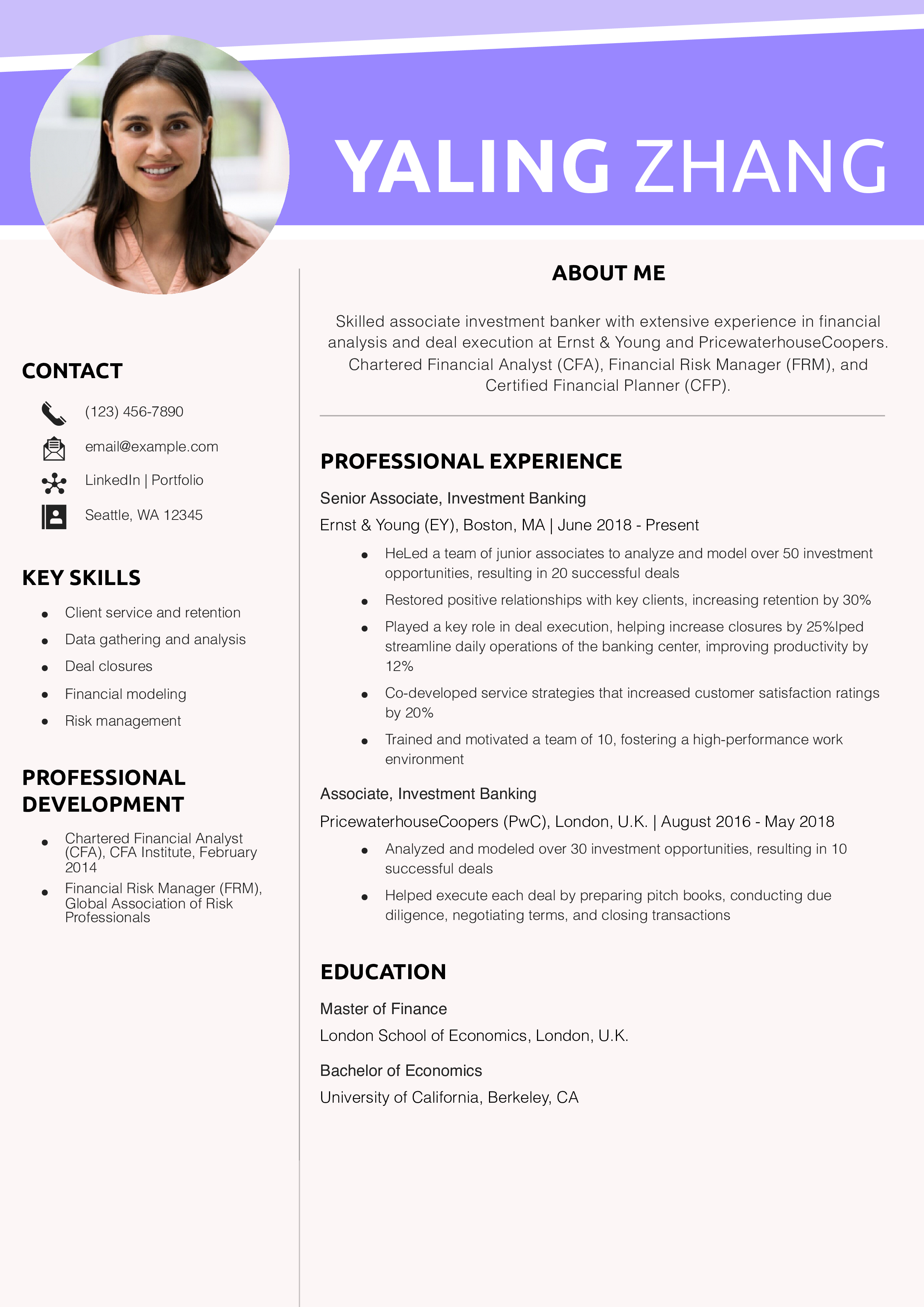

- Associate Investment Banker

This guide provides expert tips for creating a results-driven resume that emphasizes the best aspects of your banking experience.

Key takeaways:

- Use bullet points to showcase your work highlights. Start each bullet point with a strong verb like “Created” or “Enhanced.”

- Spell out the results of your past work as a banking professional, and describe how your efforts helped customers or the wider organization.

- Show your skills relevant to a banking role, such as customer service, financial analysis, or portfolio management.

How To Write a Banking Resume

Using a template can help you write an effective banking resume. Your banking resume should usually include these sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

1. Share your contact information

Give your full name, phone number, email address, location, and links to any online professional profiles. Ensure your contact information is current so employers can reach you for an interview.

Example

Your Name

(123) 456-7890

[email protected]

City, State Abbreviation Zip Code

LinkedIn Profile

2. Create a profile by summarizing your banking qualifications

Impress hiring managers at the top of your resume by giving the three to five primary reasons you excel in banking.

Example

Banking center manager with a strong background in financial management, customer service, and risk management. Demonstrated success overseeing daily operations, improving customer satisfaction, and leading top-caliber teams.

3. Create a powerful list of your banking experience

View the experience section as a chance to give detailed examples of your work and success as a banker or in other banking roles.

Example

Banking Center Manager, ABC Finance Inc., Boston, MA | January 2019 to present

- Train, supervise, and evaluate a 15-member team, ensuring adherence to the bank’s policies and procedures

- Streamlined daily reporting procedures, increasing efficiency by 15%

- Resolved various customer issues, decreasing complaints by 30% within the first year

Resume writer’s tip: Quantify your experience

Avoid bland job descriptions by using relevant performance data and metrics to show the results you’ve achieved as a banking professional. Hard numbers put your work in context and give recruiters a better sense of your scope and impact.

Do

- “Analyzed and modeled over 30 investment opportunities, resulting in 10 successful deals”

Don’t

- “Analyzed investment opportunities”

Resume writer’s tip: Tailor your resume for each application

Most finance organizations rely on some form of applicant tracking system (ATS) to identify qualified candidates for job openings. To get your resume through the initial screening and into the hiring manager’s hands, incorporate keywords from the job posting directly into your profile, professional experience, and skills section.

What if you don’t have experience?

Writing a resume can be hard if you don’t have real-world experience. But you still have valuable skills and knowledge from your education and training. Showcase any relevant coursework you’ve done or certifications you’ve earned. Also, consider including volunteer work or internships you’ve completed in your field, and emphasize your work ethic and willingness to learn. By highlighting these qualities, you can show how you’d be an asset to any team.

4. List any education and certifications relevant to banking

With the education and certifications sections, you can show you have a strong knowledge base in your field. Cite any credentials you’ve earned that speak to your abilities as a banker or banking professional. Following are templates to help you organize this information on your resume (note: years are optional).

Education

Template:

[Degree Name], [School Name], [City, State Abbreviation] | [Graduation Year]

Example:

Master of Business Administration (MBA), Concentration in Finance, Harvard Business School, Boston, MA

Certifications

Template:

[Certification Name], [Awarding Organization] | [Completion Year]

Example:

Certified Financial Services Auditor (CFSA), Institute of Internal Auditors

5. List key skills and proficiencies for banking

A separate skills section lets you quickly display the different ways you can add value to a bank or financial services company. Below, you’ll find some key banking-related terms and skills to consider for this section:

| Key Skills and Proficiencies | |

|---|---|

| Account management | Asset allocation |

| Client retention | Cost reduction |

| Customer service | Data gathering and analysis |

| Deal closures | Financial analysis |

| Financial modeling | Portfolio management |

| Process streamlining | Reporting and documentation |

| Risk management | |

Resume writer’s tip: Use specific action verbs

One of the best ways to enhance your resume is by starting each bullet point with a strong action verb. Dynamic verbs help you keep the hiring manager’s attention and show the varied nature of your experience. The following list can help you find a good mix of action verbs for your banking resume:

| Action Verbs | |

|---|---|

| Advised | Allocated |

| Consulted | Created |

| Decreased | Enhanced |

| Exchanged | Facilitated |

| Fostered | Generated |

| Grew | Guided |

| Improved | Increased |

| Introduced | Issued |

| Lowered | Prevented |

| Ranked | Reduced |

| Streamlined | Transferred |

| Updated | Won |

How To Pick the Best Banking Resume Template

A resume is a simple tool for professional communication and should be formatted accordingly. Choose a clear and straightforward template, and avoid any template with elaborate graphics or various colors and font styles. Simple resume design helps a hiring manager scan for relevant information. It also helps you tailor the document to each job application and make updates to your work history going forward.

Banking Text-Only Resume Templates and Examples

Allison Rosenberg

Detroit, MI 12345 | (123) 456-7890 | [email protected] | LinkedIn

Banker with strong experience assessing risk and managing portfolios. Use consultative sales methods to build positive long-term relationships with clients. Credentials include Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP).

Key Skills

- Business development

- Consultative sales

- Customer service

- Financial analysis

- Investment strategy

- Portfolio management

- Risk assessment and management

- Strategic planning

Education

Master of Business Administration,Concentration in Finance, Harvard Business School, Boston, MA

Bachelor of Science in Finance, University of Pennsylvania – The Wharton School, Philadelphia, PA

Professional Experience

Senior Banker, XYZ Financial Services, Philadelphia, PA | June 2018 to present

- Manage a diverse portfolio of high-net-worth clients, consistently exceeding financial targets by over 15%

- Conduct detailed risk assessments for various financial decisions, reducing potential losses by 20%

- Foster and maintain strong client relationships, increasing retention by 30%

Associate Banker, LMN Bank, Boston, MA | May 2015 to June 2018

- Directed a portfolio of clients, providing financial advice and making investment decisions that increased portfolio value by 25%

- Assessed financial risks associated with each client account, reducing potential losses by 18%

- Built strong client relationships, increasing client satisfaction by 20%

Professional Development

- Chartered Financial Analyst (CFA), CFA Institute

- Certified Financial Planner (CFP), Certified Financial Planner Board of Standards

- Financial Risk Manager (FRM), Global Association of Risk Professionals

Why this banking resume example is strong:

This resume excels with a prominent skills section that shows Allison’s different ways of adding value to an organization.

Frequently Asked Questions: Banking Resume Examples and Advice

First, look closely at the job post text and words that are repeated or emphasized. Compare these highlighted phrases to the language you’re using in your resume, particularly the profile and key skills sections. Then, seek ways to align your resume language with the job posting while not copying phrases or misstating your background.

For example, if the firm seeks someone collaborative, describe that aspect of your experience in your profile. Or say the company has many non-English speaking customers. Display your foreign language skills both in your profile and as a separate section farther down the document. With adjustments like these, you can make your resume more relevant to each opportunity.

The combination or hybrid format, which merges a functional resume's profile section with a chronological resume's experience section. Most modern resumes (including the three on this page) follow this format because it gives hiring managers the clearest view of an applicant's strengths and work history.

Include a cover letter with your resume

A good cover letter enhances most job applications. To write a standout letter, get specific. Tell the hiring manager why you’re interested in their organization and the specific banking role they hope to fill.

Check Out Related Examples

Resume Templates offers free, HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.