To craft an exceptional investment banker resume, you need the right strategic approach to effectively describe your financial expertise and professional achievements. Paint a compelling image of the investment strategies you’ve cultivated for enterprise companies and high-value clients. Highlight your background in creating financial models and performing due diligence for multi-million-dollar investment opportunities. In this guide, we’ll provide examples and expert tips to help you build a results-driven resume.

Key takeaways:

- Quantify achievements: Incorporate hard numbers, monetary figures, and metrics to emphasize the size of the deals you orchestrated and your impact on revenue growth

- Highlight certifications: Include relevant industry certifications to demonstrate your expertise in financial analysis and risk management

- Tailor your resume: Customize your resume to each job description to ensure compliance with applicant tracking systems (ATS)

Most Popular Investment Banking Resumes

Investment Banking Analyst Resume Example

Why this investment banking analyst resume is strong:

This investment banking analyst resume does an excellent job of describing the candidate’s financial expertise using eye-catching monetary figures. By establishing the size of the deals they orchestrated, the complexity and stakes of the due diligence process become more clear to the reader.

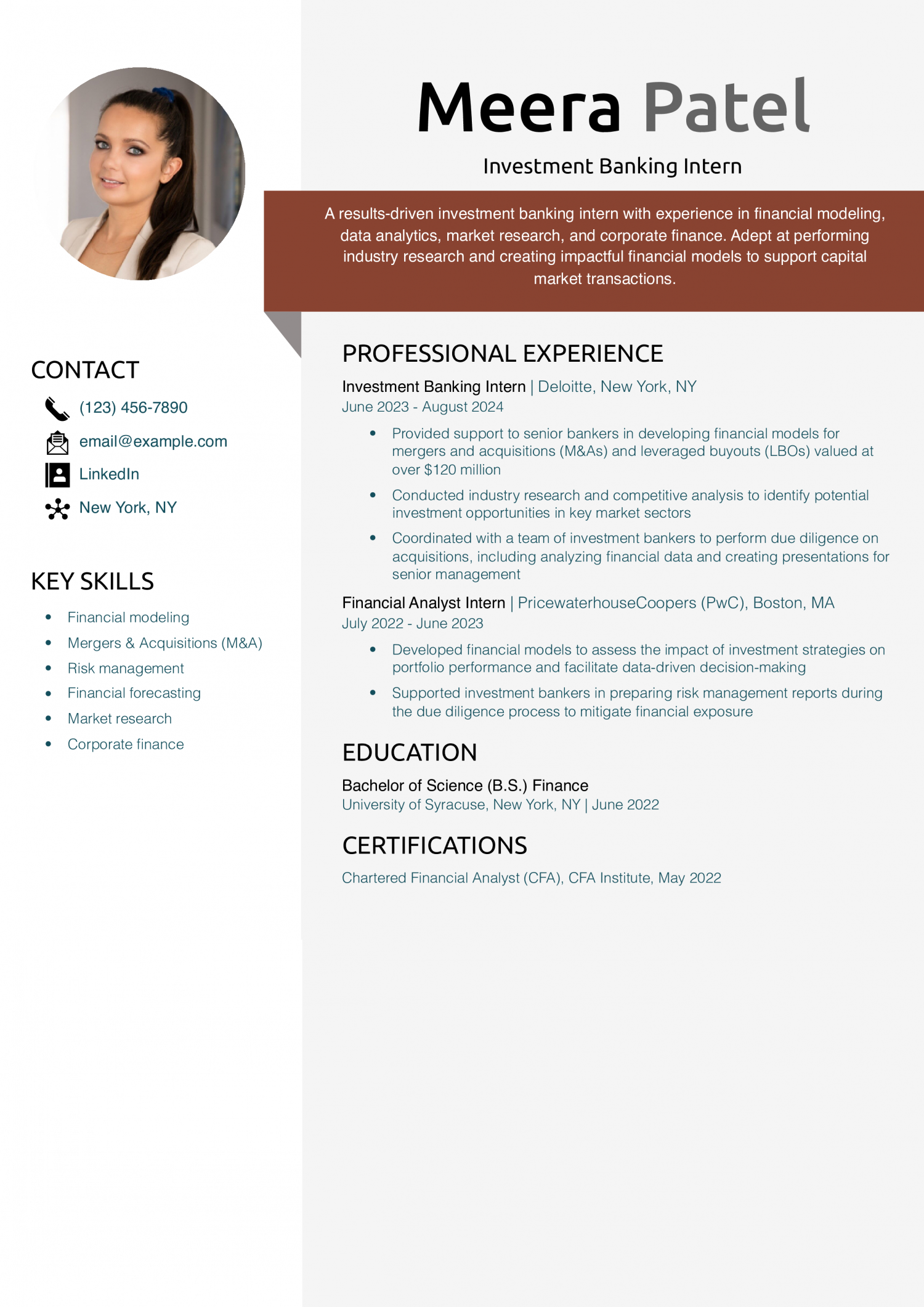

Investment Banking Intern Resume Example

Why this investment banking intern resume is strong:

This example is effective in leveraging the candidate’s internships to position them for entry-level job opportunities. Having experience working with investment bankers at two leading financial firms immediately sets them apart from other candidates.

Investment Banking Associate Resume Example

Why this investment banking associate resume is strong:

This investment banking vice president resume showcases a strong background in deal execution, client management, and team supervision. It highlights key achievements in M&A transactions, financial modeling, and business development, demonstrating leadership and strategic thinking. The combination of relevant certifications and advanced degrees reinforces the candidate’s credibility and expertise in investment banking.

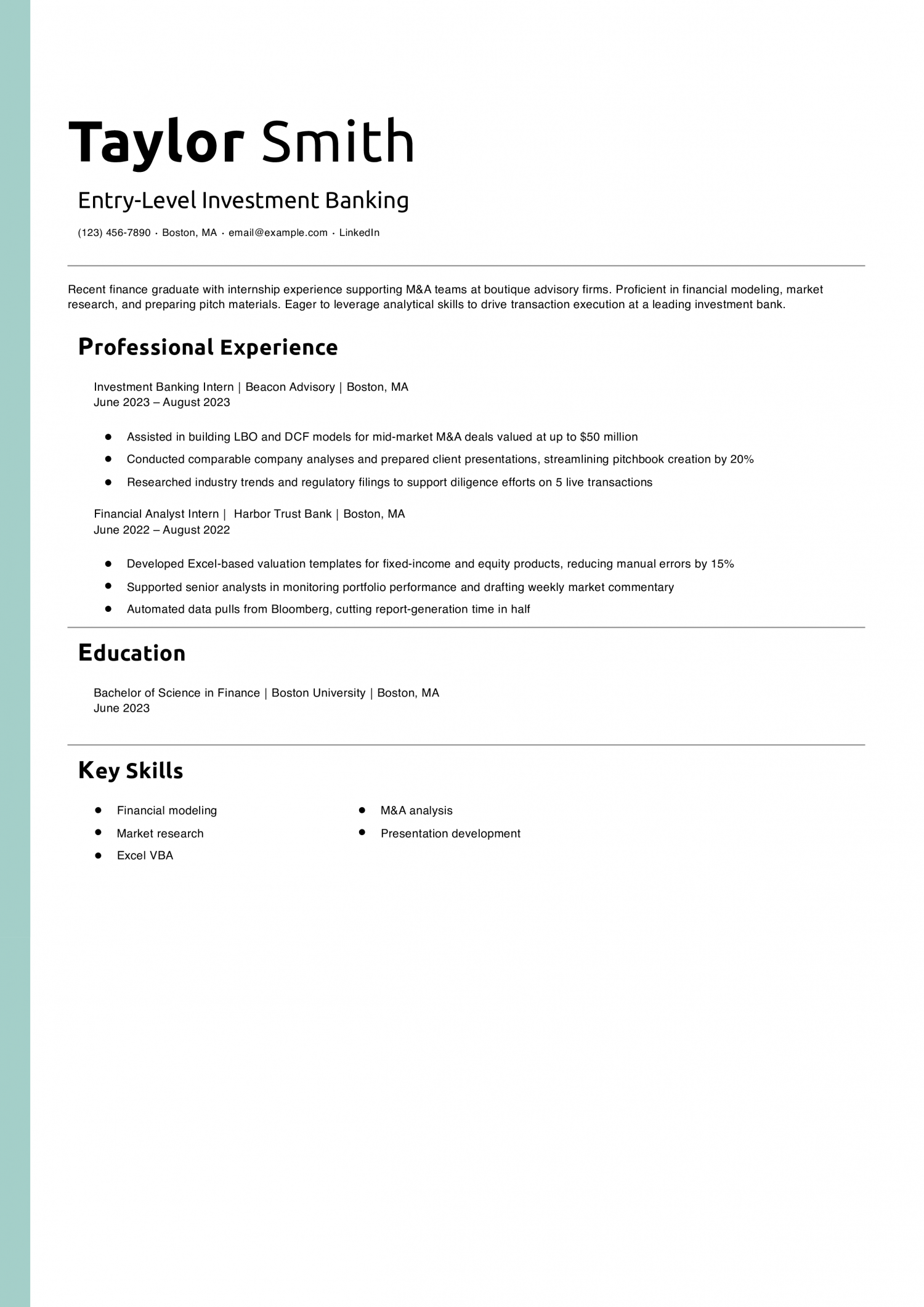

Entry-Level Investment Banking Resume Example

Why This Resume Is a Great Example

Taylor’s resume clearly demonstrates relevant internship experience and quantifies the impact of their analytical contributions, making them stand out for an entry-level role. The concise profile and achievement-oriented bullets showcase readiness for full-time banking responsibilities.

Key Tips

Highlight your internship achievements with concrete metrics and outcomes. Check out Resume Objective Examples for guidance.

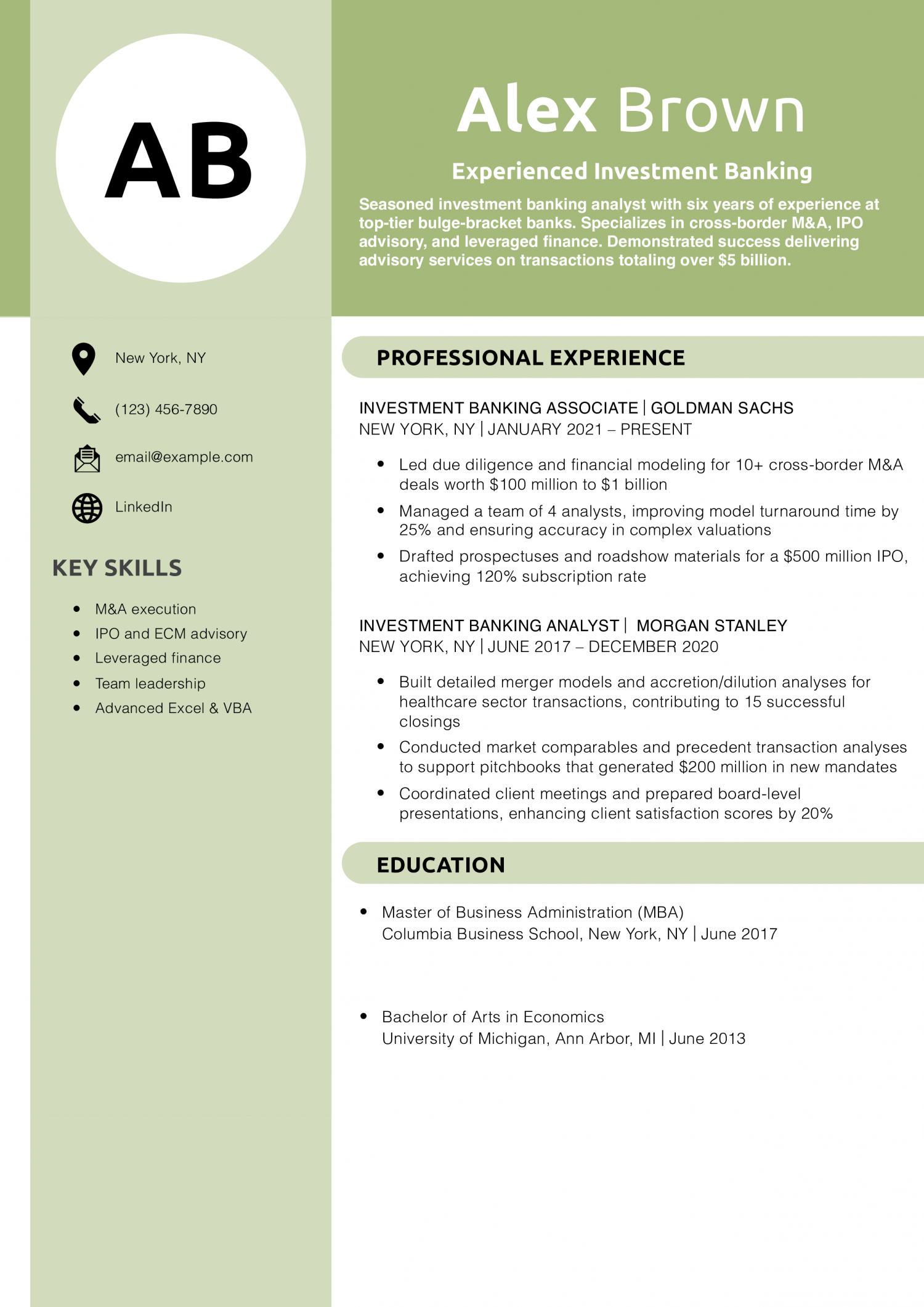

Experienced Investment Banking Resume Example

Why This Resume Is a Great Example

Alex’s resume highlights a strong track record of high-value deal execution, leadership, and quantifiable client outcomes, making it clear they’re a senior performer. The balance of technical skills and strategic achievements demonstrates both depth and breadth of capability.

Key Tips

Use reverse-chronological order to emphasize your most recent and relevant experience. For more on structuring, check out Best Resume Formats.

Goldman Sachs Investment Banking Resume Example

Why This Resume Is a Great Example

Jordan’s Goldman Sachs pedigree, paired with measurable deal achievements and team leadership, signals top-tier expertise. The clear, concise bullets convey both technical and interpersonal strengths.

Key Tips

Quantify your deal experience to showcase scale and impact. Learn more at How to Make a Resume.

Real Estate Investment Banking Resume Example

Why This Resume Is a Great Example

Morgan’s focus on real estate deal types, combined with quantifiable capital-raising and modeling impacts, makes this resume highly targeted. The inclusion of international transaction experience adds a valuable global dimension.

Key Tips

Tailor your resume to the niche (e.g., real estate) by highlighting sector-specific transactions. See Job Title Examples for ideas.

Entry-Level Banking Analyst Resume Example

Why This Resume Is a Great Example

Casey’s resume effectively bridges academic research with practical banking tasks, showcasing both technical prowess and communication skills. The clear focus on deliverables makes them a standout entry-level candidate.

Key Tips

Use action verbs and quantify your projects to show impact. For more tips, visit How to Write a Resume Summary.

Experienced Banking Analyst Resume Example

Why This Resume Is a Great Example

Jamie’s resume combines deep debt capital markets expertise with M&A credentials, demonstrating a versatile financing skill set. Mentorship achievements underscore leadership potential alongside technical mastery.

Key Tips

Emphasize both technical and leadership contributions to show rounded capability. Learn more at Skills to Put on Resume.

Equity Capital Markets Analyst Resume Example

Why This Resume Is a Great Example

Cameron’s resume clearly highlights ECM-specific deal experience with quantifiable outcomes, demonstrating both technical acumen and project ownership. The concise bullets and sector focus make it immediately clear why this candidate is a strong ECM analyst.

Key Tips

To showcase impact, focus on deal metrics like number of offerings and total capital raised. Check out Best Resume Formats for guidance on structuring your ECM resume.

Debt Capital Markets Analyst Resume Example

Why This Resume Is a Great Example

Drew’s resume spotlights DCM-specific achievements—bond volumes, increased investor engagement, and efficiency gains—to illustrate domain expertise. The clear separation of analyst and associate roles shows career progression and leadership potential.

Key Tips

Highlight both volume and process improvements to showcase breadth and depth of your DCM experience. For more on presenting financial achievements, see How to List a Degree on a Resume.

Leveraged Finance Associate Resume Example

Why This Resume Is a Great Example

Riley’s focus on leveraged finance transactions, cost-saving achievements, and team leadership makes the resume highly targeted. Quantified covenant and error-reduction metrics underscore both technical and managerial capabilities.

Key Tips

Emphasize structure and outcomes in LBO deals to stand out. Learn more about effective finance bullets in What to Put on a Resume.

M&A Associate Resume Resume Example

Why This Resume Is a Great Example

Pat’s resume draws attention to full-cycle M&A skills, including post-deal integration—an often-overlooked area that signals added value. The mentorship bullet highlights leadership within a technical function.

Key Tips

Include integration planning experience to showcase strategic perspective. For more on crafting objectives, see Resume Objective Examples.

Cross-Border M&A Resume Resume Example

Why This Resume Is a Great Example

Taylor’s focus on cross-border complexities, like FX risk, regulatory differences, and time-zone coordination, demonstrates niche expertise in high demand. The FX model improvement quantifies added client value.

Key Tips

Showcase niche deal-type expertise to differentiate your profile. See Technical Skills in IT Resume for ideas on formatting specialized skills.

Healthcare Investment Banking Analyst Resume Example

Why This Resume Is a Great Example

Alex’s specialized healthcare deal experience and regulatory analysis skills cater directly to that industry’s needs. Quantified transaction values and model outputs make achievements concrete and compelling.

Key Tips

Highlight both clinical and financial expertise for healthcare roles. Check out Transferable Skills Resume for tips on blending domain knowledge.

TMT Investment Banking Associate Resume Example

Why This Resume Is a Great Example

Jordan’s TMT specialization is underscored by sector-specific metrics, like subscriber growth and ARPU, which demonstrate both technical modeling ability and industry insight. High deal volume adds depth.

Key Tips

Quantify user- and usage-based metrics to appeal to TMT hiring managers. For more on showcasing technical skills, see Hard Skills for Resume.

Infrastructure Investment Banking Resume Example

Why This Resume Is a Great Example

Morgan’s niche focus on P3s and credit structures for infrastructure deals sets this resume apart. The impact and IRR improvements quantify policy and financial contributions.

Key Tips

Highlight public-sector collaboration to illustrate stakeholder management skills. See Career Advice—How to Update Your Resume for tips on refreshing niche resumes.

Energy Investment Banking Analyst Resume Example

Why This Resume Is a Great Example

Casey’s dual expertise in oil & gas and renewables highlights adaptability in a transitioning sector. Quantified deal values and modeling specifics reinforce domain mastery.

Key Tips

Showcase both traditional and renewable experience to demonstrate versatility. For structuring complex skills, see Best Resume Formats.

IPO Advisory Analyst Resume Example

Why This Resume Is a Great Example

Jamie’s targeted IPO advisory experience and quantified aftermarket outcomes demonstrate specialized value. The end-to-end storytelling — from readiness to stabilization — highlights full-cycle capability.

Key Tips

Emphasize both pre- and post-IPO deliverables to showcase comprehensive advisory skills. For more on presenting objectives, see Resume Objective Examples.

FIG (Financial Institutions Group) Analyst Resume Example

Why This Resume Is a Great Example

Cameron’s FIG specialization is underscored by regulatory and ROE modeling achievements, critical for banking and insurance clients. Whitepaper authorship demonstrates thought leadership.

Key Tips

Show both technical modeling and sector thought leadership to stand out in FIG roles. For tips on crafting skills sections, see Skills to Put on Resume.

Investment Banker Text-Only Resume Examples and Templates

How To Write an Investment Banker Resume Example

Before writing your content, you need a proper layout that allows you to present your investment banking qualifications and work history in a compelling manner. Your professional resume template should always include the following sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

1. Share your contact information

Include your full name, phone number, email address, city, state, and a link to your LinkedIn profile or professional portfolio if applicable.

Example

John Bergsen

[email protected] | (123) 456-7890 | New York, NY | LinkedIn | Portfolio

2. Write a compelling profile summarizing your investment banking qualifications

As an investment banker, you already understand how to present a value proposition to clients and stakeholders. You can employ a similar approach to build your professional summary, effectively capturing the broad strokes of your career within the financial industry. Start with an opening sentence that lists your title, years of experience, and three industry-related skills that match the company’s needs.

Round out your paragraph with some of your most notable and impressive wins, especially if they can be backed by hard numbers. For example, if you played an integral role in performing due diligence for a merger valued at over $300 million, feature this achievement directly in your profile to quickly grab the hiring manager’s attention.

Senior-Level Profile Example

A senior investment banking associate with over eight years of experience, specializing in corporate finance, portfolio management, and risk mitigation. A proven track record of managing diverse cross-functional teams to drive business growth for enterprise client portfolios.

Entry-Level Profile Example

A results-driven investment banking intern with entry-level experience, specializing in financial modeling, data analytics, market research, and corporate finance. Adept at performing industry research and creating impactful financial models to support capital market transactions.

3. Add an accomplishment-driven investment banking professional experience section

Hiring managers will spend the most time evaluating your work history, so it’s important to spend extra time refining this section of your investment banker resume. As you craft your bullet points, focus on illustrating the bottom-line value of your contributions, rather than only listing financial skills and job responsibilities. Provide tangible examples of you defining successful investment strategies, growing portfolios, and managing relationships with enterprise clients. By exploring the nuances of your background as a financial professional, you’re sure to stand out from the competition during the hiring process.

Senior-Level Professional Experience Example

Senior Investment Banking Vice President, Deloitte, New York, NY | June 2018 – Present

- Lead a team of 25 financial analysts and investment bankers in executing over 70 transactions totaling $1.3 billion, contributing to a 12% increase in portfolio revenue

- Manage and build trusted relationships with enterprise clients, secure over $560 million in new business, and maintain a 92% client retention rate

- Oversee all aspects of the due diligence process, develop comprehensive financial models, and deliver presentations to client stakeholders

Entry-Level Professional Experience Example

Financial Analyst Intern, PricewaterhouseCoopers (PwC), Boston, MA | June 2023 – May 2024

- Developed financial models to assess the impact of investment strategies on portfolio performance and facilitate data-driven decision-making

- Supported investment bankers in preparing risk management reports during the due diligence process to mitigate financial exposure

Resume writer’s tip: Quantify your investment banking experience

Feature monetary figures and meaningful financial data to establish a sense of scope for your professional achievements. If you encounter a situation where including hard numbers could infringe on client confidentiality, there are some alternative approaches you can use. For example, you might state that you executed transactions for a multi-million-dollar portfolio rather than including an exact figure.

Do

- “Lead a team of 25 financial analysts and investment bankers in executing over 70 transactions totaling $1.3 billion, contributing to a 12% increase in portfolio revenue”

Don’t

- “Supervise a large team to execute various financial transactions and increase annual revenue”

Resume writer’s tip: Tailor your resume for each application

Always take the extra time to align your investment banker resume with the job description. This shows that you’re genuinely interested in the opportunity and you have the skills and qualifications to succeed in the role. For instance, if a company is seeking a candidate who excels in risk management, feature an example of how you analyzed financial data to identify risk factors for potential investment opportunities.

What if you don’t have experience?

Even at the entry-level, you can still create an impactful resume to help jumpstart your career in the financial industry. If you’ve completed any internships, list those first, as they can help compensate for a lack of work experience. Another option is to demonstrate your expertise in financial modeling and analysis by describing your most compelling academic projects.

4. Include relevant investment banking education and certifications

Education and certifications carry considerable weight for investment bankers. Most companies will require a bachelor’s degree in finance or economics, though obtaining an MBA can sometimes help give you a competitive advantage. Certifications are also highly coveted, especially the Chartered Financial Analyst (CFA) designation. As you advance in your career, consider obtaining additional industry credentials to demonstrate your commitment to continuous learning and development, such as the Certified Investment Management Analyst (CIMA) specialization.

Education

Template:

[Degree Name and Major] | [Graduation Date]

[School Name] | [City, ST]

Example:

Master of Business Administration (MBA)

Harvard Business School | Boston, MA | May 2015

Bachelor of Science (B.S.) Finance

University of Pennsylvania | Philadelphia, PA | June 2012

Certifications

Template:

[Certification Name] | [Awarding Organization] | [Completion Date]

Example:

- Chartered Financial Analyst (CFA), CFA Institute | 2020

- Financial Modeling & Valuation Analyst (FMVA), Corporate Finance Institute | 2019

- Certified Investment Management Analyst (CIMA), Investments & Wealth Institute | 2018

5. List pertinent investment banking key skills

Most companies utilize some form of applicant tracking system (ATS) to identify qualified candidates during the initial screening process. To get your resume into the hiring manager’s hands, include a mix of financial terms and leadership-related skill sets that match the job posting. In addition to listing your skills, it’s also important to provide examples of you applying them in your previous investment banker roles. Below, you’ll find a list of keywords to consider adding to your resume:

| Key Skills | |

|---|---|

| Bloomberg Terminal | Business valuation |

| Capital markets | Client relationship management |

| Communication | Corporate finance |

| Data-driven decision-making | Due diligence |

| Economics | Financial analysis |

| Financial modeling | Investment strategy |

| Market research | Mergers & acquisitions (M&A) |

| Portfolio management | Risk management |

| Stakeholder management | Team management |

Resume writer’s tip: Use strong action verbs

Using action verbs is a great way to help the hiring manager visualize your contributions and professional achievements. That said, you might find yourself repeating the same few verbs when describing your investment banking experience. To help you diversify your usage of action verbs and enhance the readability of your bullet points, we’ve compiled a list of action verbs you can use during the resume writing process:

| Action Verbs | |

|---|---|

| Achieved | Advised |

| Analyzed | Collaborated |

| Communicated | Conducted |

| Consulted | Delivered |

| Developed | Drove |

| Generated | Identified |

| Implemented | Improved |

| Led | Managed |

| Monitored | Negotiated |

| Oversaw | Performed |

| Spearheaded | |

How To Pick the Best Investment Banker Resume Template

When selecting a resume template for an investment banking role, prioritize clarity and readability over aesthetics. Choose a template with a clean layout and an elegant font. Avoid overloading your resume with graphics or colors, as the focus of your resume should always be on your qualifications and accomplishments.

Frequently Asked Questions: Investment Banking Resume Examples and Advice

According to the Bureau of Labor Statistics, jobs in securities, commodities, and financial services sales agents are projected to grow by 7% between 2023 and 2033. Despite the faster-than-average growth, investment banking roles are highly competitive, so it's essential to align your resume with each individual job opportunity.

For example, if a company is seeking an investment banker with a strong background overseeing mergers and acquisitions, highlight specific examples of you performing due diligence and valuation analysis to structure deals. If an organization is looking for a candidate with exceptional leadership capabilities, emphasize your expertise in managing financial teams and stakeholder relationships.

Creating a Investment Banking resume example that stands out involves focusing on your unique contributions. Whether you've worked in leadership, handled large budgets, or managed complex projects, showcase your experience with measurable results. Include your proficiency in relevant tools and technologies, and make sure your resume reflects your career trajectory in a clear and concise manner.

Reverse chronological is the ideal format for an investment banking resume. This approach highlights your most recent and relevant experience at the top of the document, allowing hiring managers to quickly view your work history. It's best to avoid functional formats, as investment banks prioritize real-world experience and achievements over skills.

Include a cover letter with your resume

Pairing your investment banking resume with an eye-catching cover letter is a great way to enhance the strength of your job application. The cover letter allows you to communicate your value proposition directly to the firm, emphasizing how your unique background as a finance professional can help them achieve their objectives. It also enables you to show potential employers that you’re the ideal fit for the team’s culture.

Check Out Related Examples

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.