As a bank teller and frontline employee, you’re responsible for interfacing directly with members and new potential customers. You play a vital role in daily banking operations, serving as a representative of the brand. This guide provides valuable tips and expert insights to help you translate your experience into an eye-catching bank teller resume that stands out from the competition in today’s job market.

Key takeaways

- Emphasize specializations: Feature specializations that demonstrate your customer service expertise and knowledge of the banking industry. Provide examples of you utilizing these skill sets in your professional experience section.

- Detail quantifiable achievements: Leverage hard numbers and data to enhance the impact of your bullet points. Draw attention to your customer satisfaction or sales metrics.

- Use keywords for ATS: Analyze each individual job description to identify specific keywords and ensure compliance with applicant tracking systems (ATS) during the initial screening process.

Most Popular Bank Teller Resumes

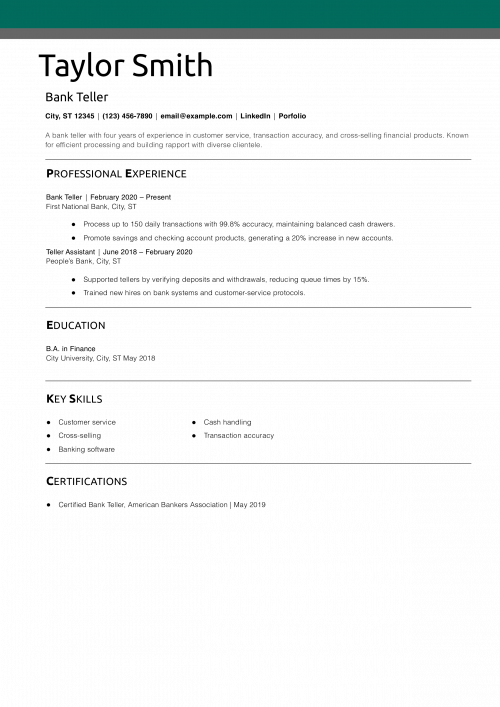

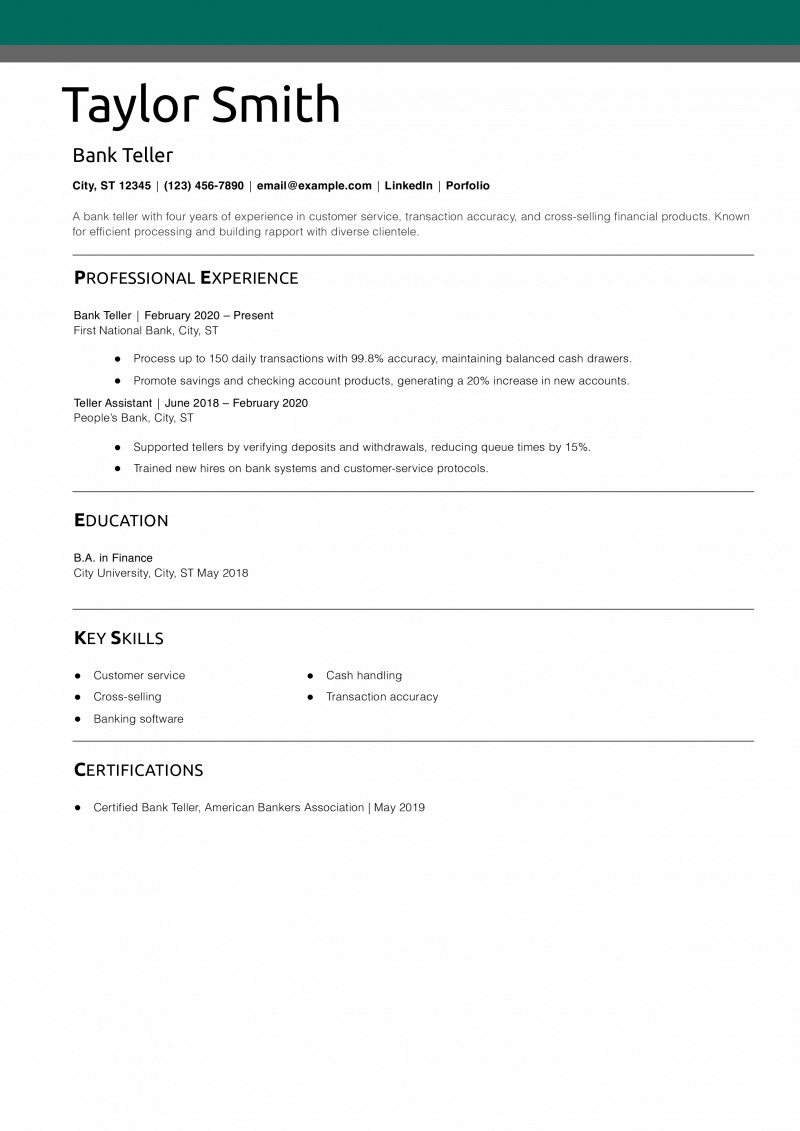

Bank Teller Resume Example

Why This Resume Is a Great Example

Taylor’s resume clearly quantifies daily transaction volumes and accuracy rates, demonstrating reliability under pressure. The structure draws attention immediately to key skills and measurable achievements, helping hiring managers see impact at a glance.

Key Tips

Always include metrics like transaction volumes to showcase your efficiency. For guidance on structuring achievement-focused resumes, see Best Resume Formats.

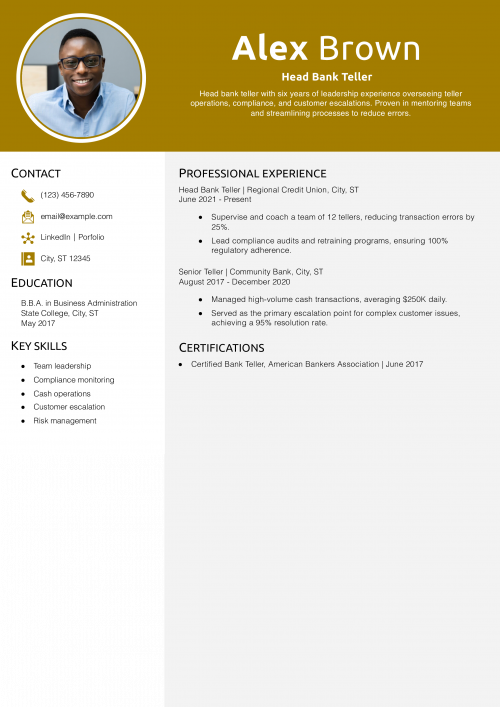

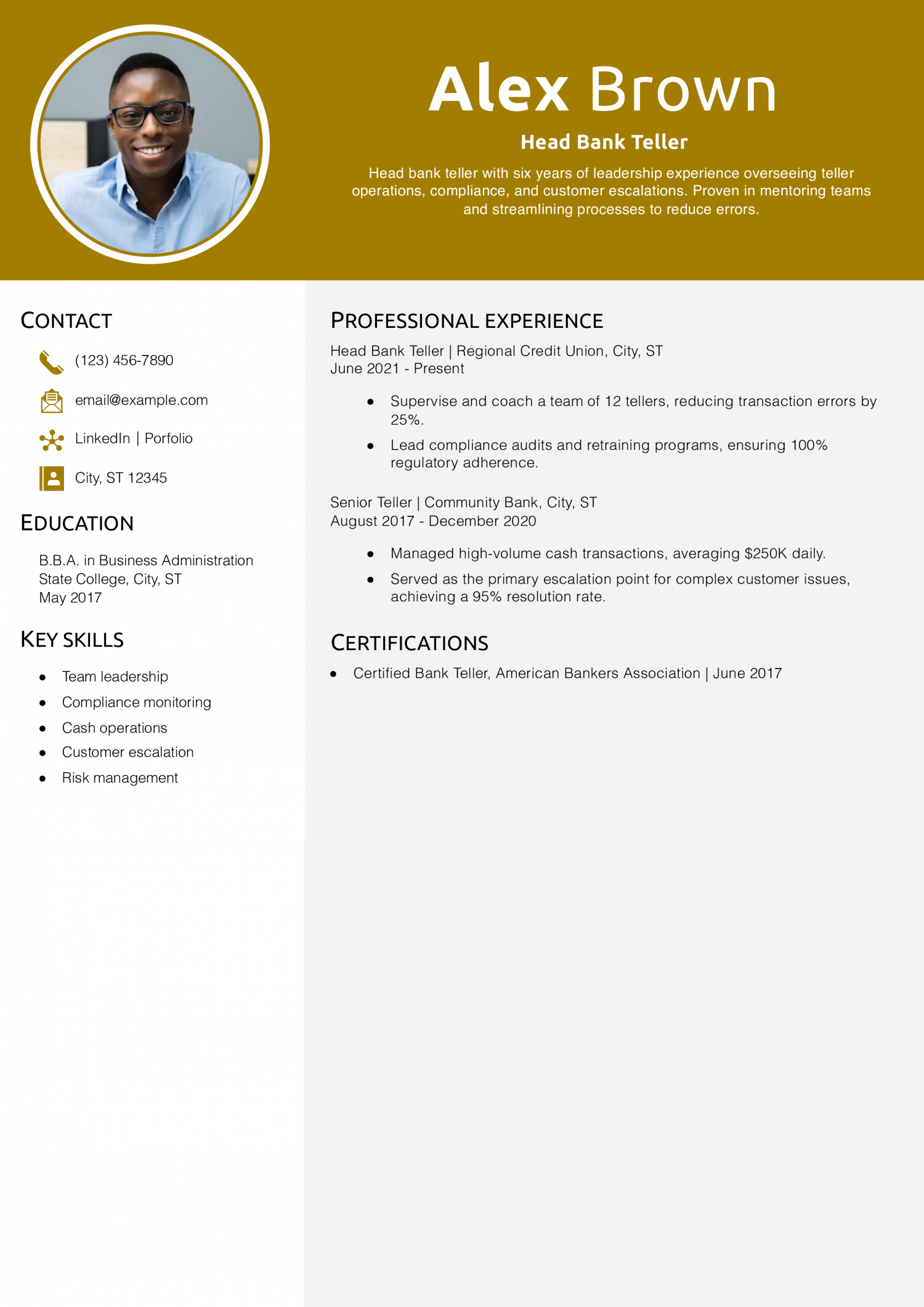

Head Bank Teller Resume Example

Why This Resume Is a Great Example

Alex highlights leadership successes, which differentiate him as a manager candidate. The reverse-chronological layout showcases his progression and increasing responsibility.

Key Tips

To stand out, emphasize leadership metrics such as error-rate improvements. For insights on creating a strong overall resume, see How to Make a Resume.

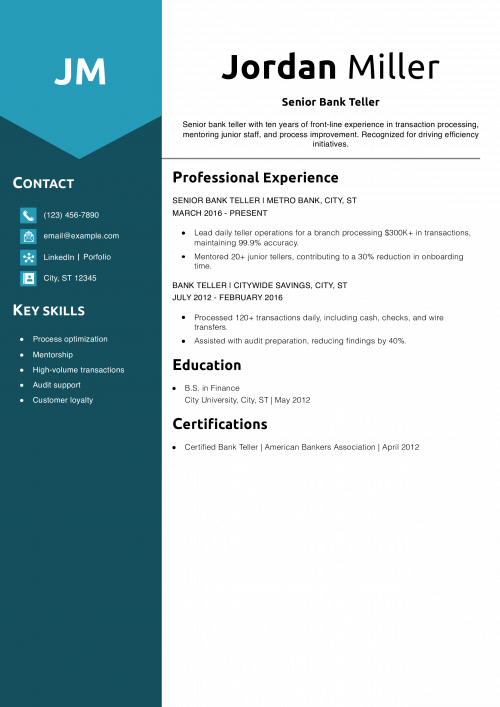

Senior Bank Teller Resume Example

Why This Resume Is a Great Example

Jordan uses precise figures (transaction volumes, accuracy rates) to illustrate expertise and reliability. The mentorship highlight underlines his leadership credentials for senior roles.

Key Tips

Include both quantitative (e.g., transaction amounts) and qualitative (e.g., mentoring) achievements. To learn about structuring senior-level resumes, see Best Resume Formats.

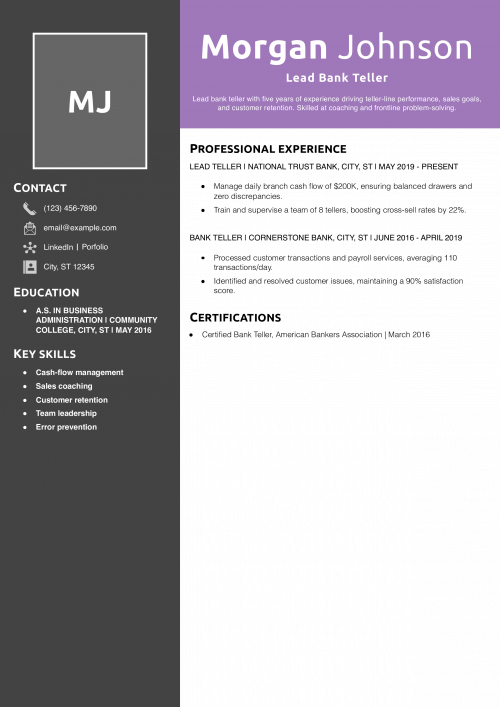

Lead Bank Teller Resume Example

Why This Resume Is a Great Example

Morgan quantifies coaching impact (cross-sell rate improvement) and cash-flow responsibility, demonstrating leadership. The clear bullet structure helps recruiters quickly assess her strengths.

Key Tips

Highlight both operational duties and sales leadership to show well-rounded capability. For advice on showcasing cross-functional skills, visit Skills to Put on Resume.

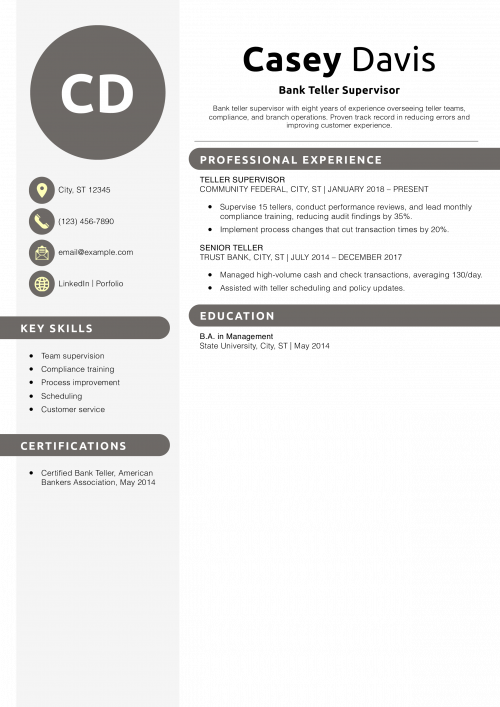

Bank Teller Supervisor Resume Example

Why This Resume Is a Great Example

Casey demonstrates clear supervisory impact, such as error reduction and transaction-time improvements. The bullet points showcase both people management and process expertise.

Key Tips

Combine compliance results with efficiency metrics to highlight dual strengths. For strategies on listing leadership skills, see Leadership Skills for Resume with Examples.

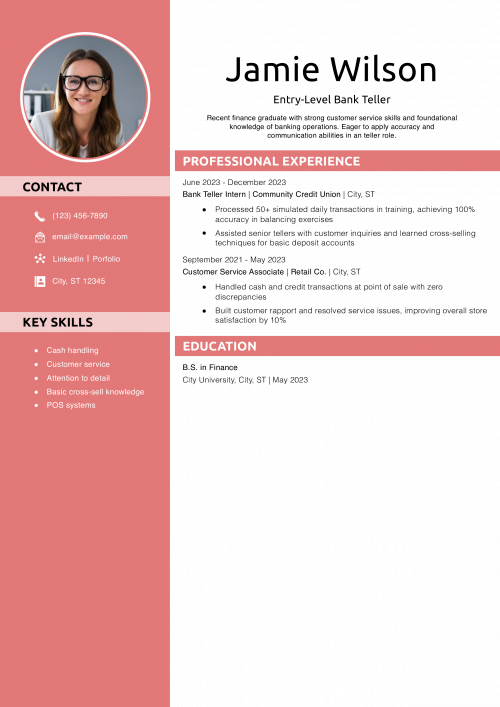

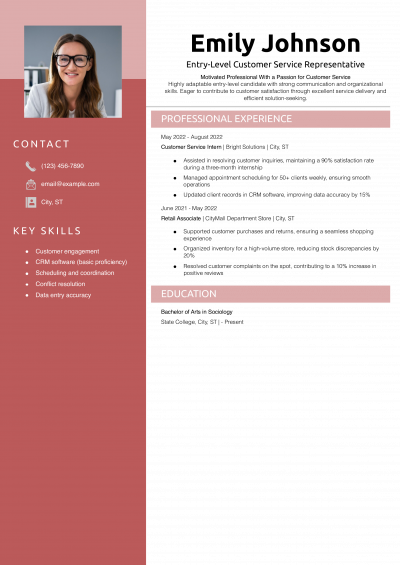

Entry-Level Bank Teller Resume Example

Why This Resume Is a Great Example

Jamie clearly ties academic accomplishments to practical teller training, showing readiness to step into a teller role. The concise bullet points highlight accuracy and customer-service experience without overstating responsibilities.

Key Tips

Emphasize any relevant internships or customer-facing roles to compensate for limited teller experience. For tips on writing a strong entry-level resume, see How to Write a Resume with No Experience.

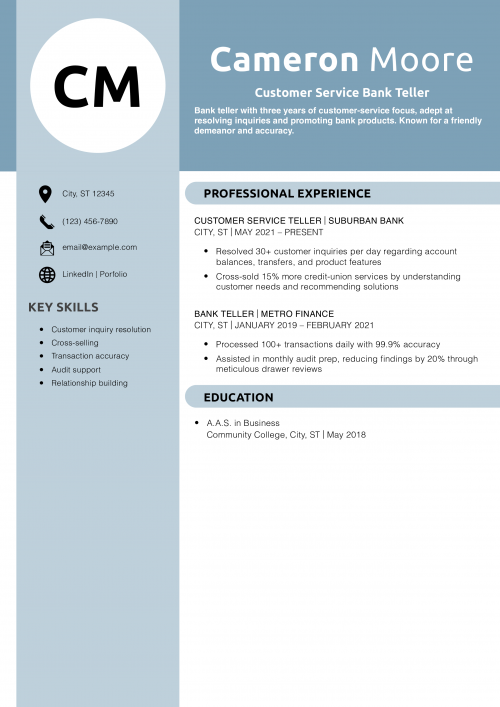

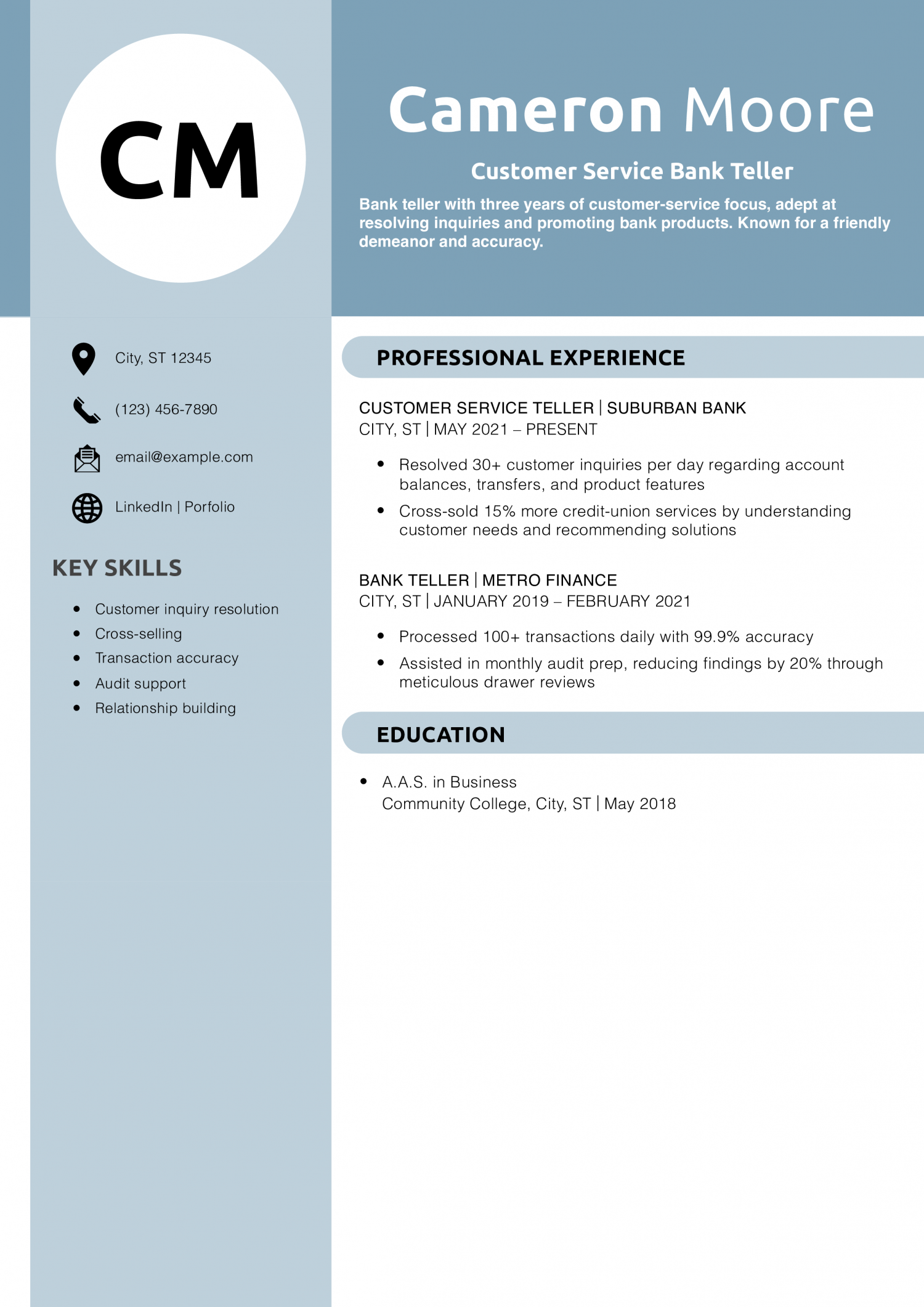

Customer Service Bank Teller Resume Example

Why This Resume Is a Great Example

Cameron balances transaction metrics with customer-service achievements, illustrating both accuracy and relationship skills. The reverse-chronological format makes progression clear.

Key Tips

Highlight how product recommendations benefited both customers and the bank. For ideas on showcasing customer service, visit What to Put on a Resume.

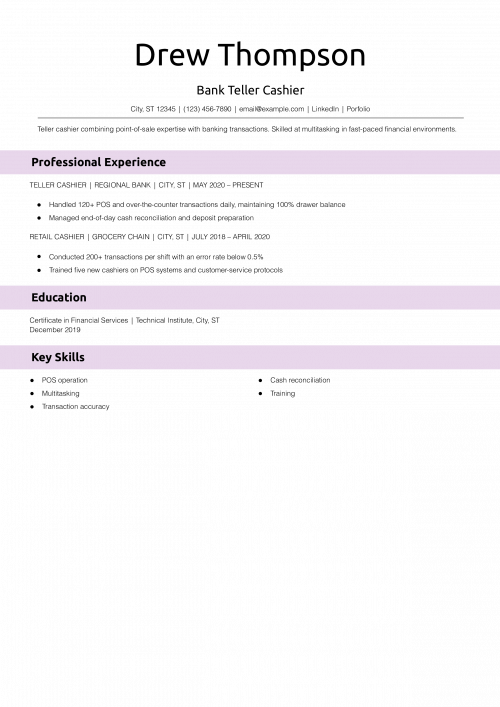

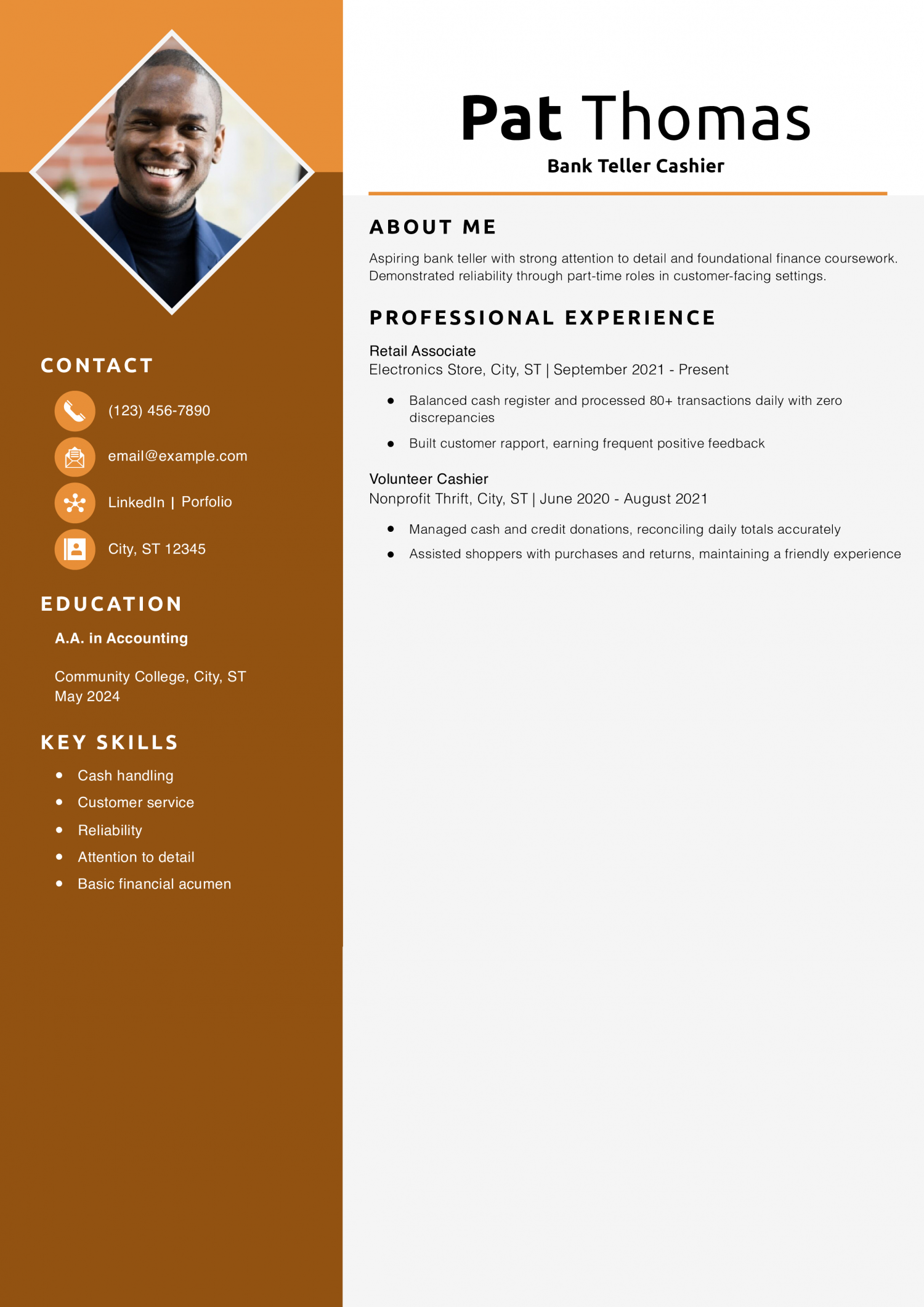

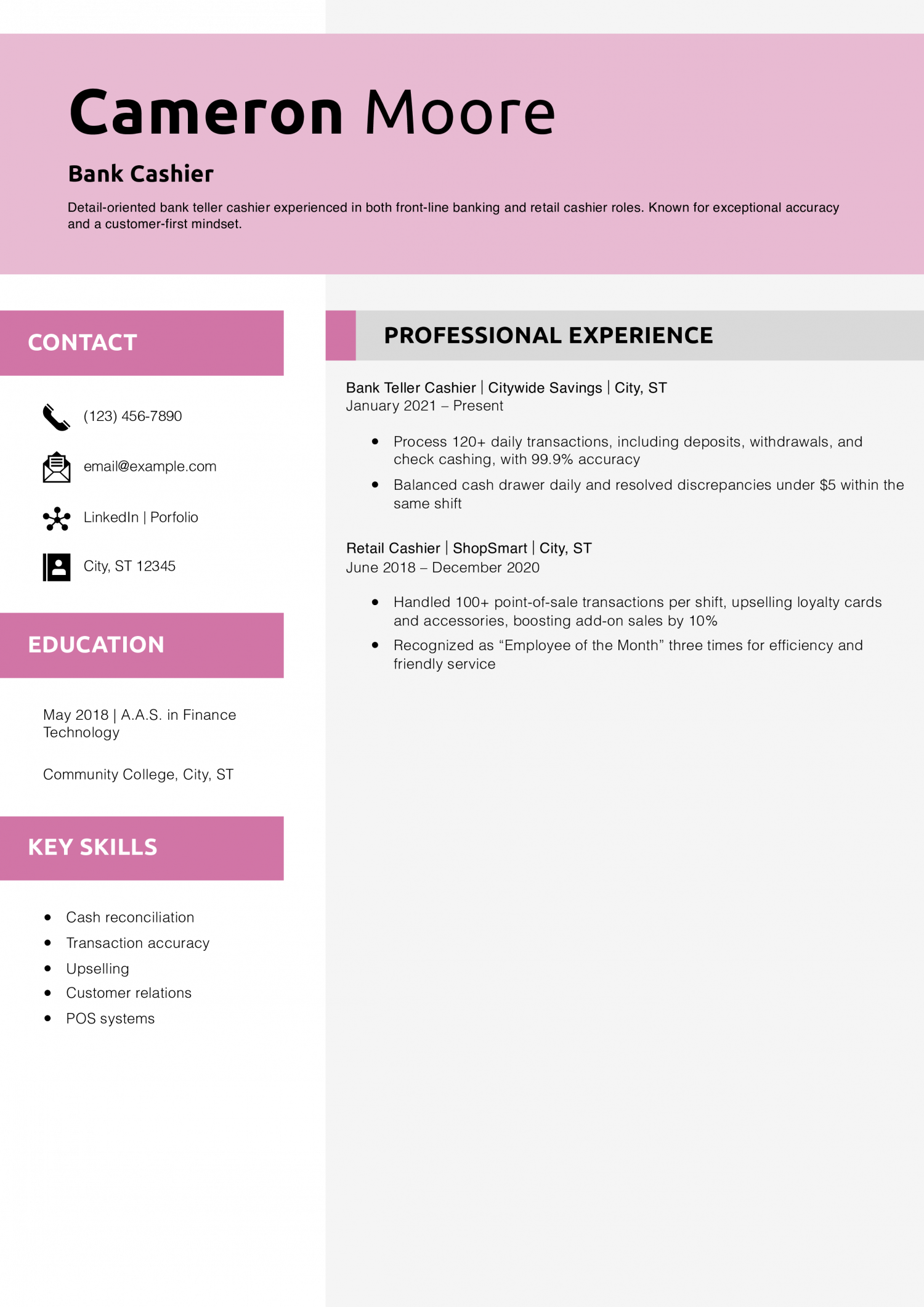

Bank Teller Cashier Resume Example

Why This Resume Is a Great Example

Drew showcases dual cashier and teller experience, demonstrating adaptability and precision. The bullet points quantify volume and accuracy, which are key for banking roles.

Key Tips

When you have both retail and teller experience, tie together the shared skills — speed, accuracy, and customer service. For more on resume structure, check Best Resume Formats.

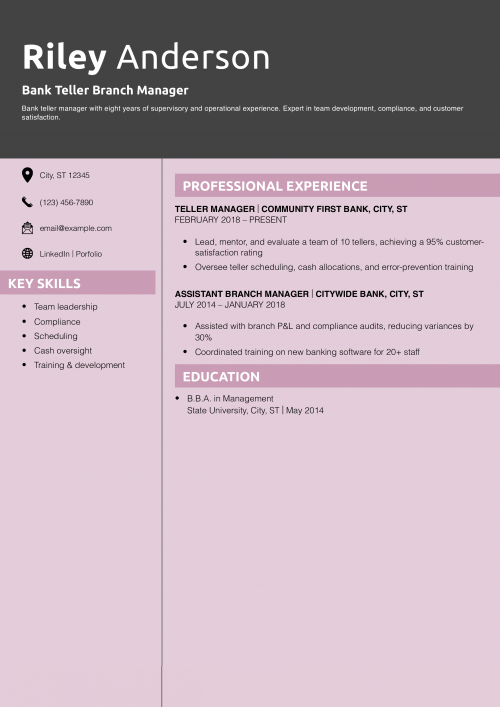

Bank Teller Branch Manager Resume Example

Why This Resume Is a Great Example

Riley’s resume pairs managerial accomplishments, such as customer satisfaction and error reduction, with operational duties, illustrating full-scope oversight. The metrics underscore tangible results.

Key Tips

Combine leadership and operational metrics to display your readiness for management roles. For suggestions on highlighting management experience, see Job Title Examples for Your Resume.

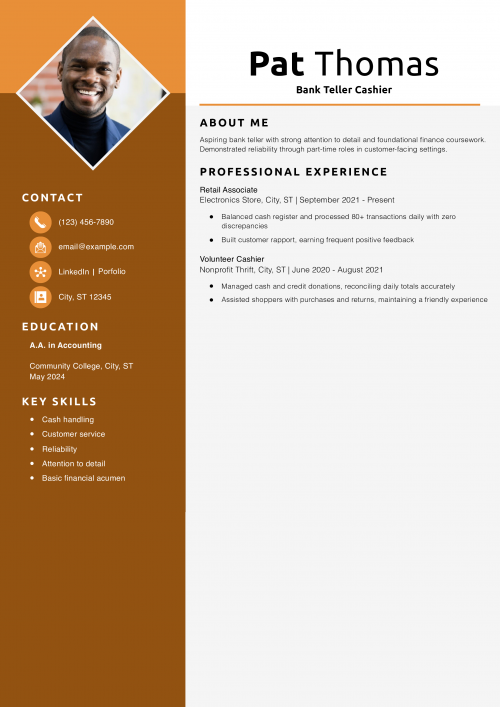

Bank Teller Cashier Resume Example

Why This Resume Is a Great Example

Pat effectively leverages non-banking roles to demonstrate transferable cash-handling and customer-service skills. The clear, concise format makes strengths immediately visible.

Key Tips

Use part-time or volunteer cashier roles to show transaction experience. For tips on building a resume from scratch, visit How to Write Your First Job Resume.

Bank Lead Teller Resume Example

Why This Resume Is a Great Example

Taylor highlights both leadership and hands-on teller metrics, showing the ability to manage people and processes. The clear bullet points quantify improvements in accuracy and onboarding efficiency.

Key Tips

Emphasize improvements you’ve driven in team performance or process accuracy. For more on showcasing leadership impact, see Job Title Examples for Your Resume.

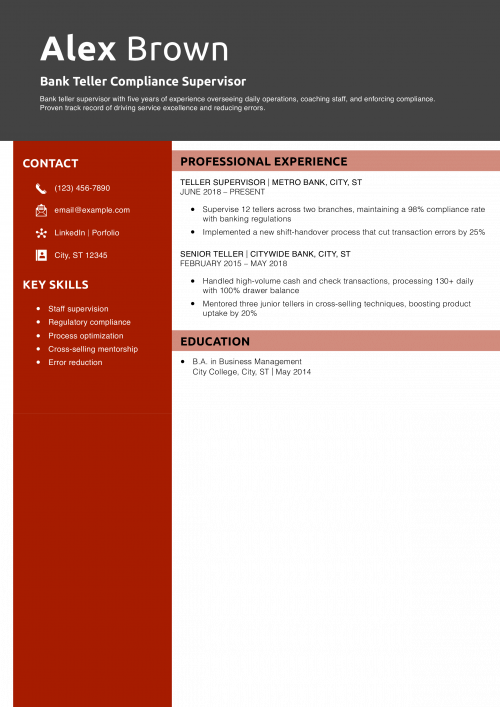

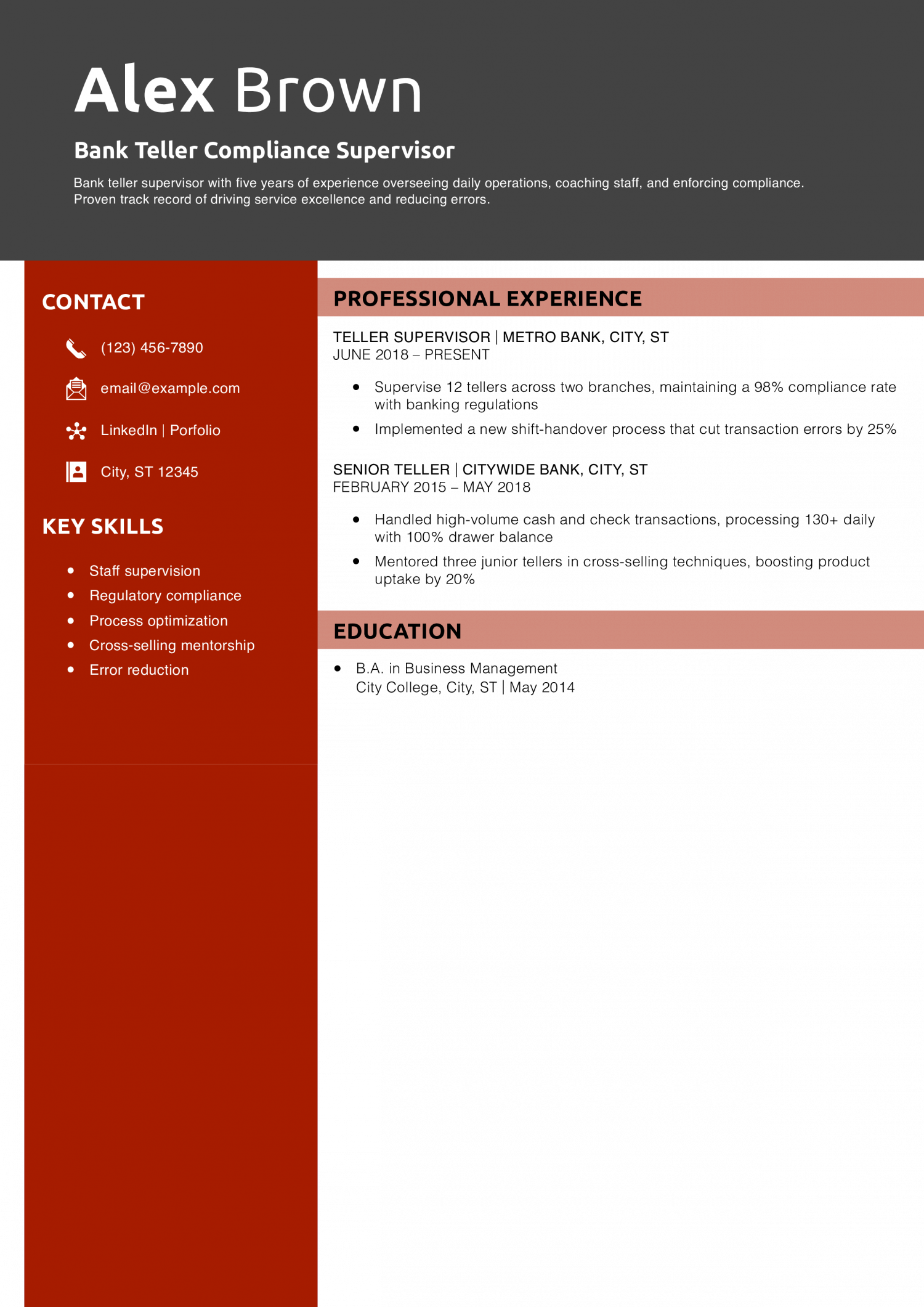

Bank Teller Compliance Supervisor Resume Example

Why This Resume Is a Great Example

Alex balances supervisory achievements with teller-level metrics, demonstrating full-scope management. The bullet points use percentages to highlight process improvements.

Key Tips

Highlight the compliance and process changes you’ve driven and back them up with metrics. For guidance on compliance roles, check out Best Resume Formats.

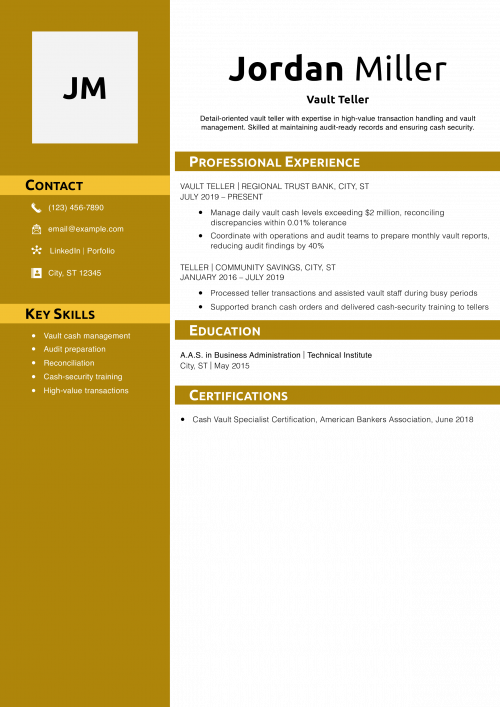

Vault Teller Resume Example

Why This Resume Is a Great Example

Jordan showcases specialized vault responsibilities and quantifies audit improvements, underlining expertise in a niche role. The concise bullet points focus on security and accuracy.

Key Tips

When you handle high-value transactions, emphasize error tolerances and audit outcomes. For more on detailing specialized roles, visit How to Write a Resume Summary.

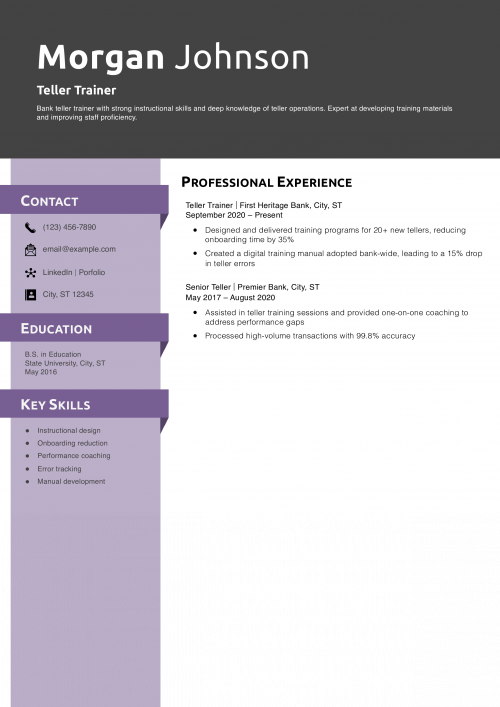

Teller Trainer Resume Example

Why This Resume Is a Great Example

Morgan combines instructional achievements with teller metrics to illustrate training impact. The two-part bullet points show process and results clearly.

Key Tips

Show both the training you delivered and the performance gains achieved. For tips on instructional roles, see How to List Degree on a Resume.

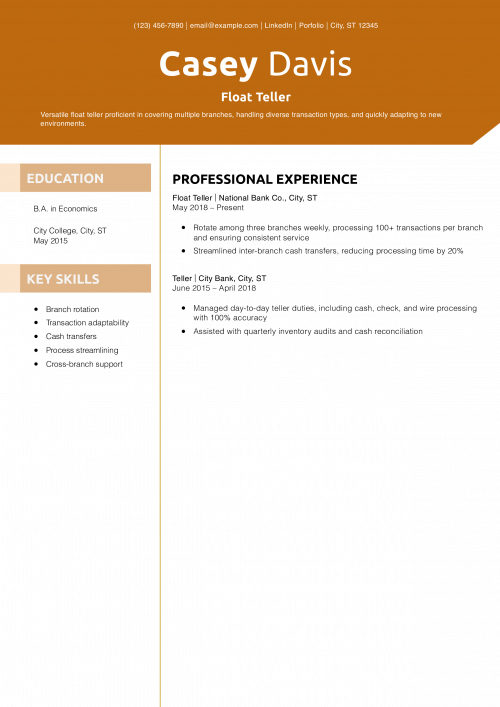

Float Teller Resume Example

Why This Resume Is a Great Example

Casey highlights the adaptability required for a float role and quantifies process improvements in cash transfers. The crisp bullet points make responsibilities and results clear.

Key Tips

When you float across branches, emphasize adaptability and any process efficiencies you introduced. For ideas on showcasing versatility, check out the Transferable Skills Resume.

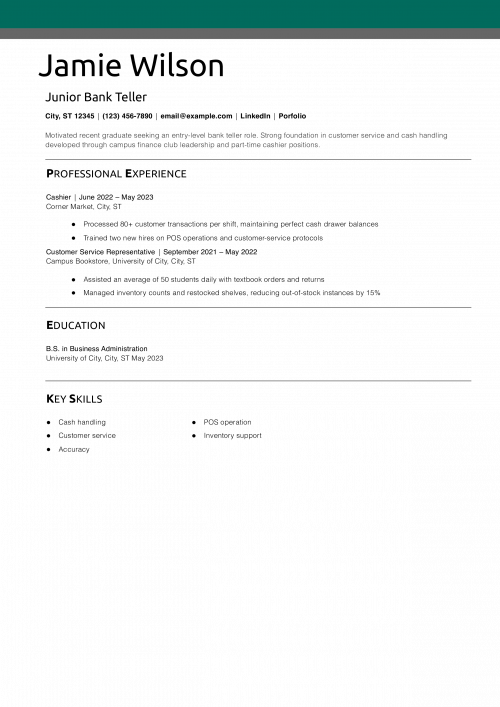

Junior Bank Teller Resume Example

Why This Resume Is a Great Example

Jamie connects part-time retail roles to teller-relevant skills, bridging the experience gap. Clear metrics on transactions and inventory use demonstrate reliability.

Key Tips

Emphasize transferable experiences, such as retail or cashier roles, that showcase your cash-handling accuracy. For more on crafting an entry-level resume, see How to Write a Resume With No Experience.

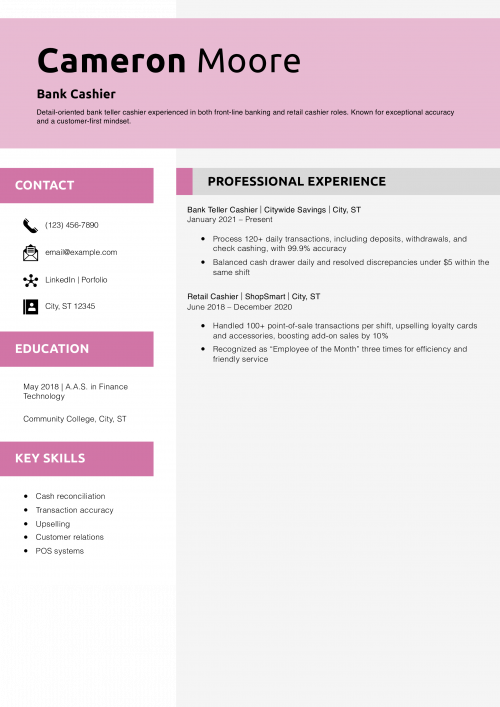

Bank Cashier Resume Example

Why This Resume Is a Great Example

Cameron blends retail and banking cashier experience to demonstrate accuracy under pressure. Quantified achievements like error rates and add-on sales give a clear impact.

Key Tips

Highlight dual experience in retail and banking to show adaptability and accuracy. For tips on showing cashier skills, visit What to Put on a Resume.

Bank Teller Manager Resume Example

Why This Resume Is a Great Example

Drew quantifies managerial impact to showcase leadership. Clear progression from head teller to manager underlines career growth.

Key Tips

When highlighting management roles, focus on both people metrics (scheduling) and performance metrics (efficiency gains). For more on structuring leadership experience, check Best Resume Formats.

Senior Lead Bank Teller Resume Example

Why This Resume Is a Great Example

Riley pairs mentoring and sales achievements to highlight senior-level impact. Metrics on accuracy and referral generation underscore both reliability and initiative.

Key Tips

Show how your mentorship and cross-selling drove tangible branch results. For guidance on showcasing sales metrics, visit Skills to Put on Resume.

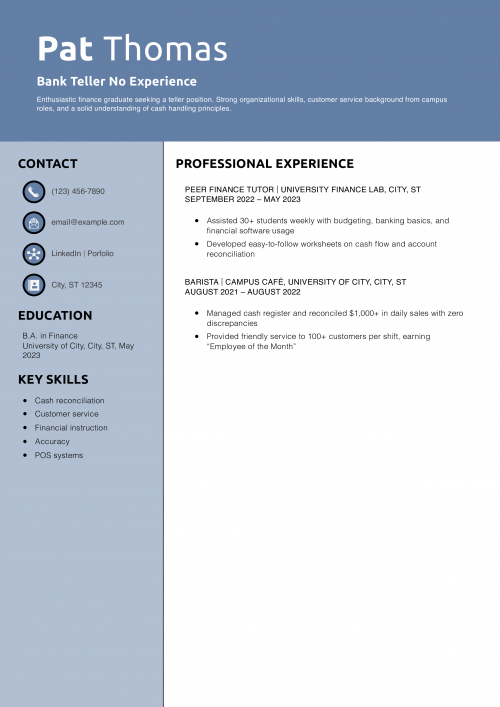

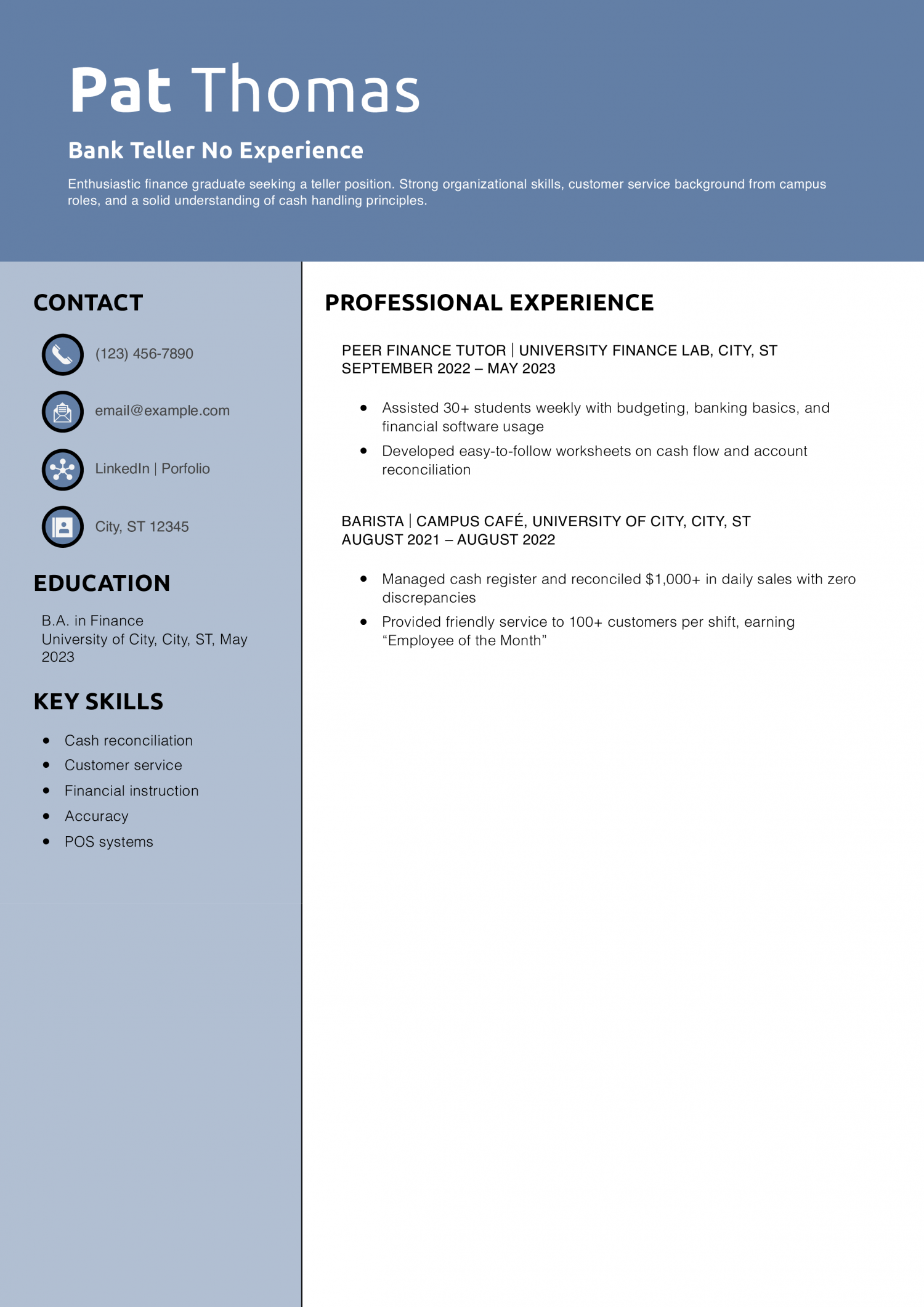

Bank Teller No Experience Resume Example

Why This Resume Is a Great Example

Pat effectively translates non-bank roles into teller-relevant skills, focusing on cash reconciliation and customer service. The bullet points quantify responsibilities to bridge the experience gap.

Key Tips

Leverage campus and retail roles to demonstrate cash accuracy and customer support. For tips on entry-level resumes, see How to Write a Resume With No Experience.

Bank Teller Text-Only Resume Examples and Templates

How To Write a Bank Teller Resume Example

The first step in writing a great bank teller resume is to organize your content effectively. Using a professional resume template can help give you the proper structure to begin building your document.

Ex. Your bank teller resume should include these sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

1. Share your contact information

In the header of your bank teller resume, list your full name, phone number, email address, location, and a link to your online portfolio or LinkedIn profile. Carefully review the accuracy of your information so that the hiring manager can easily reach out to schedule an interview.

Example

Your Name

(123) 456-7890

[email protected]

City, State Abbreviation Zip Code

LinkedIn | Portfolio

2. Write a compelling profile summarizing your bank teller qualifications

Grab the hiring manager’s attention with a strong opening summary that provides a snapshot of your career within the banking industry. Start by listing your title, years of experience, and three to four skills that match the employer’s needs. Emphasize your ability to deliver exceptional service and recommend ideal banking products based on individual customer needs.

Bank Teller Resume Profile Example #1

A head bank teller with seven years of professional experience specializing in operations management, retail banking, and regulatory compliance. A proven track record of building and managing diverse teams and identifying opportunities to improve teller operations.

Bank Teller Resume Profile Example #2

A bank teller with four years of professional experience specializing in customer service, cross-selling, client relations, and banking operations. A strong history of exceeding productivity metrics related to customer service, transaction speed, and accuracy.

3. Add an accomplishment-driven professional experience section

To generate interviews during the job search, build an accomplishment-driven professional experience section that sets you apart from other candidates. Bank teller job descriptions can often seem generic, so it’s important to explore your achievements rather than only listing your day-to-day responsibilities.

For example, think about how you’ve exceeded productivity targets throughout your career. Did your actions contribute to an increase in customer satisfaction, account enrollments, or sales revenue for the branch? These are the types of insights that employers are looking for during the hiring process.

Bank Teller Professional Experience Example #1

Bank Teller, Bank of America, Detroit, MI | October 2021 – present

- Deliver quality service to bank customers, process and verify up to 120 transactions per day with exceptional accuracy, and communicate effectively with diverse clientele to resolve banking issues, resulting in a 91% customer satisfaction rating

- Promote and cross-sell banking products and services based on customer needs, contributing to a 17% increase in new account openings for 2023

- Consistently exceed goals for banking productivity metrics related to transaction speed and accuracy by up to 25%

Bank Teller Professional Experience Example #2

Head Bank Teller, Wells Fargo, San Diego, CA | May 2019 – present

- Manage, train, and develop a team of 12 junior tellers, provide coaching and mentorship to enhance performance, and ensure compliance with banking policies, regulations, and procedures, contributing to an 18% reduction in transaction errors

- Oversee daily transactions for personal and commercial accounts totaling over $200,000 and maintain a 100% accuracy rate in balancing cash drawers

- Serve as the point of contact for escalated customer issues, identify appropriate banking solutions, and achieve a 92% customer satisfaction score on surveys

Resume writer’s tip: Quantify your experience

Use numbers, monetary figures, and data to enhance the impact of your content. Avoid vague statements such as “increased efficiency by 15,” and instead provide tangible examples you can truly substantiate with a real metric. For instance, if you consistently achieved a customer satisfaction score of over 90%, feature this number in a bullet point.

Do

- “Deliver quality service to bank customers, process and verify up to 120 transactions per day with exceptional accuracy, and communicate effectively with diverse clientele to resolve banking issues, resulting in a 91% customer satisfaction rating”

Don’t

- “Provide service to banking customers, process and verify transactions accurately, and consistently meet customer satisfaction goals ”

Resume writer’s tip: Tailor your resume for each application

As you build your bank teller resume, pay close attention to the job description. Feature specific keywords that match the employer’s needs and display examples of you utilizing these skill sets in high-volume banking environments.

What if you don’t have experience?

Crafting a resume for bank teller jobs can be challenging if you lack hands-on experience. In this situation, focus on relevant skill sets, certifications, and education. If you’ve held any type of customer service position in a different industry, be sure to highlight this experience prominently, as this is exactly the type of background banks will be looking for.

4. Include relevant education and certifications

Bachelor degrees aren’t typically required for bank teller job applications, but they can give you a big leg up over the competition. Consider pursuing a major that’s relevant to the banking industry, such as business administration, finance, or accounting. Another option is to obtain a Certified Bank Teller (CBT) credential, as this immediately shows potential employers that you’re qualified for the position.

Education

Template:

[Degree Name]

[School Name], [City, State Abbreviation] | [Graduation Year]

Example:

Bachelor of Business Administration (B.B.A.)

University of Michigan, Ann Arbor, MI | 2020

Certifications

Template:

[Certification Name], [Awarding Organization], [Completion Year]

Example:

Certified Bank Teller (CBT), American Bankers Association | 2020

5. List pertinent key skills

Feature key skills that match the job posting to ensure compliance with ATS during the initial screening process. Highlight a mix of skills that demonstrate your knowledge of banking products and customer service expertise. In addition to providing a list, show the hiring manager how you’ve applied these skills in your professional experience. Below, you’ll find a list of potential skills to consider adding to your bank teller resume:

| Key Skills and Proficiencies | |

|---|---|

| Bank operations | Bank telling |

| Cash management | Client relations |

| Commercial banking | Communication |

| Consultative sales | Cross-selling |

| Customer service | Customer success |

| Financial analysis | Online banking |

| Personal banking | Regulatory compliance |

| Retail banking | Team leadership |

| Teller operations | Wire transfers |

Resume writer’s tip: Use common action verbs

Lead each bullet point with a strong action verb to infuse an engaging and dynamic element into your writing. Avoid passive language such as “worked,” “helped,” or “responsible for” in favor of proactive verbs such as “managed,” “implemented,” or “achieved.” Below are action verbs you can use to craft the professional experience section of your bank teller resume:

| Action Verbs | |

|---|---|

| Analyzed | Collaborated |

| Communicated | Conducted |

| Coordinated | Delivered |

| Enhanced | Evaluated |

| Executed | Identified |

| Implemented | Improved |

| Managed | Oversaw |

| Performed | Provided |

| Sold | Supported |

How To Pick The Best Bank Teller Resume Template

When selecting your bank teller resume template, opt for a structure to prioritizes readability over aesthetics. Vibrant colors and graphics are nice to look at, but not what the hiring manager is here for. If the visual elements are too strong, they can actively draw the reader’s eye away from your industry experience and achievements. Instead, opt for a clean and professional template with a simple, elegant font that allows the hiring manager to engage with your content more easily.

Frequently Asked Questions: Bank Teller Resume Examples and Advice

According to the Bureau of Labor Statistics, bank teller jobs are expected to decline by 15% over the next decade. This equates to a loss of over 52,000 jobs by 2032. Automation and customer adoption of online banking are two key factors contributing to the decline. Given the outlook for bank tellers, you're likely to experience greater competition on the open market. Tailoring your resume to each job opportunity can help you maximize your odds of landing the interview.

For example, if a bank strongly values diversity, equity, and inclusion (DEI), emphasize your experience delivering quality service to various customer populations. If you're pursuing a head teller position, highlight your ability to manage team members and coordinate daily banking operations.

Creating a Bank Teller resume example that stands out involves focusing on your unique contributions. Whether you've worked in leadership, handled large budgets, or managed complex projects, showcase your experience with measurable results. Include your proficiency in relevant tools and technologies, and make sure your resume reflects your career trajectory in a clear and concise manner.

The reverse chronological format is ideal for bank teller resumes. Hiring managers are primarily interested in your work history, and this approach places your most recent and relevant experience towards the top of your document. A combination format should only be considered if you have no prior work history, as you'll need to compensate by highlighting your skills, certifications, and education more prominently.

Include a cover letter with your resume

To further increase your chances of landing the interview, complement your bank teller resume with a strong cover letter. Use this opportunity to explain why you’re interested in a particular bank and how you align with the company’s values.

Check Out Related Examples

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.