Previous surveys have found that Gen Zers tend to overestimate how much they should be earning.

ResumeTemplates.com conducted a survey in September to understand the salary expectations of Gen Zers (ages 18 to 27) who are working full-time and do not have children.

Study highlights:

- 87% of Gen Z full-time workers feel they are underpaid

- 1 in 5 Gen Zers believe they should be making $100,000 or more

- 60% report being unable to afford their basic needs on their current salary

- Nearly 20% of those who struggle to cover basic needs still spend $500 or more per month on non-essential goods

- 19% say they would need to earn $100,000 or more to afford their basic needs

9 in 10 Gen Z Say They’re Underpaid

In terms of income, the majority of respondents report earning less than $60,000 annually, with 33% earning under $30,000 and 46% earning between $30,000 and $60,000. Additionally, 17% report earning between $60,000 and $80,000, 7% say they earn between $80,000 and $100,000, and 6% make over $100,000.

According to the survey, 87% of full-time Gen Z workers feel they are underpaid, while 13% believe their pay is fair. Interestingly, all of the 13% who feel their pay is fair earn $30,000 annually. Every Gen Zer earning more than $30,000, including those making six figures, reports feeling underpaid.

Among the Gen Z respondents, 1% have not completed high school, 44% have a high school diploma, 10% hold an associate’s degree, 33% possess a college degree, and 12% have a graduate degree.

“Some Gen Zers might be underpaid, but there are several factors to consider,” says ResumeTemplates’ chief career strategist, Julia Toothacre.

“First, education level. A Gen Zer with a college degree should probably be earning more than $50,000 or $60,000. However, in fields like education or nonprofit work, salaries under $50,000 are common. Second, location is a major factor. In large metro areas, you’re likely to feel underpaid if you earn less than $100,000.

“Finally, the industry and role you choose impacts how much money you can make. For example, in sales, you have more opportunities to make more through commission. Given high inflation over the last few years, I would imagine that some Gen Zers feel underpaid because they are struggling to pay bills or maintain the lifestyle they had just a few years ago.”

1 in 5 say they should be making six figures

Of Gen Z workers who feel they are underpaid, around 9% believe they should be paid up to $40,000 annually, 17% expect between $40,000 and $50,000, 20% want between $50,000 and $70,000, 35% believe they should earn between $70,000 and $100,000, and 20% feel they should be paid over $100,000.

The majority of Gen Z workers have spent no more than four years working full-time. More specifically, 7% of respondents have worked full-time for less than a year, 17% have worked for one to two years, 22% for two to three years, 16% for three to four years, 14% for four to five years, and 23% have worked full-time for more than five years.

“Workers who have invested money into education or training want to get a return on their investment. However, as they are early in their career, most Gen Zers likely don’t have enough experience to be making as much as maybe they would like to. It takes time to move up in the ranks and earn a higher salary. Not only that, but older generations have to up or out to create those opportunities,” says Toothacre.

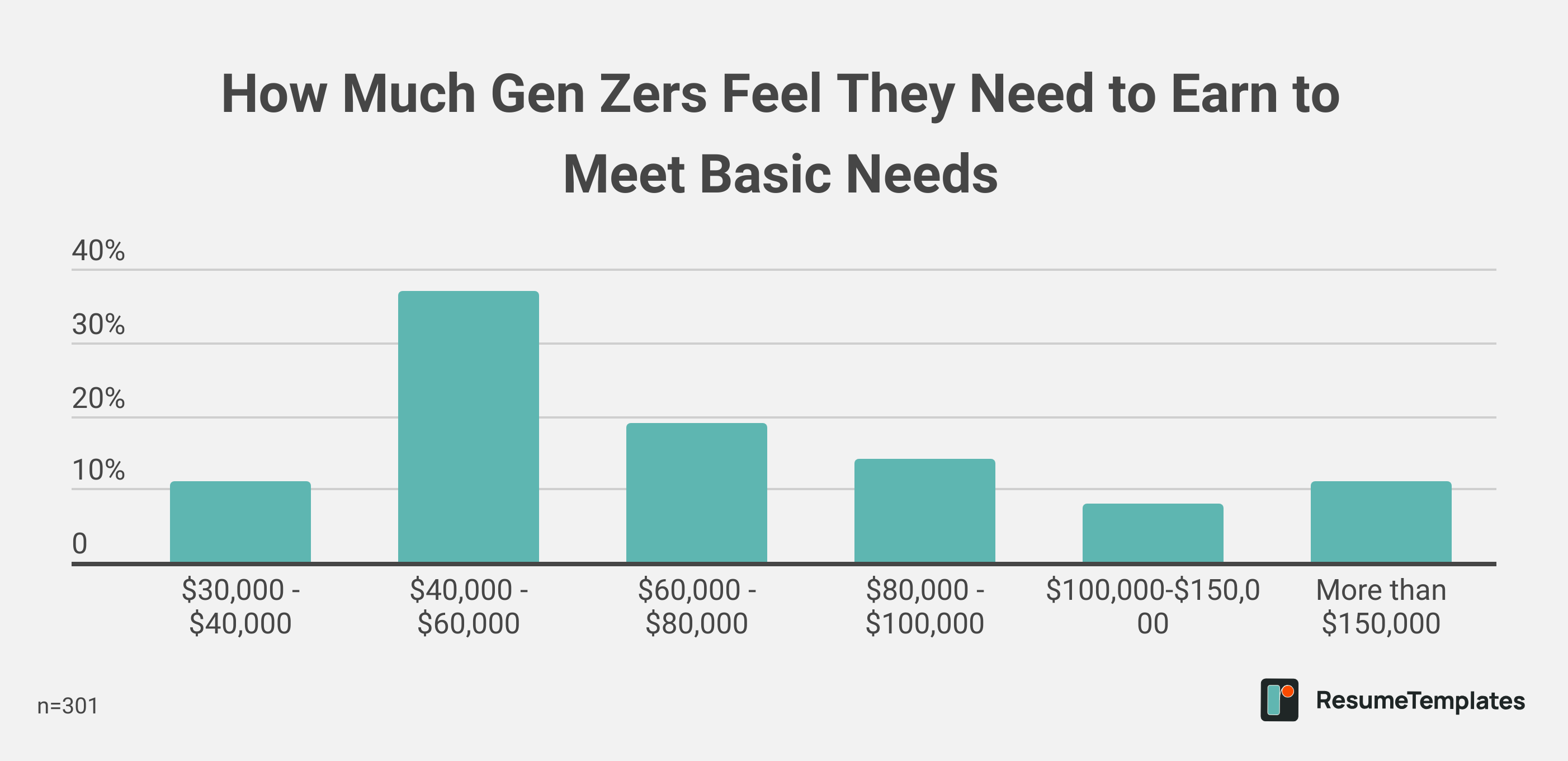

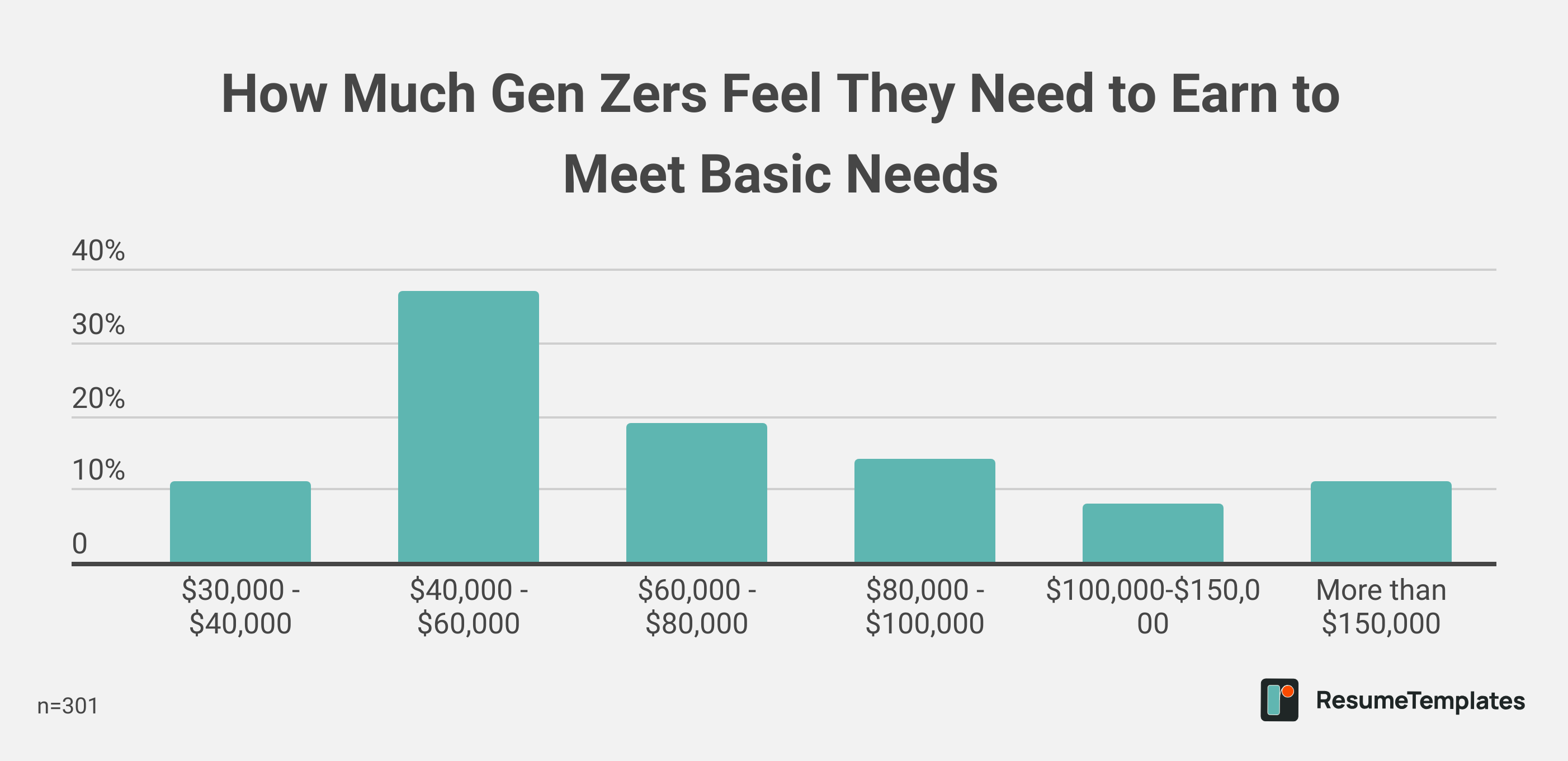

1 in 5 Gen Z Workers Who Struggle on Current Salary Say They Need More Than $100,000 To Get By

Nearly 60% of Gen Z workers surveyed say they can afford their basic needs with their current salary, while 40% report that they cannot.

Of those who say they can’t meet their basic needs on their current salary, 11% say they would need to earn between $30,000 and $40,000 to afford their basic needs, 37% say they need between $40,000 and $60,000, and 19% require between $60,000 and $80,000. Additionally, 14% feel they would need between $80,000 and $100,000, and 19% say it would require a salary of more than $100,000.

“The broader issue at play is the growing disparity between the rising cost of living and stagnant wage growth. These two factors are far from aligned. Hiring managers need to recognize that the economic landscape today is vastly different from when they were starting their careers. The reality is that salaries should be higher to reflect these changes, yet in many organizations, compensation has not kept pace with inflation or the evolving financial demands of modern life,” says Toothacre.

1 in 5 Gen Zers Who “Can’t Make Ends Meet” Spend $500+ a Month on Non-Essentials

Many Gen Zers who report struggling to make ends meet on their current salary acknowledge they could either reduce housing costs or cut back on non-essential spending each month.

Among those facing financial challenges, 33% say they could find a cheaper place to live. A number of Gen Zers (35%) currently live alone instead of sharing expenses with roommates. Additionally, 39% say they are currently spending over $1,500 per month on rent.

When it comes to discretionary spending, nearly 20% of Gen Zers are spending more than $500 per month on non-essential items. On average, those who report struggling to make ends meet spend $372 monthly on non-essential purchases, including dining out, travel, and new clothing or accessories.

This survey was conducted in September 2024 via Pollfish. In total, 750 U.S. residents ages 18 to 27 were surveyed. Appropriate respondents were found through demographic criteria and a screening question. To take the survey, respondents had to answer they are currently working full-time and do not have any children.

Resume Templates offers free, HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.