As President-elect Donald Trump prepares to take office in January, one of his key promises is to implement massive tariff hikes on goods imported by the U.S. from China, Mexico, and Canada. While it remains to be seen if new tariff policies go into effect, companies are preparing for the possibility that imported goods will cost more.

In November, Resume Templates surveyed 500 companies that import finished goods or raw materials from foreign countries to learn more about how Trump’s proposed tariffs will impact retailers and customers.

Study highlights:

- 82% of companies will likely raise prices if Trump’s proposed tariffs are implemented

- 7 in 10 companies surveyed will use cost-cutting measures to counteract the effects of tariffs, including layoffs and salary cuts

- 35% of companies are increasing how much they import before Trump takes office

- The majority of companies anticipate a reduction in profit margins and growth as a result of tariffs

82% of Companies Plan To Raise Prices

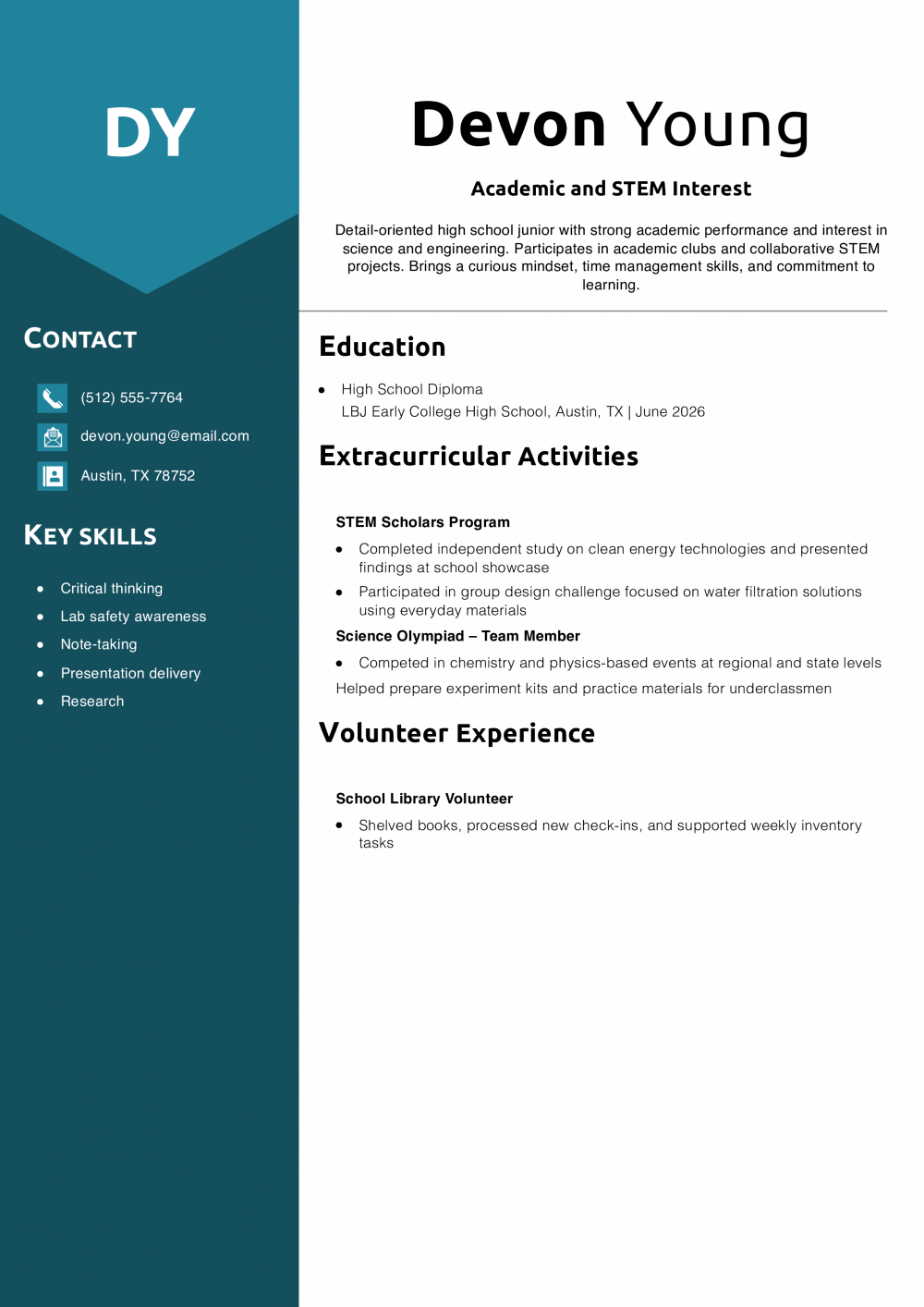

Should Trump’s proposed tariffs go into effect, 41% of companies say it’s very likely that they will increase prices on the goods they sell, while 41% say price increases are somewhat likely.

Respondents who voted for Vice President Kamala Harris are more pessimistic about how Trump’s proposed tariffs will impact their prices. Of these respondents, 59% say price increases are very likely, compared to 26% of Trump voters. Meanwhile, 33% of Trump voters say price hikes aren’t likely, compared to just 5% of Harris voters.

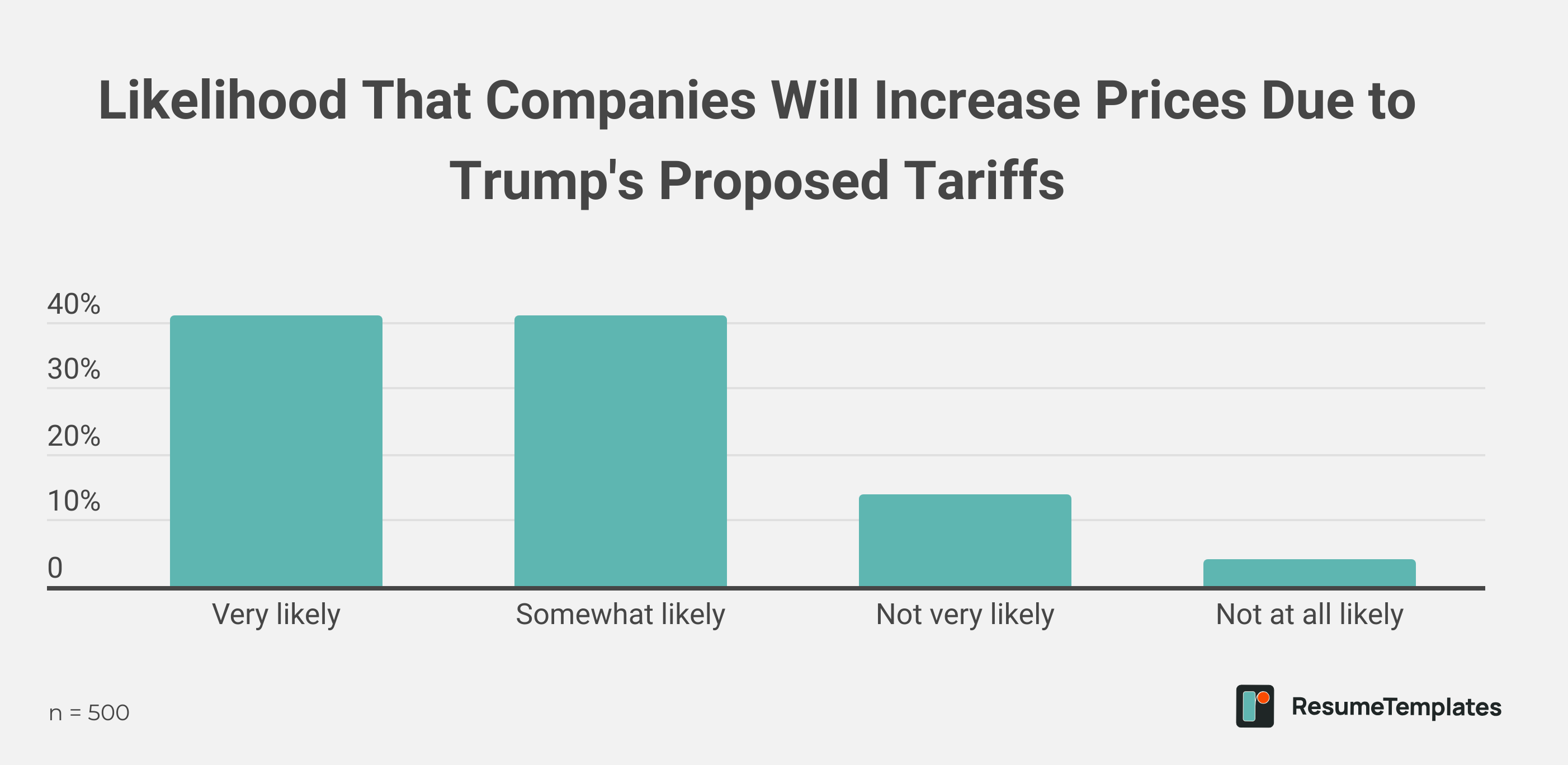

Among those who say price hikes are likely, 41% anticipate raising prices by 5% to 10%. Another 22% predict that their companies will raise prices by 11% to 15% if Trump’s tariffs go into effect.

Nine out of 10 companies that plan on increasing prices expect it will decrease demand for their products. More specifically, 13% expect that it will significantly decrease customer demand, while 37% expect a moderate decrease, and 40% anticipate a minimal decrease in customer demand for their products.

7 in 10 Companies Are Considering Cost-Cutting Measures To Counteract Trump’s Proposed Tariffs

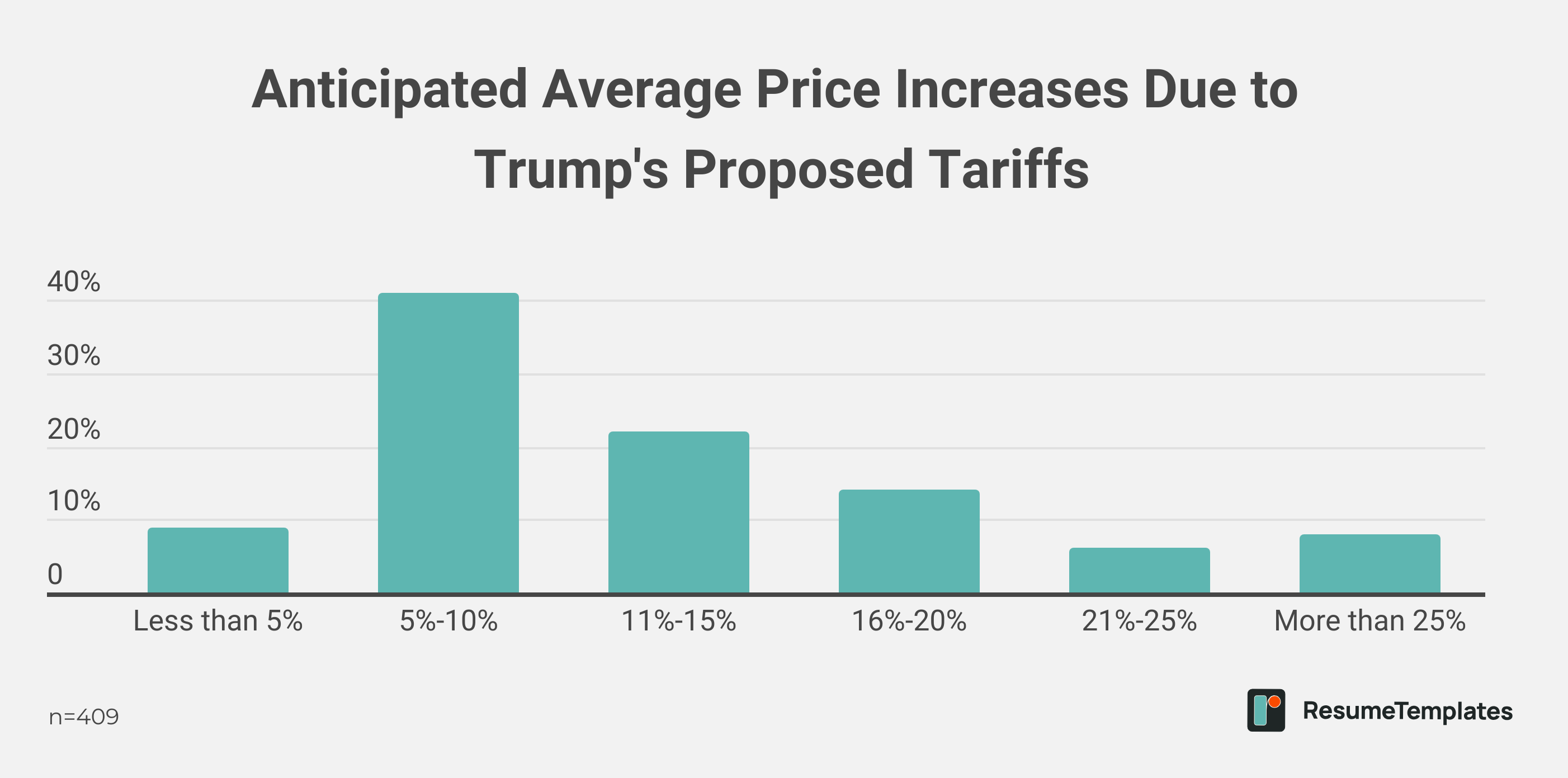

Besides increasing prices, most companies also anticipate implementing other cost-cutting measures to counteract the effects of Trump’s proposed tariffs. Of companies, 28% say it’s very likely they’ll take action to cut costs, while 43% say such measures are somewhat likely.

Layoffs and salary cuts among anticipated cost-cutting measures

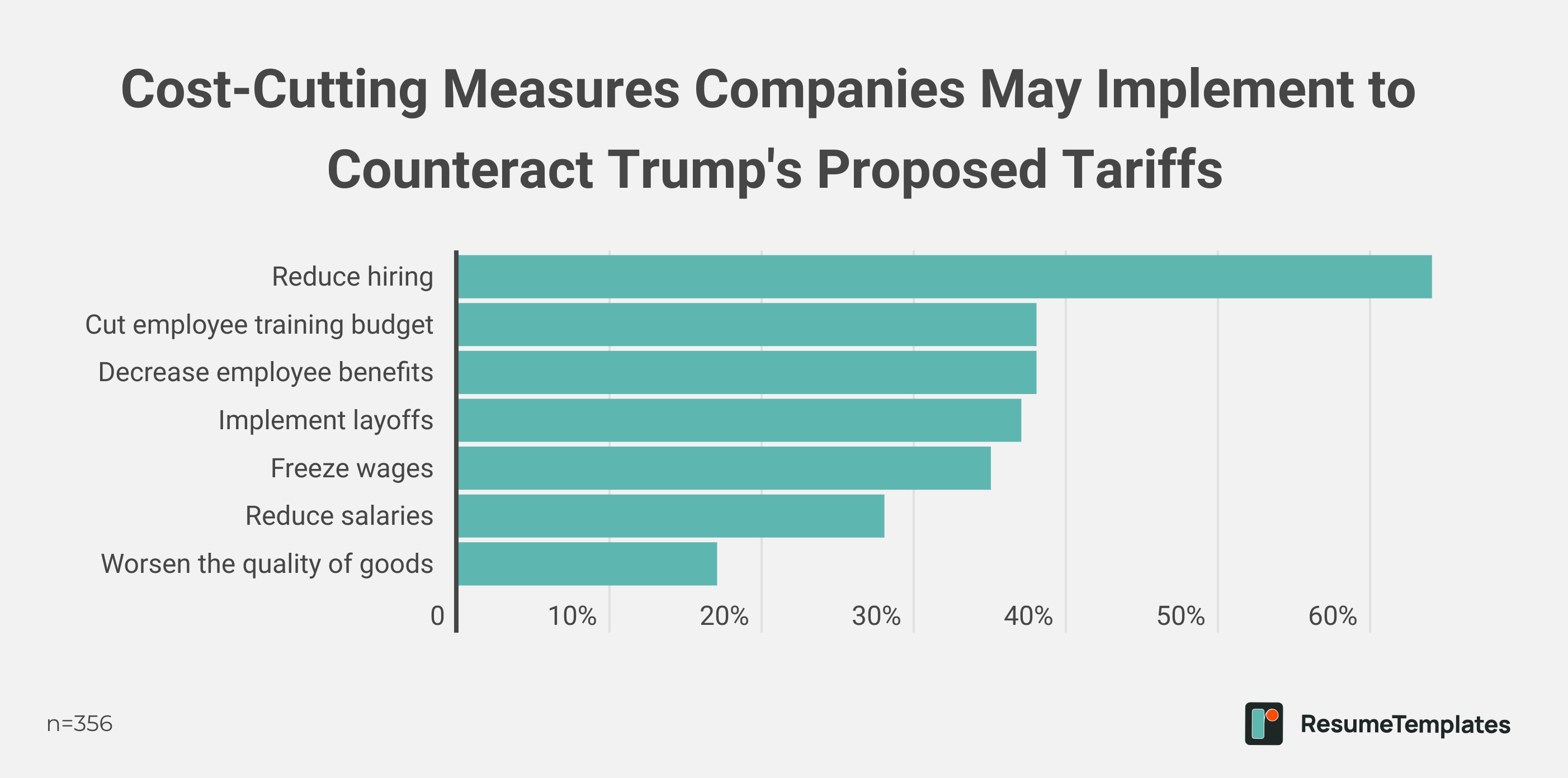

Of companies anticipating implementing cost-cutting measures, 37% are considering layoffs, and 64% say reduced hiring is a possibility as counteractive measures to the proposed tariffs.

Other possible cost-cutting measures include reductions to employee benefits and bonuses (38%), budget cuts for employee training and development (38%), wage freezes (35%), salary reductions (28%), and decreasing the quality of goods they sell (17%).

Although the tariffs haven’t taken effect, 41% of this group have already begun implementing cost-cutting measures.

“Anytime the economy is impacted, layoffs are one of the first ways companies cut costs quickly,” says Resume Templates career strategist and coach Julia Toothacre. “Knowing this, workers should always be somewhat ready to search for a job.” For employees concerned about potential layoffs, Toothacre recommends considering possible career moves, updating LinkedIn profiles, and connecting with other professionals in their network.

“It’s important to remember that not all companies will be impacted by these tariffs,” Toothacre adds. “If your company’s product is made in the U.S. or you’re service-based, this will have minimal, if any, impact on your company. If you’re concerned about the impact of tariffs, then you need to look closely at the company’s products and manufacturing. Some companies have been vocal about the impact of tariffs, and you might find articles or LinkedIn posts about their position on the matter.”

7 in 10 Companies Expect Tariffs To Reduce Profit Margins

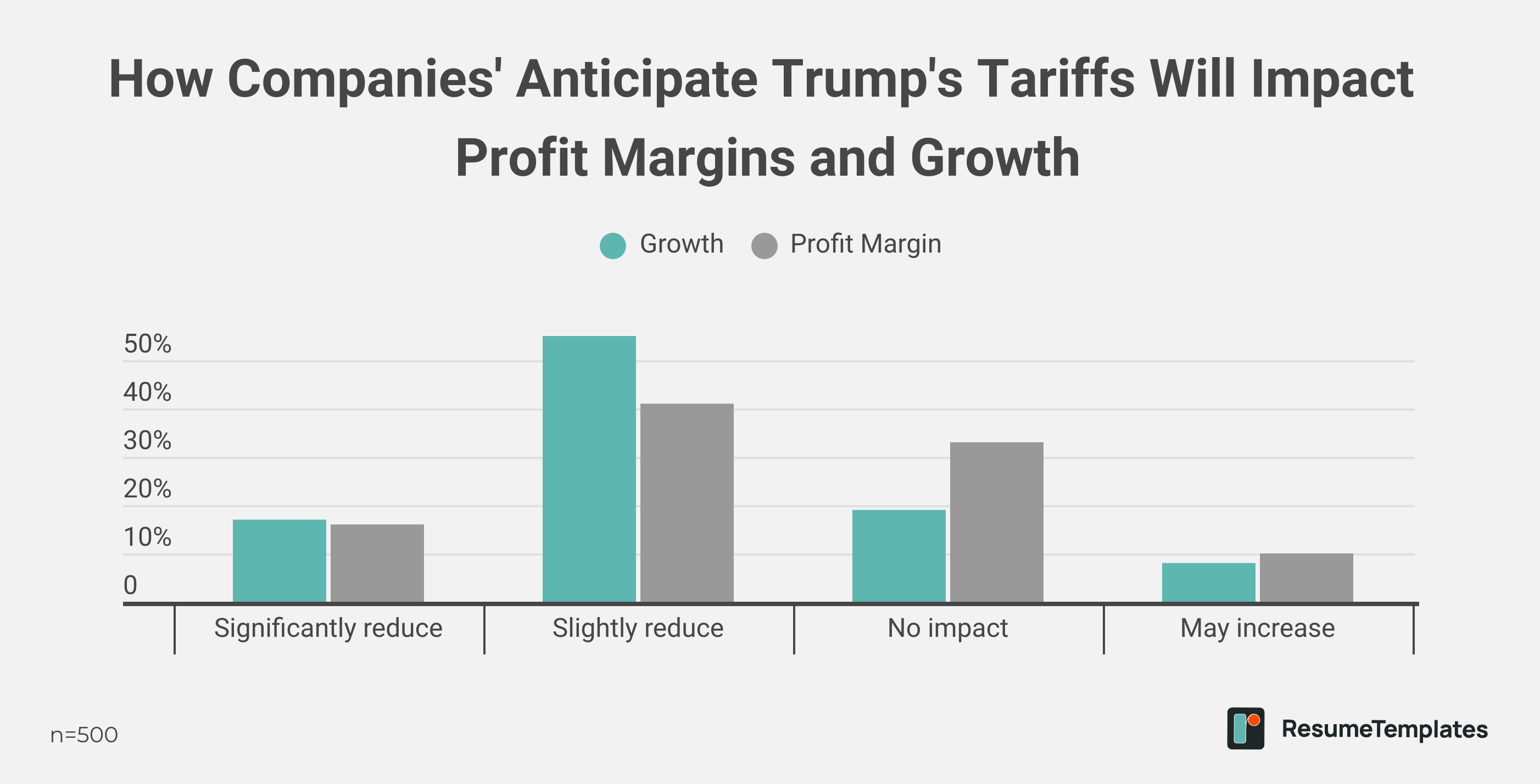

Respondents also expect that, if implemented, Trump’s tariffs will hurt profit margins and reduce growth.

A total of 17% of respondents predict that Trump’s tariffs will significantly reduce their profit margins, while 55% anticipate a slight reduction in profit margins. As for company growth, 16% of respondents say the proposed tariffs will significantly reduce growth, while 41% expect a slight reduction in growth.

To get ahead of rising costs, 35% of companies are increasing purchases of foreign goods before Trump takes office.

Methodology: Resume Templates commissioned and launched this survey via Pollfish on November 15, 2024. In total, 500 workers were surveyed. To take the survey, respondents had to answer that they currently work at a company that imports finished goods or raw materials from foreign countries and that they are knowledgeable about Trump’s proposed tariffs and the potential impact they would have on their business. Media inquiries can be directed to Abigail Davis, [email protected].

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.